FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3

4

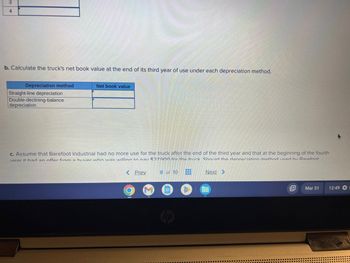

b. Calculate the truck's net book value at the end of its third year of use under each depreciation method.

Depreciation method

Straight-line depreciation

Double-declining-balance

depreciation

Net book value

c. Assume that Barefoot Industrial had no more use for the truck after the end of the third year and that at the beginning of the fourth

vear it had an offer from a huver who was willing to pay $27900 for the truck Should the depreciation method used by Rarefoot

Next >

< Prev

8 of 10

H--

H

Mar 31

12:49 O

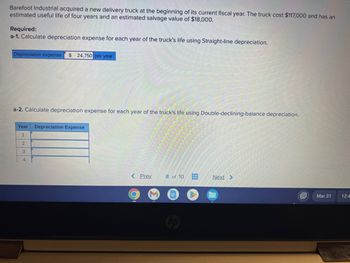

Transcribed Image Text:Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $117,000 and has an

estimated useful life of four years and an estimated salvage value of $18,000.

Required:

a-1. Calculate depreciation expense for each year of the truck's life using Straight-line depreciation.

Depreciation expense $24,750 per year

a-2. Calculate depreciation expense for each year of the truck's life using Double-declining-balance depreciation.

Year

1

2

3

4

Depreciation Expense

< Prev 8 of 10

●

www

www

Next >

D

Mar 31

12:4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Phillips corporation purchased a truck that cost $70,000. The company expected to drive the truck 100,00 miles. the truck had an estimated salvage value of $10,000. Of the truck is driven 14,000 miles in the current accounting period. with of the following amounts should be recognized as depreciation expensearrow_forwardApex Fitness Club uses straight-line depreciation for a machine costing $21,950, with an estimated four-year life and a $2,250 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,800 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this questlon by enterIng your answers In the tabs below. Required 1 Required 2 Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revision Required 2arrow_forwardS Mohr Company purchases a machine at the beginning of the year at a cost of $36,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 8 years with a $5,000 salvage value. Depreciation expense in year 2 is: Multiple Choice $9,000. $31,000. $4,500. $3,875. $0.arrow_forward

- Mohr Company purchases a machine at the beginning of the year at a cost of $41,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 8 years with a $3,000 salvage value. The book value of the machine at the end of year 2 is: Multiple Choice $4,750. $9,500 $28,500. $31,500. $38,000. 3 of 10 E Next Preyarrow_forwardGrouper Company acquires a delivery truck at a cost of $50,000. The truck is expected to have a salvage value of $12,000 at the end of its 5-year useful life.Compute annual depreciation expense for the first and second years using the straight-line method. Year 1 Year 2 Annual depreciation expense $ $arrow_forwardApex Fitness Club uses straight-line depreciation for a machine costing $30,450, with an estimated four-year life and a $2,250 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,800 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the machine's book value at the end of its second year. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revisionarrow_forward

- Copy equipment was acquired at the beginning of the year at a cost of $62,460 that has an estimated residual value of $5,700 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 946,000 copies. This year, 267,000 copies were made. a. Determine the depreciable cost. b. Determine the depreciation rate. per copy c. Determine the units-of-output depreciation for the year.arrow_forwardThunderbird Manufacturing purchases a new stamping machine for $50,000. Its useful life is estimated to be 250,000 units with a salvage value of $5,000. Prepare a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. Thunderbird ManufacturingUnits-of-Production Depreciation ScheduleStamping Machine End of Year Depreciation per Unit ($) Units Produced Annual Depreciation ($) Accumulated Depreciation ($) Book value ($) $50,000 (new) 1 $ 50,000 $ $ $ 2 $ 70,000 $ $ $ 3 $ 45,000 $ $ $ 4 $ 66,000 $ $ $ 5 $ 30,000 $ $ $arrow_forwardDinkins Company purchased a truck that cost $66,000. The company expected to drive the truck 100,000 miles over its 5-year useful life, and the truck had an estimated salvage value of $10,000. If the truck 31,000 miles in the current accounting period, what would be the amount of depreciation expense for the year using the units-of-production method? Multiple Choice O OOO $11,200 $20,460 $26,400 $17,360 drivenarrow_forward

- Apex Fitness Club uses straight-line depreciation for a machine costing $27,450, with an estimated four-year life and a $2,050 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,600 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the machine's value at the end of its second year. answers to the nearest whole dollar.) Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revision $ 0 lations. Round your finalarrow_forwardUse the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On April 1, Cyclone Company purchases a trencher for $288,000. The machine is expected to last five years and have a salvage value of $44,000. Exercise 8-11 (Algo) Straight-line, partial-year depreciation LO C2 Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the straight-line method. Choose Numerator: Year First year Second year Annual Depreciation X Choose Denominator: Fraction of Year || = = = = Annual Depreciation Annual depreciation Depreciation Expensearrow_forwardA storage tank acquired at the beginning of the fiscal year at a cost of $586,000 has an estimated residual value of $52,000 and an estimated useful life of 10 years. Determine the following: a. the amount of annual depreciation by the straight-line method and b. the amount of depreciation for the first, second, and third years computed by the double-declining-balance method. c. A diesel-powered tractor with a cost of $216,000 and estimated residual value of $39,000 is expected to have a useful operating life of 45,000 hours. During February, the generator was operated 860 hours. Determine the depreciation for the month. d. Prepare the journal entry to record the depreciation under c. above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education