ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Question 30

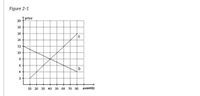

Referring to Figure 2-1 , suppose a tax of $6 per unit is imposed on the sellers in this market. What will be the new

Transcribed Image Text:Figure 2-1

20 Trice

18

16

14

12

10

6.

4

D

10 20 30 40 50 60 70 80 quantity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please written by computer source Suppose that the demand curve for a product is given by Q = 100 −10p and the supply curve is Q = 10p. Assume that income effects (elasticities) are small so consumer surplus is a good measure of consumer welfare. (a) What is the equilibrium price and quantity with no distortions? (b) The government imposes a tax of $2.00 per unit sold. What is the new equilibrium quantity? Sketch the market equilibrium in a graph. (c) Given the tax what is the change in consumer surplus? What is the change in producer surplus? What is the change in government revenue? What is the net Dead Weight Loss from the tax? (d) Say the government proposes to use the revenue from the tax to pay for snacks in our last ECON 312A lecture. The total social benefits from the snacks would be $82.00. Will the tax increase overall welfare if the revenue is used to buy the snacks? What is the dollar value of the net gain or loss to society?arrow_forwardMicroeconomics question equilibrium price 3) The demand for ski lessons is given by D(p) 100-2p and the supply is given by S(p)= 3p. (a) Compute the equilibrium price and quantity, and the consumer and producer surplus and total welfare. (b) Suppose a tax of $10 per ski lesson is imposed on consumers. Compute the new price paid by consumers and the price received by sky instructors, as well as the new consumer and producer surplus and total welfare. (c) Suppose a senator from a mountainous state suggests that although ski lesson consumers are rich and deserve to be taxed, ski instructors are poor and deserve a subsidy. He proposes a $6 subsidy on production while maintaining the S10 tax on consumption of ski lessons. Show that this policy would have no different effects than a tax of $4 per lesson.arrow_forwardN2arrow_forward

- Question 2iarrow_forward4. In order to reduce farm output, raise farm prices, and thus raise farm incomes (revenues), the government pays farmers to set aside a portion of their land from production. Using a graph, explain in terms of the elasticity of demand for farm products why farmers may be better-off when harvests are low even if we ignore the money they receive from the set-aside program.arrow_forwardThe table below shows how supply and demand of gasoliine vary depending on the price: Demand (million of gal.) Price ($/gal) Supply (million of gal.) 1 787 483 1.2 700 550 1.4 640 600 1.6 580 623 1.85 531 660 2.2 450 680 2.4 430 700 2.6 420 720 2.8 390 735 2.9 357 765 Note: there is some randomization in the above data to account for price fluctuations. Make sure to check that you input the correct data in your device. Perform the following work • Assume that Supply has a quadratic relationship with the price. Find this relationship (the help buttons contain an article to compute trend-lines in Excel): S(p) = Round your answer to 3 decimal places • Assume that the Demand has a quadratic relationship with the price. Find this relationship (the help button links to an article to compute trend-lines in Excel): D(p) = Round your answer to 3 decimal places Use the trendlines to find the price corresponding to the equlibrium price between supply and demand: $ per gallon Round your answer to…arrow_forward

- PRICE [Dolars per laptop) The following diagram shows supply and demand in the market for laptops. 150 Demand 135 120 105 90 75 60 45 30 15 Supply ° 1 0 35 70 105 140 175 210 245 280 QUANTITY (Millions of laptops) 315 350 Fill in the following blanks with integer values: The market price is The market quantity is The consumer surplus is 4200 The producer surplus is 4200 The total surplus is 8400 A price ceiling is imposed at $60. The market price is now There is now a (surplus/shortage/none) Is there deadweight loss (yes/no)? of what amount? How much if any? If a price floor is implemented at $65, would it be binding? (yes/no)arrow_forwardQuestion The demand curve for a product is given by QD = 475 - 25P and the supply curve for a product is given by QS = 15P - 45 %3D a) Illustrate the demand curve and the supply curve on the same graph. Label both axes. b) Calculate both the equilibrium price and quantity. c) Calculate the consumer surplus and the producer surplus. d) Identify consumer surplus and producer surplus on your graph. Label as CS and PS. e) Find the total willingness to pay for the equilibrium quantity and the total variable cost of supplying the equilibrium quantity. Identify these areas on your graph. please show workarrow_forwardSuppose that last year the equilibrium price and the quantity of good X were $10 and 5 million pounds. Because of strong demand this year, the equilibrium price and the quantity of good X are $12 and 7 million pounds, respectively. Assuming that the supply curve of good X is linear, what happened to producer surplus in the market? A B Producer surplus increased from $12.5 million to $49 million. Producer surplus increased from $12.5 million to $24.5 million. Producer surplus increased from $3 million to $7 million. Producer surplus increased from $4.2 million to $5.6 million. C Darrow_forward

- Suppose that a $4 subsidy is given to consumers in this market, what is the new consumer surplus?arrow_forwardNonearrow_forwardThe demand and supply schedule for coffee are: Price ($ per cup) Quantity Demanded Quantity Supplied $1 130 10 $2 110 20 $3 90 30 $4 70 40 $5 50 50 $6 30 60 $7 10 70 $8 0 80 a) If there is no tax on coffee, what is the price and how much coffee is consumed b) What is the consumer surplus? Show your calculations c) What is the price elasticity of demand when the price goes up from $3 to $4 dollars? Is the demand for coffee elastic or inelastic? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education