ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

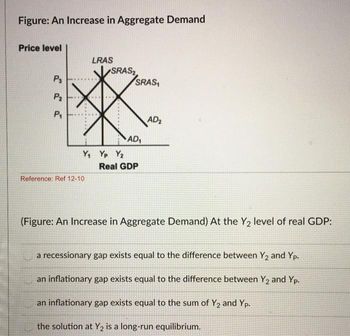

Transcribed Image Text:Figure: An Increase in Aggregate Demand

Price level

P3

P₂

P₁

LRAS

Reference: Ref 12-10

SRAS

Y₁ Yp Y₂

SRAS

AD₁

Real GDP

AD₂

(Figure: An Increase in Aggregate Demand) At the Y2 level of real GDP:

a recessionary gap exists equal to the difference between Y₂ and Yp.

an inflationary gap exists equal to the difference between Y2 and Yp.

an inflationary gap exists equal to the sum of Y2 and Yp.

the solution at Y₂ is a long-run equilibrium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- LAS 100 90 X 80 70 110 60 0 320 360 below full-employment; 40 above full-employment; 20 below full-employment; 20 above full-employment; 40 actual; 0 SAS 400 440 480 520 Real GDP (billions of 2007 dollars) Figure 10.3.1 AD Refer to Figure 10.3.1. The economy is at its short-run macroeconomic equilibrium. There is a difference between equilibrium real GDP and potential GDP of $ billion.arrow_forwardPrice Level(average price) 40 38 36 34 32 AD 1 30 28 26 24 22 20 0 AD 2 2 4 AD 3 AS 6 8 10 12 14 16 18 20 Real Output (quantity in billions per year) Suppose the economy is at full employment when AD = AD3. a. The GDP gap when the demand curve is at AD2 is $ 7 billion b. Would this mean the economy is in a recession or expansion? Recessionarrow_forwardPrice level (GDP priceindex) Real GDP demanded Real GDP supplied (trillions of 2005 yen) 75 600 400 105 450 550 135 300 700 The short-run macroeconomic equilibrium real GDP is ¥------ trillion and the equilibrium price level is ------. The size of the (recessionary , or inflamatory) gap is ¥-------- trillion.arrow_forward

- Is the equilibrium at full employment, inflation or recession? Price level Aggregate Demand Aggregate Potential GDP Supply 50 $700 $100 100 $600 $200 150 $450 $450 200 $300 $480 250 $220 $500 300 $150 $510 $510 350 $100 $512arrow_forwardWhat is inflationary gap? Select one: When aggregate expenditures are greater than the full employment level causing a demand pull-inflation When aggregate expenditures are greater than full employment level causing cost push inflation None of the options are correct It is the gap between a developed nation GDP and an under-developed/ developing nation GDP When aggregate expenditures are inadequate to bring about a full employment levelarrow_forwardIf investment increases by 24 billion and the economy's MPC is 0 0.5, the aggregate demand curve will shift rightward by _____ billion dollars at each price level.arrow_forward

- $ Which of the following would cause the Aggregate Supply curve to move from AS to AS2 in the graph below? fs Price Level 150 140 130 120 110 100 90 80 70 60 % 5 0 16 5 O A general increase in energy and labor cost for businesses. O A federal government increase in spending. t 6 10 15 Real GDP ($ billion) -AS-AD-AS2 2 fa lyi & 7 7 J * 20 8 8 num lk ( 25 (1¹) 9arrow_forwardWith the passage of time, which of the following will help direct this economy in Figure 10-21 toward its potential long-run rate of output (e1 to E2)? Figure 10-21 Price Level ti LRAS E₂ SRAS, SRAS: AD₂ AD₁ Y, Y₁ Goods and Services (Real GDP) Output is initially less than long-run capacity O lower interest rates that will stimulate AD and lower resource prices that will increase SRAS O higher interest rates that will reduce aggregate demand and higher resource prices that will reduce SRAS lower interest rates and higher resource prices, both of which will stimulate aggregate demand O higher interest rates that will reduce SRAS and lower resource prices that will stimulate aggregate demandarrow_forwardPrice level (CPT) 110 105 100 95 AS Ful employment, 50 151 Real GDP AD₁ (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by: A increasing government tax revenue by approximately $33 billion. B decreasing government tax revenue by $100 billion. increasing government tax revenue by $100 billion. decreasing government tax revenue by $750 billion. decreasing government tax revenue by approximately $33 billion.arrow_forward

- Question 4 Exhibit 14A-3 Macro AD-AS Model Price level CPI P3 P₂ P₁ LRAS SRAS Yp Y₁ AD Real GDP (billions of dollars per year) In Exhibit 14A-3, the level of real GDP represented by Yp: O is potential real GDP for this economy. O indicates that the economy is experiencing zero inflation. O indicates that the economy is experiencing a recessionary gap. O would be associated with considerable unemployment.arrow_forwardCOURSE: MACROECONOMICS - IS-LM and/or MUNDELL FLEMING MODELS Refer to 2 different models (and/or conditions) under which an increase in the amount of money circulating in the economy has a NULL impact on GDP. Then, refer to 2 different models (and/or conditions) under which an increase in the amount of money circulating in the economy has a MAXIMUM impact on GDP. EXPLAIN very briefly the mechanism by which each model generates that NULL or MAXIMUM impact on GDP. Hint: 2 conditions under increase of M (money) and how impact null (zero) and maximum on GDP. Example, considering both fiscal or monetary policies or liquidity trap model. Please graph and explain on detail both cases.arrow_forwardPrice level 110 105 100 96 1 AS Ful employment. AD₂ AD₁ 50 51 Real GDP (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by: A increasing government tax revenue by approximately $33 billion. B decreasing government tax revenue by $100 billion. increasing government tax revenue by $100 billion. decreasing government tax revenue by $750 billion. decreasing government tax revenue by approximately $33 billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education