ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

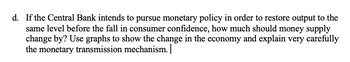

Transcribed Image Text:d. If the Central Bank intends to pursue monetary policy in order to restore output to the

same level before the fall in consumer confidence, how much should money supply

change by? Use graphs to show the change in the economy and explain very carefully

the monetary transmission mechanism.

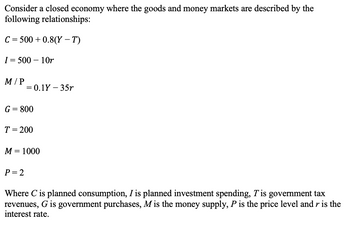

Transcribed Image Text:Consider a closed economy where the goods and money markets are described by the

following relationships:

C = 500+ 0.8(Y-T)

I= 500 - 10r

M/P

= 0.1Y - 35r

G = 800

T = 200

M = 1000

P = 2

Where C is planned consumption, I is planned investment spending, T' is government tax

revenues, G is government purchases, M is the money supply, P is the price level and r is the

interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following scenarios below BEST matches an inflationary monetary policy aka a “loose money” policy? a.Buying bonds increases the money supply, which lowers the interest rate b.Increasing taxes increases the reserve requirements, which decreases investment c.Increasing the discount rate lowers the real interest rate, which raises investment d.Selling bonds decreases the money supply which increases the interest rate e.Decreasing government spending lowers the interest rate, which lowers consumptionarrow_forwardIn an economy where the central bank implements negative interest rates as a monetary policy tool, what is the most likely short-term impact on consumer savings behavior and bank profitability? A. An increase in consumer savings as people seek to safeguard their money and a rise in bank profitability due to increased lending. B. A decrease in consumer savings as the incentive to save diminishes and a decrease in bank profitability due to lower interest margins. C. No significant change in consumer savings behavior but an improvement in bank profitability due to lower borrowing costs. D. A shift in consumer investment towards riskier assets and challenges in bank profitability due to compressed interest margins. Please don't use chatgpt it is giving wrong answer and please provide valuable answerarrow_forward3. If the economy is at the natural rate of unemployment with the level of real GDP at potential output, what would expansionary fiscal or monetary policy do to the economy? How would the economy be affected in the short run and long run?arrow_forward

- What is the purpose of Monetary policy? Prove explanations in detail with an examplearrow_forwardHow does the federal government reduce interest rate? What happens to interest rate and quantity of money as a result of expansionary monetary policy? Please explain using a diagram of interest rates vs quantity of money. showing the relevant shifts in the supply and demand curve.arrow_forwardA policy that results in slow and steady growth of the money supply is an example of A-an “easy” monetary policy. B-a “passive” monetary policy. C-a “practical” monetary policy. D-an “active” monetary policy.arrow_forward

- Suppose that the money supply increases by 20 percent. If there is no inflation, what does the quantity theory of money tell us must happen to real GDP? (Assume that the velocity of money is constant.) Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a It must increase by more than 20% It must increase by less than 20% C It stays the same d. It must increase by 20%arrow_forwardAnalyse the impact of these events on the price level and total output of an economy in the short term. If policymakers were to use monetary policy to actively stabilize the economy, in which direction should they move the money supply and interest rate and show the effects of these policies? Please discuss your answers with appropriate graphs. - (a) The government raises taxes and reduces expenditures to balance its budget. (b) Enterprises in the economy are pessimistic about the economy in the future. - (c) Foreigners increase their taste for domestically produced beef. (d) The money wage rate rises.arrow_forwardFederal Reserve is the central bank of the United States. She conducts monetary policy with various tools.a. Many central banks share similar policy objectives. What are the objectives of the Federal Reserve? b. Suppose the Federal Reserve announces a “loose” monetary policy.What has to be done, traditionally, with an open market operation? Explain with reference to the money creation processarrow_forward

- A. Discuss, with the help of diagrams, Friedman’s argument concerning the short and long-run effects of an increase in the money supply. B. Now discuss how his argument can be extended to study short and long-run effects of changes in the growth rate of a growing money supply. Both parts please.arrow_forwardNot copy pastarrow_forwardWhat are the main differences between Fisher’s and Friedman’s theory of the demand for money?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education