FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Investment Accounting in Band Inc. for Year 1**

In this section, we will walk through the process of preparing the necessary journal and adjusting entries related to investments made in Band Inc. during Year 1. This is a critical part of keeping accurate financial records and ensuring compliance with accounting principles.

---

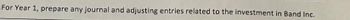

*For Year 1, prepare any journal and adjusting entries related to the investment in Band Inc.*

---

Follow these steps:

1. **Initial Investment Entry**: Record the original investment in Band Inc.

- **Debit**: Investment in Band Inc. account

- **Credit**: Cash or Bank account

2. **Dividend Received Entry**: If any dividends are received from Band Inc., record them.

- **Debit**: Cash or Dividend Receivable account

- **Credit**: Dividend Income account

3. **Adjusting Entries**: At the end of the year, make any necessary adjustments, such as for market value changes or accruals.

- **Debit/Credit**: Adjustment accounts as per market value changes

- **Credit/Debit**: Investment in Band Inc. account

4. **Income from Investment**: Recognize any income earned from the investment during the year.

- **Debit**: Investment in Band Inc. account

- **Credit**: Income from Investment account

---

Ensure to review the specific financial guidelines and standards applicable to your region or organization for detailed procedures and compliance. This process helps to present a true and fair view of the financial position regarding investments in the company's financial statements.

Transcribed Image Text:### Investment Activities of Parade Corp. Related to Band Inc.

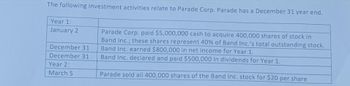

**Overview:**

Parade Corp. has a fiscal year ending on December 31. The following outlines the investment activities between Parade Corp. and Band Inc. over the span of approximately one year.

*Year 1:*

- **January 2:**

- Parade Corp. invested $5,000,000 in Band Inc. by purchasing 400,000 shares of stock.

- This investment represents 40% of Band Inc.’s total outstanding stock.

- **December 31:**

- Band Inc. achieved $800,000 in net income for the year.

- Band Inc. declared and distributed dividends totaling $500,000 for Year 1.

*Year 2:*

- **March 5:**

- Parade Corp. sold all 400,000 shares of Band Inc. stock at a price of $20 per share.

**Diagram/Graph:**

Note: No diagrams or graphs accompany this text. The provided data is presented in a tabular format, which is summarized above for clarity.

---

This transcription preserves the financial details and timeline of Parade Corp.'s investment for educational purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the year, Cellular Land, Inc. issued 1,500 shares of its $0.50 stated value common stock for $15 per share, and declared and paid cash dividends totaling $0.25 per share. By what amount does contributed capital increase as a result of these events? $22,500 $750 $21,750 $22,125arrow_forwardDuring Year 11, Pacilio Security Services experienced the following transactions: Paid the sales tax payable from Year 10. Paid the balance of the payroll liabilities due for Year 10 (federal income tax, FICA taxes, and unemployment taxes). Issued 5,000 additional shares of the $5 par value common stock for $8 per share. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share. Purchased $500 of supplies on account. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase. After numerous attempts to collect from customers, wrote off $3,670 of uncollectible accounts receivable. Sold 210 alarm systems for $600 each plus sales tax of 5 percent. All sales were on account. Record the cost of goods sold related to the sale from Event 8 using the FIFO method. Billed $125,000 of monitoring services for the year. Credit card sales amounted to $58,000, and the credit card company charged a 4 percent fee. The remaining $67,000 were…arrow_forwardAt the beginning of the year, the Carolyn Brewery of Melbourne, Australia purchased a 25 percent ownership interest in Amber Pub of Brisbane, Australia. The investment cost $12 million. At year- end, Amber Pub declared and paid cash dividends to shareholders totaling $320,000, after reporting earnings of $2.0 million. A. Calculate the income statement effect of Carolyn's investment in Amber Pub as of year-end. B. Calculate the book value of Carolyn's equity investment in Amber Pub at year-end. C. Calculate the book value of Carolyn's equity investment in Amber Pub at year-end assuming that Down Under reported a loss of $1.2 million instead of a profit of $2.0 million and still paid vidend $320,000.arrow_forward

- On January 1, Year 5, Anderson Corporation paid $864,000 for 27,000 (20%) ofthe outstanding shares of Carter Inc. The investment was considered to be one of significantinfluence. In Year 5, Carter reported profit of $102,000; in Year 6, its profit was $112.00O. Dividends paidwere $67,000 in each of the two years. Required A Calculate the balance in Anderson's investment account as at December 31, Year 6.arrow_forwardAn investor company owns 40% of the outstanding common stock of an investee company, which allows the investor to exercise significant influence over the investee. The Equity Investment was reported at $1,050,000 as of the end of the previous year. During the year, the investor received dividends of $110,000 from the investee. The investee reports the following income statement for the year: Revenues Expenses $2,700,000 1,800,000 900,000 100,000 Comprehensive income $1,000,000 a. How much equity income should the investor report in its net income (i.e., as part of the current year income statement)? Net income Other comprehensive income $0 b. What amount should the investor report for the Equity Investment in its balance sheet at the end of the year? $0arrow_forwardBean Corporation purchased 35% of the outstanding shares of common stock of Williams Corporation as a long-term investment. Subsequently, Williams Corporation reported net income. What journal entry would Bean Corporation use to record its share of the earnings of Williams Corporation? debit Cash: credit Dividend Revenue debit Investment in Williams Corporation Stock: credit Cash debit Cash: credit Investment in Williams Corporation debit Investment in Williams Corporation; credit Income of Williams Corporationarrow_forward

- Dristell Incorporated had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $419,000 was sold for $519,000. b. Additional common stock was issued for $179,000. c. Dristell purchased its own common stock as treasury stock at a cost of $84,500. d. Land was acquired by issuing a 6%, 10-year, $769,000 note payable to the seller. e. A dividend of $59,000 was paid to shareholders. f. An investment in Fleet Corporation's common stock was made for $139,000. g. New equipment was purchased for $74,500. h. A $99,500 note payable issued three years ago was paid in full. i. A loan for $119,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from financing activities. (Cash outflows should be indicated with a minus sign.) DRISTELL INCORPORATED Statement of Cash Flows (partial) For the Year Ended December…arrow_forwardScott Co. acquired a 30% interest in Roker, Inc. for $210,000 and appropriately applied the equity method. During the first year, Roker, Inc. reported net income of $125,000 and paid cash dividends totaling $25,000.What amount will Scott report as it relates to the investment at the end of the first year on its income statement? Select one: A. Investment earnings totaling $37,500 B. Investment earnings totaling $22,500 C. Receipt of dividends totaling $7,500 D. Net investment earnings totaling $75,000arrow_forwardDristell Inc. had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $400,000 was sold for $500,000. b. Additional common stock was issued for $160,000. c. Dristell purchased its own common stock as treasury stock at a cost of $75,000. d. Land was acquired by issuing a 6%, 10-year, $750,000 note payable to the seller. e. A dividend of $40,000 was paid to shareholders. f. An investment in Fleet Corp.'s common stock was made for $120,000. g. New equipment was purchased for $65,000. h. A $90,000 note payable issued three years ago was paid in full. i. A loan for $100,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from investing activities. (List cash outflows and any decrease in cash as negative amounts.) Net cash flowsarrow_forward

- West Asset Management Inc. purchased a stock at $78.26 per share at the beginning of the year and held the stock for one year. At the end of the year, West Asset Management sold all of its holdings for this stock at $83.26 per share and received a dividend of $4.25 per share. What was West Asset Management’s total investment return for this stock in the holding period? A. 6.39% B. 15.64% C. 11.82% D. 5.43%arrow_forwardRios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios Co., which has a fiscal year ending on December 31: Record these transactions on page 10: 20Y2 Feb. 1 Purchased 6,600 shares of Caldwell Inc. common stock at $43 per share plus a brokerage commission of $660. Caldwell has 100,000 shares of common stock outstanding. May 1 Purchased securities of Holland Inc. as a trading investment for $82,998. July 1 Sold 3,430 shares of Caldwell Inc. for $41 per share less a $115 brokerage commission. 31 Received an annual dividend of $0.25 per share on 3,170 shares of Caldwell Inc. stock. Nov. 15 Sold the remaining shares of Caldwell Inc. for $44 per share less a $95 brokerage commission. Dec. 31 The trading securities of Holland Inc. have a fair value on December 31 of $74,343. Record these transactions on page 11: 20Y3 Apr. 1 Purchased…arrow_forwardTerrance Company reported $20,000 retained earnings at the beginning of the year. The company repurchased 200 shares at $50 per share during the year for the first time. Later, during the year the company sold 100 shares of these treasury shares for $45 per share. Terrance earned $15,000 net income during the year. The company also declared and paid dividends on 500 outstanding 4% preferred stock with $100 par value. Based on this information alone, compute the retained earnings balance at the end of the year. O $34,500 O $35,000 O $32,500 O $32,000 O $37,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education