FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

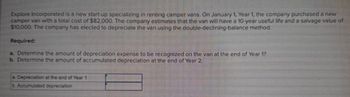

Transcribed Image Text:Explore Incorporated is a new start-up specializing in renting camper vans. On January 1, Year 1, the company purchased a new

camper van with a total cost of $82,000. The company estimates that the van will have a 10-year useful life and a salvage value of

$10,000. The company has elected to depreciate the van using the double-declining-balance method.

Required:

a. Determine the amount of depreciation expense to be recognized on the van at the end of Year 1?

b. Determine the amount of accumulated depreciation at the end of Year 2.

a Depreciation at the end of Year 1

b. Accumulated depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Apex Fitness Club uses straight-line depreciation for a machine costing $30,450, with an estimated four-year life and a $2,250 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,800 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revisionarrow_forwardApex Fitness Club uses straight-line depreciation for a machine costing $27,450, with an estimated four-year life and a $2,050 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,600 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the machine's value at the end of its second year. answers to the nearest whole dollar.) Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revision $ 0 lations. Round your finalarrow_forwardPier Exports purchased equipment on January 1, 2018, at a cost of $600,000. Thecompany estimates that there will be $60,000 salvage value and that the equipmentwill have a useful life of 8 years. The company elects to use the sum-of-the-years'digit method until 2021, at which time the company changes to the straight-linemethod of depreciation for the equipment. Required:1. The equipment's book value at January 1, 2021 is $ _________. Round your final answer to the nearest dollar.2. The annual depreciation expense for 2021 is $ _________. Round your final answer to the nearest dollar.arrow_forward

- Robert Parish Corporation purchased a new machine for its assembly process on August 1, 2020. The cost of this machine was $117,900. The company estimated that the machine would have a salvage value of $12,900 at the end of its service life. Its life is estimated at 5 years, and its working hours are estimated at 21,000 hours. Year-end is December 31. Instructions Compute the depreciation expense under the following methods. Each of the following should be considered unrelated. a. Straight-line depreciation for 2020. b. Activity method for 2020, assuming that machine usage was 800 hours. c. Sum-of-the-years’-digits for 2021. d. Double-declining-balance for 2021.arrow_forwardHelp me selecting the right answer. Thank youarrow_forwardCheyenne Corp. purchased a new machine on October 1, 2022, at a cost of $131,000. The company estimated that the machine will have a salvage value of $18,500. The machine is expected to be used for 10,000 working hours during its 5-year life. Straight-line method for depreciation expense for 2022 is 5625 My question is "Compute the depreciation expense under units-of-activity for 2022, assuming machine usage was 1,900 hours." The answer should be a depreciation expense this is for a study guide on wiley plusarrow_forward

- Counselors of Atlanta purchased equipment on January 1, 2023, for $20,000. Counselors of Atlanta expected the equipment to last for four years and have a residual value of $2,000. Suppose Counselors of Atlanta sold the equipment for $8,000 on December 31, 2025, after using the equipment for three full years. Assume depreciation for 2025 has been recorded. Journalize the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment. Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss)arrow_forward[The following information applies to the questions displayed below.]On January 1, 2021, the Excel Delivery Company purchased a delivery van for $46,000. At the end of its five-year service life, it is estimated that the van will be worth $4,000. During the five-year period, the company expects to drive the van 165,000 miles. Required:Calculate annual depreciation for the five-year life of the van using each of the following methods. 1. Straight line. 2.Double-Declining Method 3. Units of production using miles driven as a measure of output, and the following actual mileage:arrow_forwardFreedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $48,000. The machine has an estimated life of five years and an estimated salvage value of $6,600. Required: a. Calculate the depreciation expense for each year of the asset's life using: 1. Straight-line depreciation. 2. Double-declining-balance depreciation. b. How much depreciation expense should be recorded by Freedom Co. for its fiscal year ended December 31, 2019, under each method? (Note: The machine will have been used for one-half of its first year of life.) c. Calculate the accumulated depreciation and net book value of the machine at December 31, 2020, under each method. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Required C Calculate the depreciation expense for each year of the asset's life using Straight-line depreciation. Depreciation Expense Year 1 2 3 4 5arrow_forward

- Cheadle Company purchased a fleet of 20 delivery trucks for $8,000 each on January 2, 2019. It decided to use composite depreciation on a straight-line basis and calculated the depreciation from the following schedule: 1. Prepare the journal entries necessary to record the preceding events. 2. Assume that the company expected all the trucks to last 4 years and be retired for $1,600 each. Using group depreciation, prepare journal entries for all 6 years, assuming the company retired the trucks as shown by the latter schedule.arrow_forwardColquhoun International purchases a warehouse for $301,000. The best estimate of the salvage value at the time of purchase was $16,000, and it is expected to be us for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determir that the warehouse will be useful for only another fifteen years. A. Calculate annual depreciation expense for the first four years. $ 171,000 B. Determine the depreciation expense for the final fifteen years of the asset's life. 11,400 X Feedback V Check My Work When revising deprecation schedules, the book value is used as the adjusting base to apply the new changes to when determine the revised yearly depreciation amount. C. Prepare the journal entry for year five. If an amount box does not require an entry, leave it blank. Depreciation Expense 171,000 X Accumulated Depreciation-Warehouse 171,000arrow_forwardBob Co purchased a building for $50,000 and began depreciating assuming a salvage value of $5,000 and useful life of 20 years. After 5 years, it was determined that the salvage value would be $10,000, but the useful life would only be for an additional 10 years. Calculate the depreciation, assuming straight line, for Year 1 and Year 6 of the building, and prepare the necessary journals.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education