FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

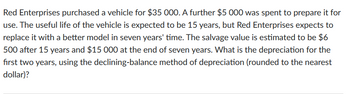

Transcribed Image Text:Red Enterprises purchased a vehicle for $35 000. A further $5 000 was spent to prepare it for

use. The useful life of the vehicle is expected to be 15 years, but Red Enterprises expects to

replace it with a better model in seven years' time. The salvage value is estimated to be $6

500 after 15 years and $15 000 at the end of seven years. What is the depreciation for the

first two years, using the declining-balance method of depreciation (rounded to the nearest

dollar)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming straight-line depreciation is used. Income Before Depreciation Depreciation Expense Net (Pretax) Income Year 1 Year 2 Year 3 Year 4 Year 5 Totals $0 $0 $0arrow_forwardComplete using the declining-balance method of depreciation. Round to the nearest hundredth of a percent when necessary. Useful Life(Years) Straight-LineRate (%) Multiple (%) Declining-BalanceRate (%) 5 % 200 %arrow_forwardUsing the sum-of-the-years’-digits method, find the denominator of the depreciation rates for an asset with an expected life of seven yearsarrow_forward

- Which method of computing depreciation expense results in the amount of depreciation for each year depending on the units-of-production for that year? A. Straight line B. Double-declining balance C. Units-of-production D. Sum-of-the-years digits E. None of the abovearrow_forwardProblem 12-33 Replacement decision analysis (LO12-4] new Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $78,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $34,800. A new piece of equipment will cost $230,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Cash Year Savings $ 61,000 1 51,000 3 49,000 47,000 44,000 33,000 4 The firm's tax rate is 25 percent and the cost of capital is 10 percent.arrow_forwardDepreciation by Two Methods A storage tank acquired at the beginning of the fiscal year at a cost of $75,000 has an estimated residual value of $4,500 and an estimated useful life of five years. a. Determine the amount of annual depreciation by the straight-line method. b. Determine the amount of depreciation for the first and second years computed by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your answers to the nearest dollar. Depreciation Year 1 Year 2arrow_forward

- Revision of Depreciation A building with a cost of $630,000 has an estimated residual value of $126,000, has an estimated useful life of 36 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? b. What is the book value at the end of the twentieth year of use? c. If at the start of the twenty-first year it is estimated that the remaining life is 20 years and that the residual value is $30,000, what is the depreciation expense for each of the remaining 20 years?arrow_forwardwhat is the depreciation expense to be recognized each calendar year for financial reporting purposes under 200 percent declining-balance method (half-year convention)with a switch to straight-line when it will maximize depreciation expense?arrow_forwardRequired: State the effect (higher, lower, no effect) of accelerated depreciation relative to straight-line depreciation on a. Depreciation expense in the first year. b. The asset's net book value after two years. Cash flows from operations (excluding income taxes). с.arrow_forward

- Answer full question.arrow_forwardOn January 1, 2023, a machine was purchased for $105,000. The machine has an estimated salvage value of $6,420 and an estimated useful life of 5 years. The machine can operate for 106,000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2023, 21,200 hours; 2024, 26,500 hours; 2025, 15,900 hours: 2026, 31,800 hours; and 2027, 10,600 hours. Compute the annual depreciation charges over the machine's life assuming a December 31 year-end for each of the following depreciation methods. (Round rate per hour to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 45,892.) 1. Straight-line Methodi $ 2. Activity Method Year 2023 2024 2025 $ 19,716 19,716 24,645 14,787arrow_forwardDepreciation by Two Methods A computer system acquired on January 1 at a cost of $180,000 has an estimated useful life of ten years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. First Year Second Year b. Determine the depreciation for each of the first two years by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your final answers to the nearest dollar. First Year Second Year 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education