FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

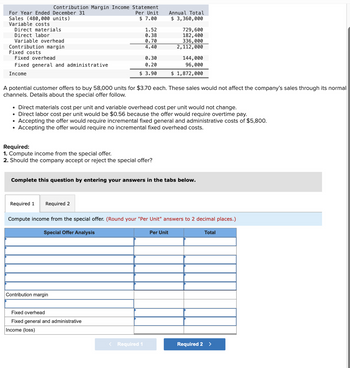

Transcribed Image Text:Contribution Margin Income Statement

Per Unit

$ 7.00

For Year Ended December 31

Sales (480,000 units)

Variable costs

Direct materials

Direct labor

Variable overhead

Contribution margin

Fixed costs

Fixed overhead

Fixed general and administrative

Income

1.52

0.38

0.70

4.40

0.30

0.20

$ 3.90

Required:

1. Compute income from the special offer.

2. Should the company accept or reject the special offer?

Required 1 Required 2

A potential customer offers to buy 58,000 units for $3.70 each. These sales would not affect the company's sales through its normal

channels. Details about the special offer follow.

Contribution margin

• Direct materials cost per unit and variable overhead cost per unit would not change.

• Direct labor cost per unit would be $0.56 because the offer would require overtime pay.

• Accepting the offer would require incremental fixed general and administrative costs of $5,800.

• Accepting the offer would require no incremental fixed overhead costs.

Fixed overhead

Fixed general and administrative

Income (loss)

Annual Total

$ 3,360,000

Complete this question by entering your answers in the tabs below.

729,600

182,400

336,000

2,112,000

< Required 1

144,000

96,000

$ 1,872,000

Compute income from the special offer. (Round your "Per Unit" answers to 2 decimal places.)

Special Offer Analysis

Per Unit

Total

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Belle Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. 80,000 units 48,000 units $ 24 per unit $ 26 per unit $3 per unit $ 600,000 in total Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead Belle Company's product is sold for $80 per unit. Variable selling and administrative expense is $2 per unit and fixed selling and administrative is $320,000 per year. Compute the net income under absorption costing. Multiple Choice O $80,000 $98,000 $296,800 tran^^^arrow_forwardDon't give answer in image formatarrow_forwardQuestion 19?arrow_forward

- EstimatedFixedCost EstimatedVariableCost(perunitsold) Production costs: Direct materials $19 Direct labor 13 Factory overhead $261,300 10 Selling expenses: Sales salaries and commissions 54,300 4 Advertising 18,400 Travel 4,100 Miscellaneous selling expense 4,500 4 Administrative expenses: Office and officers' salaries 53,100 Supplies 6,500 2 Miscellaneous administrative expense 6,040 2 Total $408,240 $54 It is expected that 8,640 units will be sold at a price of $135 a unit. Maximum sales within the relevant range are 11,000 units. Required: Question Content Area 1. Prepare an estimated income statement for 20Y7. Belmain Co.Estimated Income StatementFor the Year Ended December 31, 20Y7 $- Select - Cost of goods sold: $- Select - - Select - - Select -…arrow_forwardPlease do not give answer in image formatearrow_forwardGreen and White Company reported the following monthly data: Units produced Sales price Direct materials Direct labor Variable overhead Fixed overhead What is Green and White's contribution margin for this month if 1,090 units were sold? Multiple Choice O $74,400 $26,160 $32,700 3,100 units $ 30 per unit $ 1 per unit $ 2 per unit $ 3 per unit $ 12,400 in total $93,000arrow_forward

- Total Amount Units Sales Variable Costs: 31,250 Per Unit $ 445,313 $ 14.25 Direct Materials $ 125,000 4.00 = Direct Labor $ 28,000 0.90 = Variable Manufacturing Overhead $ 66,250 2.12 = Sales Commissions $ 15,625 0.50 = Shipping Variable Billing Total Variable Costs $ 3,125 0.10 $ 313 0.01 $ 238,313 7.63 Contribution Margin $ 207,000 6.62 Fixed Costs: Fixed Manufacturing Overhead Advertising Sales and Admin. Salaries Fixed Billing Total Fixed Costs Net Operating Income (Loss) 40,000 16,800 87,300 10,000 154,100 $ 52,900 F. Using the budgeted contribution margin income statement in part E. above, calculate the following: a. Breakeven in units: b. Operating Leverage Multiplier: Given a sales volume increase of 8%, operating income will increase by: c. Percent: d. Dollars: #N/A #N/A #N/A #N/Aarrow_forwardSubject: accountingarrow_forward5 Vista Company reports the following information. Direct materials Direct labor Variable overhead Fixed overhead Units produced Compute its product cost per unit under absorption costing. Multiple Choice $76.00. $152.00. $171.00. $ 44 per unit 64 per unit $ 44 per unit $ 380,000 per year 20,000 units < Prarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education