FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

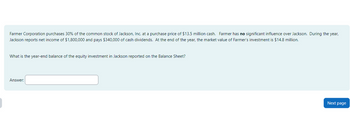

Transcribed Image Text:Farmer Corporation purchases 30% of the common stock of Jackson, Inc. at a purchase price of $13.5 million cash. Farmer has no significant influence over Jackson. During the year,

Jackson reports net income of $1,800,000 and pays $340,000 of cash dividends. At the end of the year, the market value of Farmer's investment is $14.8 million.

What is the year-end balance of the equity investment in Jackson reported on the Balance Sheet?

Answer:

Next page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- We own 35% of Smith corporation, please prepare journal entries for the following events under the appropriate method of accounting. Smith corporation has $100,000 of Net Income for the year. Smith distributes $50,000 to its shareholders in distributions. Our investment in the Smith corporation stock increased by $20,000 during the year.arrow_forwardYankton Company began the year without an investment portfolio. During the year, it purchased investments classified as trading securities at a cost of $13,000. At the end of the year, the market value of the securities was $11,000. Yankton Company's financial statements for the current year should show Ca. no loss on the income statement, net trading securities of $11,000, and an unrealized loss of $2,000 as a stockholders' equity adjustment on the balance sheet b. no loss on the income statement and net trading securities of $13,000 on the balance sheet Cc. a loss of $2,000 on the income statement and net trading securities of $13,000 on the balance sheet Od. a loss of $2,000 on the income statement and temporary investments of $11,000 on the balance sheetarrow_forwardIndigo Corporation purchased 370 shares of Sherman Inc. common stock for $13,100 (Indigo does not have significant influence). During the year, Sherman paid a cash dividend of $3.00 per share. At year-end, Sherman stock was selling for $37.50 per share. Assume the stock is nonmarketable. Prepare Indigo's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)arrow_forward

- Lauralee, Inc. owns a 30% interest in Eastwood Co., giving it representation on the investee’s board of directors. At the beginning of the year, the Equity Investment was carried on Lauralee’s balance sheet at $500,000. During the year, Eastwood reported net income of $250,000 and paid Lauralee a dividend of $50,000. In addition, Lauralee sold inventory to Eastwood, recording a gross profit of $20,000 on the sale. At the end of the year, 50% of the merchandise remained unsold by Eastwood. Required: a. Prepare the equity method journal entry to defer the unrealized inventory gross profit.b. How much equity income should Lauralee report from Eastwood during the year?c. What is the balance in the Equity Investment at the end of the year?arrow_forwardBrooks Company purchases debt investments as trading securities at a cost of $71,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $90,000. Brooks sells a portion of its trading securities (costing $35,500) for $40,250 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction.arrow_forwardAs a long-term investment at the beginning of the fiscal year, Florists International purchased 40% of Nursery Supplies Inc.'s 6 million shares for $50 million. The fair value and book value of the shares were the same at that time. The company realizes that this investment typically would be accounted for under the equity method, but instead chooses the fair value option. During the year, Nursery Supplies earned net income of $30 million and distributed cash dividends of $1.25 per share. At the end of the year, the fair value of the shares is $46 million. Required: 1. How would this investment be classified on Florists balance sheet? Trading securities Held-to-maturity security Significant-influence investment Other securities 2. Prepare all appropriate journal entries related to the investment during 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered…arrow_forward

- The securities owned by Jane Company were held as a long-term investment. During the currentyear, the following transactions occurred:Jan. 1 Purchased 15,000 shares of ABC Company at P70 per share.May 1 Purchased 8,000 shares of XYZ Corporation for P660,000.Apr 1 Received a cash dividend of P6 per share from ABC Company.July 1 Received a share for a share dividend from XYZ Corporation.Aug 1 Purchased 10,000 shares of GHI Enterprises at P75 each.Oct 1 Received a cash dividend of P6 per share from ABC Company.Oct 31 XYZ Corporation offered shareholders rights to subscribe to one new share for every tenrights tendered at P25. At the time of issuance, the market value of the right is P4. Sharerights are not accounted for separately.Nov 15 Exercised the XYZ Corporation’s share rights.Dec. 1 Sold 10,000 shares of XYZ Corporation at P35 per share. Use the FIFO approach indetermining the cost of the shares sold.Dec. 31 The fair values of the portfolio is as follows:ABC Company – P73 per…arrow_forwardFor Year 1, prepare any journal and adjusting entries related to the investment in Band Inc.arrow_forwardDuring 2023, Elisabeth Ltd. purchased 8,000 shares of Lilly of the Valley Corp. for $34 per share ($272,000 total). Elisabeth held these shares until September 2025, when it sold them for $42 per share. During these three years, Lilly of the Valley paid dividends of $2 per share on July 31. On Elisabeth's fiscal year-end (December 31), shares of Lilly of the Valley closed at $39, $30, and $46 in 2023, 2024, and 2025, respectively. Required Assume that the company designated half of the Lilly of the Valley shares as FVPL and the other half irrevocably elected to record fair value changes through OCI. Determine the amounts to be reported on Elisabeth's balance sheet and statement of comprehensive income with respect to the company's investment in Lilly of the Valley Corp. What do you observe about the total amount of retained earnings for the three years combined? Complete the analysis for 2024. Balance sheet Financial asset Equity: AOCI on Lilly of the Valley shares* Retained earnings…arrow_forward

- During 2021, Scott Peterson purchased 275 shares of common stock issued by true state manufacturing for $13,800 including commission. Later in the same year, Scott sold the shares for 14,000 after commission. Calculate the following: 1. Profit on this stock transaction 2. Percentage return on investment %arrow_forwardOn January 1, Year 5, Anderson Corporation paid $864,000 for 27,000 (20%) ofthe outstanding shares of Carter Inc. The investment was considered to be one of significantinfluence. In Year 5, Carter reported profit of $102,000; in Year 6, its profit was $112.00O. Dividends paidwere $67,000 in each of the two years. Required A Calculate the balance in Anderson's investment account as at December 31, Year 6.arrow_forwardAn investor company owns 40% of the outstanding common stock of an investee company, which allows the investor to exercise significant influence over the investee. The Equity Investment was reported at $1,050,000 as of the end of the previous year. During the year, the investor received dividends of $110,000 from the investee. The investee reports the following income statement for the year: Revenues Expenses $2,700,000 1,800,000 900,000 100,000 Comprehensive income $1,000,000 a. How much equity income should the investor report in its net income (i.e., as part of the current year income statement)? Net income Other comprehensive income $0 b. What amount should the investor report for the Equity Investment in its balance sheet at the end of the year? $0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education