ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

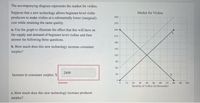

Transcribed Image Text:The accompanying diagram represents the market for violins.

Suppose that a new technology allows beginner-level violin

producers to make violins at a substantially lower (marginal)

cost while retaining the same quality.

Market for Violins

300

270

a. Use the graph to illustrate the effect that this will have on

the supply and demand of beginner-level violins and then

answer the following three questions.

240

210

180

b. How much does this new technology increase consumer

surplus?

150

120

60

2400

Increase in consumer surplus: $

30

D.

20 30 40 50 60

Quantity of violina (in thousands)

Incorrect

10

70

80

90

100

c. How much does this new technology increase producer

surplus?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The average ticket price for a concert at the opera house was $30. The average attendance was 5000. When the ticket price was raised to $33, attendance declined to an average of 4700 persons por performance. What should the ticket price be to maximize revenue for the opera house? (Assume a linear demand curve.) To maximize revenue, the price should be $ por ticket. (Type an integer or decimal rounded to two decimal places as needed. Simplify your answer.)arrow_forwarda) In the market for sugary drinks, the current equilibrium price is $10 and the equilibrium quantity is 30. The demand choke price is $50 and the supply choke price is $5 (a) Draw a demand and supply diagram, and shade the regions that represent consumer and producer welfare. Calculate the Total welfare in this market b) In this market, you now know that E D = −0.4 and E S = 1.2. Redraw your diagram in part (a) with the correct sloping curves. In this part you do not have to shade the welfare regions. All you need to do is redraw the diagram with the same equilibrium price and quantity, and choke prices but adjust the slope of each curve to reflect their respective elasticity c) If a tax was to be implemented in this market, what percentage of the burden is borne by the buyer? d) The government plans to discourage the consumption of sugary drinks and as such, they implemented a $1 tax on every bottle produced. In this situation, the suppliers are taxed directly but they hope to pass…arrow_forwardIn 2020 the UK government introduced a sales tax on all products bought online from overseas. Please note this is not a tariff – it is a tax. The tax will be 2% of the value of the products sold in the UK. This tax is collected from online sellers such as Amazon or ebay. Source: BBC (2019). See link: https://www.bbc.com/news/business-50656106 Consider the market for online products. The initial market equilibrium is at 10 million products sold per year at an average price of $500 each. Then, the UK government imposes a tax on the market, collected from sellers (for example Amazon and ebay). The tax is 2% per item (each item has an average price of $500). Show the effect of this on the market for online products. Show the effect on consumers of online products, on the online sellers and on the government. Does the UK economy gain or lose as a result of the tax? Explain why. Use a diagram to support your answer.arrow_forward

- Use the graph below to answer the following questions: a) what is the level of producer surplus if the market clearing price is $6? b) calculate the change in producer surplus if price increases from $6 to $8. c) what is the elasticity of supply in the $6-$8 price range?arrow_forward9. In recent years, the number of car producers in China has increased rapidly. In fact, China now has more car brands than the United States. In addition, car sales have climbed every year and automakers have increased their output at even faster rates, causing fierce competition and a decline in prices. At the same time, Chinese consumers' incomes have risen. Assume that cars are a normal good. Draw a diagram of the supply and demand curves for cars in China to explain what has happened in the Chinese car market.arrow_forward1. The demand function for a certain brand of CD is given by p = -0.01x² - 0.2x + 10 where p is the unit price in dollars and x is the quantity demanded each week, measured in units of a thousand. The supply function is given by p = 0.01x² + 0.2x + 4 where p is the unit price in dollars and x stands for the quantity that will be made available in the market by the supplier, measured in units of a thousand. Determine the producers' surplus if the market price is set at the equilibrium price. (Round your answer to the nearest dollar.)arrow_forward

- The following graph displays four demand curves (PP, QQ, RR, and SS) that intersect at point V. PRICE (Dollars per unit) 20 18 16 14 12 10 4 2 0 44 a 4 +XX+ W 6 8 10 12 QUANTITY (Units) 14 16arrow_forward1. Briefly describe 5 things that a firm could do that would reduce the price sensitivity of buyers 2. Briefly explain five reasons why firms may choose prices that are below their profit-maximizingprice 3. List 5 things that could increase demand and 5 things that could increase supply for a typical(normal) good (hint: be specific on the direction of change for each event) 4. Describe 5 consumer decision biases 5. Describe 5 costs from international trade 6. Briefly describe 2 or 3 things that could shift labor demand and 2 or 3 things that could shift laborsupply 7. Explain the implications from the short-run and long-run Phillips curve 8. Briefly describe 5 things that could cause the US dollar to appreciate in value 9. List 5 things that could decrease aggregate demand and 5 things that could decrease the short-runaggregate supply for an economy (hint: be specific on the direction of change for each event) 10. Describe the fiscal and monetary options that could be used to reduce…arrow_forwardV1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education