Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

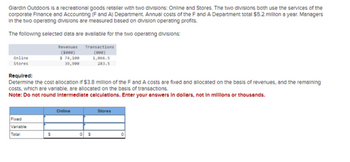

Transcribed Image Text:Giardin Outdoors is a recreational goods retaller with two divisions: Online and Stores. The two divisions both use the services of the

corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.2 million a year. Managers

In the two operating divisions are measured based on division operating profits.

The following selected data are available for the two operating divisions:

Revenues

(5000)

$ 74,100

39,900

Online

Stores

Required:

Determine the cost allocation if $3.8 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining

costs, which are variable, are allocated on the basis of transactions.

Note: Do not round Intermediate calculations. Enter your answers in dollars, not in millions or thousands.

Fixed

Variable

Total

$

Transactions

(000)

1,066.5

283.5

Online

$

Stores

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.arrow_forwardHorton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: The other corporate administrative expenses include officers salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows: The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows: Prepare the divisional income statements for the two divisions.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forward

- Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August. One of the profit centers for Varney Corporation is the Communication Systems (COMM) division. Assume the following information for COMM: COMM has 2,500 employees, of whom 20% are office employees. All of the office employees have been issued a smartphone, and 95% of them have a computer on the network. One hundred percent of the employees with a computer also have an email account. The average number of help desk calls for August was 0.6 call per individual with a computer. There are 400 additional printers, servers, and peripherals on the network beyond the personal computers. a. Compute the service allocation rate for each of CCSs services for August. b. Compute the allocation of CCSs services to COMM for August.arrow_forwardProfit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forwardGiardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.230 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Revenues($000) Transactions(000) Online $ 75,300 1,366.5 Stores 41,100 433.5 Required: What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? What is the F and A cost that is charged to each division if the the number of transactions is used as the allocation basis?arrow_forward

- Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.225 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Revenues ($000) $ 75, 100 40,900 Online Stores Required: Determine the cost allocation if $3.825 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining costs, which are variable, are allocated on the basis of transactions. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Fixed Variable Total Transactions (000) 1,316.5 408.5 Online Storesarrow_forwardManjiarrow_forwardGiardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.260 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Online Stores Required: Revenues ($000) $ 76,500 42,300 Transactions (000) 1,666.5 583.5 a. What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? b. What is the F and A cost that is charged to each division if the the number of transactions is used as the allocation basis? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What is the F and A cost that is charged to each division if divisional revenues are used as the allocation…arrow_forward

- Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.245 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Online Stores Required A Revenues ($000) Required: a. What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? b. What is the F and A cost that is charged to each division if the the number of transactions is used as the allocation basis? $ 75,900 41,700 Complete this question by entering your answers in the tabs below. Division Online Stores Transactions (000) 1,516.5 508.5 Required B What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? Note: Do not…arrow_forwardSubject: acountingarrow_forwardGiardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.215 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Online Stores Revenues ($000) Fixed Variable Total $ 74,700 40,500 Required: Determine the cost allocation if $3.815 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining costs, which are variable, are allocated on the basis of transactions. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Transactions_ (000) 1,216.5 358.5 Online Storesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,