ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

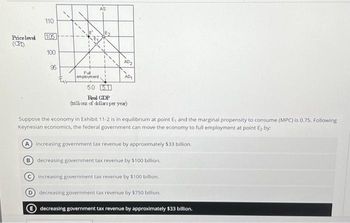

Transcribed Image Text:Price level

110

105

100

96

1

AS

Ful

employment.

AD₂

AD₁

50 51

Real GDP

(trillions of dollars per year)

Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following

Keynesian economics, the federal government can move the economy to full employment at point E₂ by:

A increasing government tax revenue by approximately $33 billion.

B decreasing government tax revenue by $100 billion.

increasing government tax revenue by $100 billion.

decreasing government tax revenue by $750 billion.

decreasing government tax revenue by approximately $33 billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4 Exhibit 11-2 Aggregate demand and supply model 110 Price level 105 (CPI) 100 95 E NE Full employment. AS AD₁ AD 5.0 5.1 Real GDP (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.9. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by increasing government spending by $_____ billion.arrow_forwardAssuming that the economy shown in the figure below is in equilibrium, calculate the recessionary or inflationary gap in each case below. AS 350 AD 300 250 200 150 100 50 100 200 300 400 500 600 700 800 900 1000 Real GDP a. Potential GDP (LAS) is $300 then there is a(n) (Click to select) ♥ gap of $ (Click to select) b. Potential GDP (LAS) is $600 then there is a(n) inflationary recessionary Įgap of $ c. Potential GDP (LAS) is $750 then there is a(n) (Click to select) v gap of $ Price indexarrow_forwardBelow graph these are 5 questions. Where equilibrium will shift to A or to B if : There is a rise in public sector borrowing There is a rise in government government subsidies to the motor industry The government spends less on defence The basic rate of income tax is raised The VAT rate is cut from 20% to 15%.arrow_forward

- You are studying an economy with an income tax rate, t1, of 32%and an MPS of 0.3. It is currently suffering from a “recessionary gap” of $500 m. (i.e., Eqm Y<Y full employment, FE, aka Yn). Make the necessary calculations for the topolicythat it should institute; who does what? Provide the full name of this policy. Compare this economy to one without income taxes to explain the term “automatic stabilizer.”[Hint: Let I change and compare the I multipliers in each of these economies.] \arrow_forwarduèstion 21 pounts The economy is in a recession. The government enacts a policy to increase the real GDP by $10 billion. The MPS is 0.2. Assuming that the agggregate supply curve is horizontal across the range of GDP being considered, by how much should the government change spending or taxes in order to achieve its objective? Show your calculations. e For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt A v x X, Re v 55 OWORDS POWERED 図 田 lili 用arrow_forwardQuestion 3 of 16 Income and consumption changes for five people are shown in the table. Given this information, rank the marginal propensities to consume (MPC) for the five people from largest to smallest. Largest MPC Smallest MPC Answer Bank Bert Doug Eli Carter Al Name Income change Consumption change Al +$5,000+$5,000 +$3,000+$3,000 Bert +$2,500+$2,500 +$800+$800 Carter +$1,000+$1,000 +$800+$800 Doug −$2,500−$2,500 −$1,750−$1,750 Eli −$5,000−$5,000 −$2,000−$2,000arrow_forward

- 2. For simplicity, we normally treat aggregate tax payments (T) as determined by politics or other factors unrelated to output. However, suppose that aggregate tax payments are proportional to income. That is, T=t·Y, where tis the marginal tax rate and is between o and 1. a. How, if at all, would this change in our assumptions affect the Keynesian cross diagram? b. Would this change increase, decrease, or have no impact on the multiplier effect, or is it not possible to tell? (That is, how would the effect of a given vertical shift of the planned expenditure line compare with what it was before?)arrow_forwardConsider an economy that is operating atthe full-employment level of real GDP.Assuming the MPC is 0.90, predict the effect onthe economy of a $50 billion increase in governmentspending balanced by a $50 billionincrease in taxes.arrow_forwardAn inflationary gap is how much GDP needs to decrease from the current GDP to maintain employment while avoiding inflation. Let us say that we are experiencing an inflationary gap of $200 million. The government decides to increase taxes. Assume that the MPC equals .80. What will be the tax increase?arrow_forward

- During the 1930s the U.S. entered the Great Depression. During the Great depression investment fell from a yearly rate of $16.7 billion to $1.7 billion. In 1932, President Hoover increased income taxes. Assume the MPC is .92 C). If the AD shortfall in 1934 was $300 billion, what change in government expenditures on goods and services (G) would you have recommended to restore full-employment? D). If the AD shortfall in 1934 was $300 billion, what change in income/transfer payments would you have recommended ? E). If the AD shortfall in 1934 was $300 billion, what change in income taxes would you have recommended ?arrow_forwardThe graph below depicts an economy where a decline in aggregate demand has caused a recession. Assume the government decides to conduct fiscal policy by increasing government purchases to reduce the burden of this recession. Price Level 160 140 LA 120 100 80 60 40 20 0 Fiscal Policy LRAS AD₁ Real GDP (billions of dollars) billion AS 80 160 240 320 400 480 560 640 720 800 AD O Instructions: Enter your answers as a whole number. a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? billion B b. If the MPC is 0.6, how much does government purchases need to change to shift aggregate demand by the amount you found in part a? Suppose instead that the MPC is 0.75. c. How much does aggregate demand and government purchases need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $ billion and government purchases need to change by $ billion.arrow_forwardAssume that government purchases decrease by $10 billion, with other factors held constant, including the price level. Calculate the change in the level of the real GDP demanded for each of the following values of the MPC. Then, calculate the change if the government, instead if reducing its purchases, increased autonomous net taxes by $10 billion. a. 0.9 b. 0.8 c. 0.75 d. 0.6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education