ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Don't use Ai.

Answer in step by step with explanation.

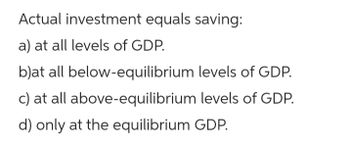

Transcribed Image Text:Actual investment equals saving:

a) at all levels of GDP.

b)at all below-equilibrium levels of GDP.

c) at all above-equilibrium levels of GDP.

d) only at the equilibrium GDP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Explain why investment (I) varies more from year-to-year than consumption (C).arrow_forwardAn economy with no government and no foreign trade tends to move toward equilibrium GDPbecause at output levels greater than equilibrium GDP, inventories are a)increasing, and actual investment exceeds desired investment.b)increasing, and actual investment is less than desired investment.c) decreasing, and actual investment exceeds desired investment.d)decreasing, and actual investment is less than the desired investment.arrow_forwardHand written solutions are strictly prohibitedarrow_forward

- True/False An increase in savings implies a decrease in consumption and therefore a decrease in GDP.arrow_forwardtrue/false explain When savings equals investment, reducing savings and increasing consumption is especially effective in stimulating output.arrow_forwardOutput (Y): 10,000 Government Spending (G): 1,500 Desired Consumption (C): 8,500 If the goods market is in equilibrium for a closed economy, what is the desired level of investment?arrow_forward

- In a closed economy, subsistence consumption is 10 billions, households spend 60% of their net disposable income on leisure consumption, investment is constant at 40 billions, taxes are 20 billions, government spending is 20 billions and the gross domestic product is 145 billions. Assume that suppliers always respond to variations in demand, that it takes them 1 month to adjust to new demand levels and that they make adjustments once per month (if any). One day, the government increases its spending to 30 billions. After 2 months (at the end of the 2nd month), by how much has the gross domestic product increased? Select one: a. 16 b. 25. c. 32 d. 50arrow_forwardDuring recessions investment falls by a larger percentage than GDP. falls by about the same percentage as GDP. falls by a smaller percentage than GDP. falls but the percentage change is sometimes much larger and sometimes much smallerarrow_forwardSuppose GDP is $800 billion, taxes are $150 billion, private saving is $50 billion, and public saving is $20 billion. Assuming this economy is closed, calculate consumption, government purchases, national saving, and investment.arrow_forward

- Explain how the current level of investment depends on the following factors: 1) the current level of national income; 2) the current level of the interest rate; 3) the expected net profits in future time periods; 4) the expected interest rates in future time periods; 5) the current level of profit.arrow_forwardAssume a closed economy with a GDP (Y) of 6,000. Consumption (C) is given by the equation C = 600+ 0.6(Y -T). Investment (I) is given by the equation I = 2,000- 100i, where i is the nominal rate of interest (in percent). Taxes (T) are 500 and government spending (G) is also 500. (a) What is the autonomous consumption? (b) What is the autonomous spending? (c) What is the marginal propensity to consume?arrow_forwardA decrease in a country's capital stock occurs when Multiple Choice ____ businesses sell machinery and equipment to one another. ____ the prices of investment goods rise faster than the prices of consumer goods. ____ businesses have larger inventories at the end of the year than they had at the start. ____ the consumption of fixed capital exceeds gross domestic investment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education