Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

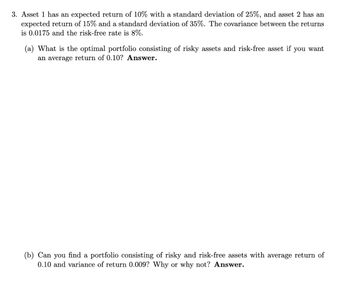

Transcribed Image Text:3. Asset 1 has an expected return of 10% with a standard deviation of 25%, and asset 2 has an

expected return of 15% and a standard deviation of 35%. The covariance between the returns

is 0.0175 and the risk-free rate is 8%.

(a) What is the optimal portfolio consisting of risky assets and risk-free asset if you want

an average return of 0.10? Answer.

(b) Can you find a portfolio consisting of risky and risk-free assets with average return of

0.10 and variance of return 0.009? Why or why not? Answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are 10% and 20%, respectively. a. What is the slope of the capital allocation line (CAL) constructed using the risk-free asset and the risky asset? A. 0.30 B. 0.15 C. 0.25 D. 0.20 b. If an investor has a risk aversion coefficient of A=2, what is the optimal fraction of the money that she invests in the risky asset? A. 62.5% B. 42.5% C. 30% D. 20% c. If an investor invest 25% of her money in the risky asset, which is the investor’s risk aversion coefficient? a. 5 b. 1 c. 3 d. 4arrow_forwardConsider two well-diversified portfolios: Portfolio 1 has an expected return of 8% and a beta of 0.80 while Portfolio 2 has an expected return of 13% and a beta of 1.50. If the risk-free rate is 1.5%, which portfolio would a rational risk-averse investor prefer and why? O A. Portfolio 2 because it has the higher reward to risk ratio. O B. Portfolio 1 because it has the higher reward to risk ratio. OC. Portfolio 2 because it has the higher reward. O D. Portfolio 1 because it has the lower risk.arrow_forwardImagine a feasible set of portfolios with two risky assets with a correlation of -1. What name did Harry Markowitz give to the portfolios on the upper arm of the sideways 'v'? The feasible set The portfolio possibility line. The optimum set The efficient set Previous Page Next Pagearrow_forward

- Consider the following portfolio choice problem. The investor has initial wealth w and utility u(x)=. There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1-q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) Does the investor put more or less of his portfolio into the risky asset as his wealth increases?arrow_forwardDraw the profit diagram of the portfolio just drawn (and clearly state any assumptions you make). The profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?arrow_forwardSuppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forward

- The risk-free rate is currently 3.3%, and the market return is 14.8%. Assume you are considering the following investments: Investment Beta A 1.54 B 1.16 C 0.51 D 0.11 E 2.14 . a. Which investment is most risky? Least risky? b. Use the capital asset pricing model (CAPM) to find the required return on each of the investments. c. Find the security market line (SML), using your findings in part b. d. On the basis of your findings in part c, what relationship exists between risk and return? Explain.arrow_forwardThere are two risky assets and a riskfree asset. The riskfree rate is 0.03. The first risky asset has expected rate of return 0.18 and standard deviation 0.3; the second risky asset 0.09 and 0.2. Their correlation is 0.1. A portfolio on the best feasible CAL has an expected return of 0.12. Then this portfolio's portfolio weight on the first risky asset is 0%. (Enter a percentage number and keep 3 decimal places).arrow_forwardAsset W has an expected return of 13.4 percent and a beta of 1.6. If the risk-free rate is 5.0 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Do not round intermediate calculations and enter your expected return answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 3 decimal places, e.g., 32.161.) Asset W has an expected return of 13.4 percent and a beta of 1.6. If the risk-free rate is 5.0 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Do not round intermediate calculations and enter your expected return answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 3 decimal places, e.g., 32.161.)arrow_forward

- (Portfolio VaR) Suppose there are two investments A and B. Either investment A or B has a 4.5% chance of a loss of $15 million, a 2% chance of a loss of $2 million, and a 93.5% change of a profit of $2 million. The outcomes of these two investments are independent of each other.arrow_forwardSuppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below (Attached image). Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?arrow_forwardA single mispriced asset has an alpha a = 3.0%, a beta ẞ = 1, and unsystematic risk σ² = 9%. The market risk premium is 5.0% and the market's standard deviation is 0.1. What is the information ratio of the mispriced asset? In constructing an optimal allocation between this mispriced asset and the market portfolio, what proportion of your investment would you place in the mispriced asset? Oa. 0.1; 6.67% O b. 0.33; 6.67% O c. 0.33; 6.90% O d. 0.1; 66.67% O e. 0.1; 6.90%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education