ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

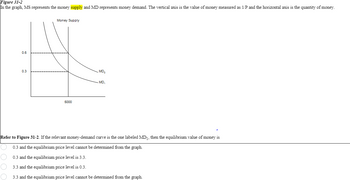

Transcribed Image Text:Figure 31-2

In the graph, MS represents the money supply and MD represents money demand. The vertical axis is the value of money measured as 1/P and the horizontal axis is the quantity of money.

Money Supply

0.6

0.3

5000

MD₂

MD,

Refer to Figure 31-2. If the relevant money-demand curve is the one labeled MD1, then the equilibrium value of money is

0.3 and the equilibrium price level cannot be determined from the graph.

0.3 and the equilibrium price level is 3.3.

3.3 and the equilibrium price level is 0.3.

3.3 and the equilibrium price level cannot be determined from the graph.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Suppose the economy's price level is 2 and real GDP is 30 , 000 for the year. Suppose the money supply is 5 , 000. If the money market is in equilibrium, then how many times per year is the typical dollar bill used to pay for a newly produced good or service? 10 8 12 16arrow_forwardSuppose that money demand is given by M = $Y(0.30-i) where $Y is $200 and i denotes the interest rate in decimal form. Also, suppose that the supply of money is $25. Calculate the equilibrium interest rate as a percent. The equilibrium interest rate is %. (Round your response to two decimal places.) If the Federal Reserve wants to increase the interest rate by 10 percentage points (0.1 in decimal form) over and above the equilibrium interest rate determined above, at what level should it set the money supply? The money supply should be set at $ (Round your response to one decimal place.)arrow_forwardFrom 1999 to 2009, the prices of all goods and services fell by a total 2.88%. What does this suggest about the growth of Japan's money stock according to the Quantity Theory of Money? A) Japan's money stock decreased by 2.88% per year from 1999 to 2009. B) Japan's money stock decreased by a total of 2.88% from 1999 to 2009. C) Japans' money stock increased by 2.88% per year from 1999 to 2009. D) Japan's money stock increased by a total of 2.88% from 1999 to 2009arrow_forward

- Suppose that the following system of equations describe the macroeconomy of a hypothetical country: Y= C(y)+I(i)+G : IS or goods market M/p=L(i,y) : LM or money market a) Get the total differentials of the above system of equations and put your answer in matrix representation. b) Taking money supply and government expenditure as exogenous and the price level as fixed, determine and provide economic intuition for the signs and magnitudes of the following multipliers i) dY/dG ii) di/dG c) For a simultaneous increase in both the interest elasticity of investment and interest elasticity demand for money parameters, determine the net effect on the values of the multipliers in part b). d) For a horizontal LM curve, determine the numerical values of your answers in part b) above if: Marginal propensity to consume=5/6 Tax rate=0.25 Interest elasticity of investment=5 Interest elasticity of demand for money=50 Income elasticity of demand for money=2arrow_forwardWhich of the following statements are true based on these graphs? Check all that apply. The unemployment rate is currently 6% higher than the natural rate of unemployment. The natural level of output is $9 trillion. The current quantity of output is greater than potential output. Suppose the central bank of the economy increases the money supply. Show the long-run effects of this policy on both of the graphs by shifting the appropriate curves. The long-run effect of the central bank's policy is in real GDP. in the inflation rate, in the unemployment rate, andarrow_forward(b) List one assumption of the quantity theory of money. Based on the simple quantity theory of money, what would be the impact on the economy of increasing the money supply by 5%?arrow_forward

- Show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph. INTEREST RATE 12 10 8 2 0 0 20 Money Supply known as the Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 = Money Demand Money Supply ? Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to by at every price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is effect. Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase…arrow_forwardNonearrow_forwardu10. Using the demand and supply schedule for money shown below, do the following: a)Graph the demand for and the supply of money curves. b)Determine the equilibrium interest rate. c)Suppose the RBA decreases the money supply by $5 billion. Show the effect in your graph and describe the money market adjustment process that is likely to follow. What is the new equilibrium rate of interest? Interest rate (%) Demand for money (billions of dollars) Supply of money (billions of dollars) 4 10 30 3 20 30 2 30 30 1 40 30arrow_forward

- The money demand function is (M/P)d = Y-150rThe money supply M is 1,000 and the price level P is 2. For this economy, use a graph to illustrate the LM curve for r ranging from 0 to 8.arrow_forwardLet M be the quantity of money and i the interest rate in decimal form. Suppose that money demand is given by M =100−20×(1+i) and that money supply is M = 79. Then the interest rate i isarrow_forwardthanks in advance. YD = Y+TR-TA.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education