ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

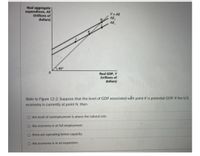

Transcribed Image Text:Real aggregate

expenditure, AE

(trillions of

dollars)

Y AE

AE,

45

Real GDP, Y

(trillions of

dollars)

Refer to Figure 12-2. Suppose that the level of GDP associated with point K is potential GDP. If the U.S.

economy is currently at point N, then

O the level of unemployment is above the natural rate.

O the economy is at full employment.

O firms are operating below capacity.

O the economy is in an expansion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardPrice level (CPT) 110 105 100 95 AS Ful employment, 50 151 Real GDP AD₁ (trillions of dollars per year) Suppose the economy in Exhibit 11-2 is in equilibrium at point E, and the marginal propensity to consume (MPC) is 0.75. Following Keynesian economics, the federal government can move the economy to full employment at point E₂ by: A increasing government tax revenue by approximately $33 billion. B decreasing government tax revenue by $100 billion. increasing government tax revenue by $100 billion. decreasing government tax revenue by $750 billion. decreasing government tax revenue by approximately $33 billion.arrow_forward(Figure: Shifts of the AD–AS Curves) Use Figure: Shifts of the AD–AS Curves. A decrease in wages in the short run is illustrated by panel:arrow_forward

- In the first quarter of 2020, US real GDP declined about 9%, due to the economics shocks from the Covid 19 virus. If prices were completely flexible, and this means all prices, both inputs (such as labor), as well as output prices, what would you think would have been the drop in GDP? If prices are completely fixed, would the drop in GDP be greater or less than the flexible case? Why? If the Expenditure method of accounting for GDP, has to equal the Income Side, and the economy overproduces a particular item, say automobiles, the income side will also be higher, workers will buy the extra cars with extra income and the economy can gyrate indefinitely higher? Why or why not?arrow_forward40 AD3 38 - AS 36 - AD 2 34 - 32- AD, 30 - 28 - 26 24 - 22 - 20 4 10 12 14 16 18 20 Real Output (quantity in billions per year) Suppose the economy is at full employment when AD = AD3. a. The GDP gap when the demand curve is at AD1 is billion b. The shortfall when the demand curve is at AD1 is billion Price Level (average price)arrow_forwardWhat is the contractionary phase of the business cycle characterized by? O reduced output and increased unemployment increased output and increased unemployment reduced output and reduced unemployment increased output and reduced unemploymentarrow_forward

- The macroeconomy is depicted by the graph to the right 160- a. The current equilibrium price level and output level respectively are: 80 and $ 10 trillion. (Enter your responses as a whole numbers.) LRAS 140- b. The full employment level of GDP is SRAS O A. $10 trillion since the LRAS is defined at this point. 120- O B. unknown since no information was provided about the labor market. 100- O C. $10 trillion now but thereafter it depends on what the aggregate demand curve does. O D. $10 trillion now but it depends on the SRAS curve. 80- 60- AD 40- 10 12 14 16 18 20 Real GDP ($ trillions) Price levelarrow_forwardTyped plz and asap thanksarrow_forwardRefer to the figure below. Which of the points in the above graph are possible short-run equilibria? Price level (GDP deflator, 2000 = 100) O A and B O A and C O A and D O A, B, C, and D LRAS SRAS, SRAS₂ AD₂ AD₁ Real GDP (trillions of 2000 dollars)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education