MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

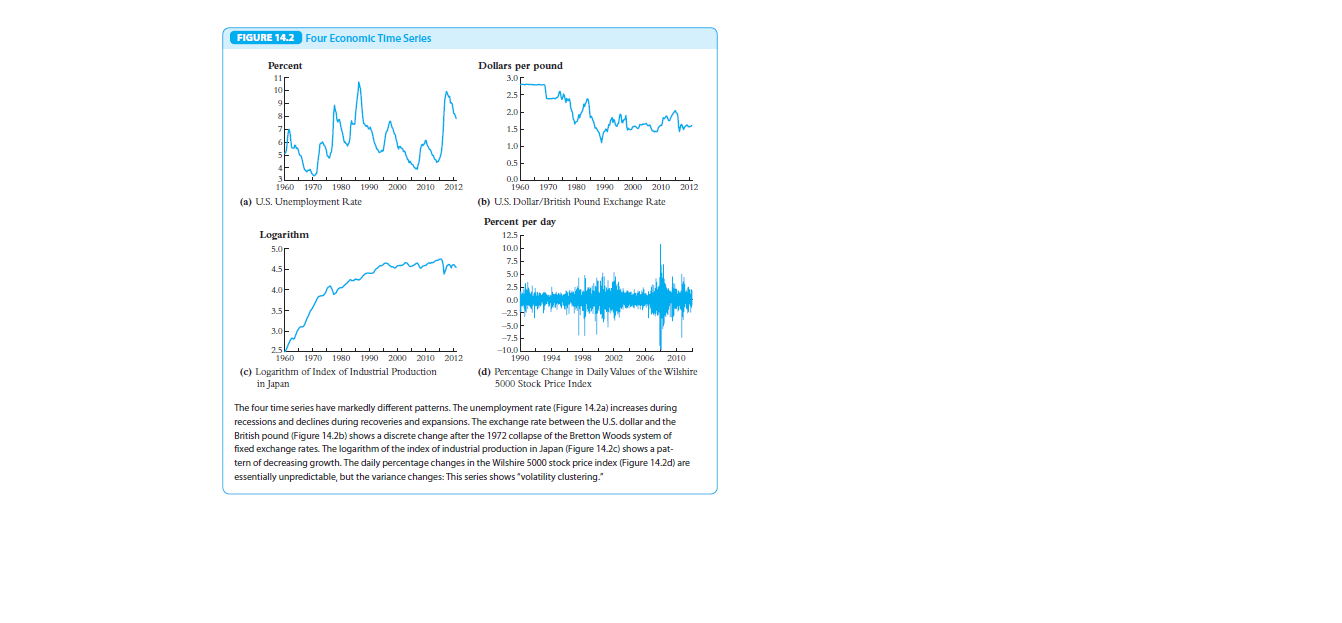

Look at the four plots in Figure 14.2—the US unemployment rate, the

dollar-pound exchange rate, the logarithm of the index of industrial production, and the percentage change in stock prices. Which of these series

appears to be non-stationary? Which of them appears to resemble a random

walk?

Transcribed Image Text:FIGURE 14.2 Four Economic Time Serles

Percent

Dollars per pound

11r

1아

3.0r

2.5

2.아

1.5-

1.0

0.5

-

0.0L

1960 1970 1980 1990 2000 2010 2012

1960 1970 1980 1990 2000 2010 2012

(a) U.S. Unemployment Rate

(b) U.S. Dollar/British Pound Exchange Rate

Percent per day

Logarithm

12.5

5.0r

10.0

7.5

4.5-

5.0

2.5

4.0-

0.0

3.5-

-2.5

-5.0

3.0-

-7.5

25

1960 1970 1980 1990 2000 2010 2012

-10.0

1990 1994

1998 2002

2006

2010

(c) Logarithm of Index of Industrial Production

in Japan

(d) Percentage Change in Daily Values of the Wilshire

5000 Stock Price Index

The four time series have markedly different patterns. The unemployment rate (Figure 14.2a) increases during

recessions and declines during recoveries and expansions. The exchange rate between the U.S. dollar and the

British pound (Figure 14.2b) shows a discrete change after the 1972 collapse of the Bretton Woods system of

fixed exchange rates. The logarithm of the index of industrial production in Japan (Figure 14.2c) shows a pat-

tern of decreasing growth. The daily percentage changes in the Wilshire 5000 stock price index (Figure 14.2d) are

essentially unpredictable, but the variance changes: This series shows "volatility clustering."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- The data for this problem are the air freight shipments (in ton-miles) each month (beginning in January for one year) in the U. S. for 10 years. The following is a time series plot of this data. What are the most important features of this plot? Ton-miles 3000- 2500- 2000- 1500- 1000- 1 Time Series Plot of Ton-miles ܚ ܪܘܐܐܐ ܘ ܚܐ ܀ 12 24 36 48 60 Index 72 84 96 108 120arrow_forward.A new, miracle diabetes drug that diminishes major symptoms of diabetes has been approved by the FDA. Health care professionals and researchers believe that the new drug will prolong lifespan of diabetes patients. If the population is in steady state and the incidence is constant, what will the effect of this new drug be on the prevalence of diabetes in the population? Explain.arrow_forward1.8 Compute and compare the total electricity consumption of Sub-Saharan Africa to the United States in 2012. The population of Sub-Saharan Africa was 926 million, and the United States was 314 million. The per person consumption in the United States in 2012 was 12.96 MWh per year. Consult Fig. 1.11 for the per person consumption in Sub-Saharan Africa.arrow_forward

- I need some help with the following problems on excel.arrow_forwardFrom the data in the table it shows the 2019 daily return data for the S&P 500 Index (stocks) and the US 30 year Bond (bonds). How do I test the hypothesis that mean daily return on stocks exceeds the mean daily return on bonds? Please show the steps. S&P500 dailt returns data: Date Price Daily Return 2019-12-31 3230.78 0.294602% 2019-12-30 3221.29 -0.578082% 2019-12-27 3240.02 0.003398% 2019-12-26 3239.91 0.512817% 2019-12-24 3223.38 -0.019545% 2019-12-23 3224.01 0.086614% 2019-12-20 3221.22 0.494478% 2019-12-19 3205.37 0.445929% 2019-12-18 3191.14 -0.043230% 2019-12-17 3192.52 0.033529% US 30 Year Bond Date Price Daily Return 31-Dec-19 2.389 2.32% 30-Dec-19 2.335 0.78% 29-Dec-19 2.317 -0.03% 27-Dec-19 2.318 -0.16% 26-Dec-19 2.321 -0.71% 25-Dec-19 2.338 0.15% 24-Dec-19 2.334 -0.83% 23-Dec-19 2.354 0.31% 22-Dec-19 2.346 0.12% 20-Dec-19 2.344 -0.43%arrow_forwardSuppose that the index model for stocks A and B is estimated from excess returns with the following results: RA= 2.0% + 0.40RM + eA RB = -1.8%+ 0.9RM + eB OM = 15%; R-squareA = 0.30; R-squareB = 0.22 What is the standard deviation of each stock? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Stock A Stock B Standard Deviation % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman