Essentials of Economics (MindTap Course List)

8th Edition

ISBN: 9781337091992

Author: N. Gregory Mankiw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Engineering Econ HW5 Q1

Transcribed Image Text:Fall 2024

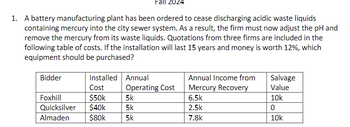

1. A battery manufacturing plant has been ordered to cease discharging acidic waste liquids

containing mercury into the city sewer system. As a result, the firm must now adjust the pH and

remove the mercury from its waste liquids. Quotations from three firms are included in the

following table of costs. If the installation will last 15 years and money is worth 12%, which

equipment should be purchased?

Bidder

Installed

Annual

Annual Income from

Salvage

Cost

Operating Cost

Mercury Recovery

Value

Foxhill

$50k

5k

6.5k

10k

Quicksilver $40k

5k

2.5k

0

Almaden

$80k

5k

7.8k

10k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Energy entrepreneur T. Boone Pickens has proposed converting the trucking fleet in the United States to liquefied natural gas (LNG) and using wind power to replace the missing LNG in electric power production. What infrastructure issues do you see that must be resolved before the Pickens plan could be adopted?arrow_forwardWhat life cycle cost concept begins raising concerns by year 5 with any electric vehicle (EV)? If that issue affected resale value at year 5, would that affect perceived value-in-use? How exactly?arrow_forwardInvestors sometimes fear that a high-risk investment is especially likely to have low returns. Is this fear true? Does a high risk mean the return must be low?arrow_forward

- Why might it be difficult for a buyer and seller to agree on a price when imperfect information exists?arrow_forwardWhat are some ways that someone looking for a loan might reassure a bank that is faced with imperfect information about whether the borrower will repay the loan?arrow_forwardWhat is a capital gain?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co