Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

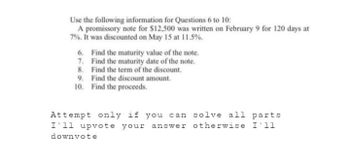

Transcribed Image Text:Use the following information for Questions 6 to 10:

A promissory note for $12,500 was written on February 9 for 120 days at

7%. It was discounted on May 15 at 11.5%.

6.

7.

Find the maturity value of the note.

Find the maturity date of the note.

8. Find the term of the discount.

Find the discount amount.

Find the proceeds.

9.

10.

Attempt only if you can solve all parts

I'll upvote your answer otherwise I'11

downvote

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Determine the maturity date and compute the interest of each of the following notes: (use 360 days for interest calculation. Round to the nearest dollar) The options for the shaded blanks A - E are the months January through December.arrow_forwardAbe Corporation discounted a 120-day note with a maturity value of $8,000 dated June 8 at the Village Bank on September 2, at a discount rate of 9%. Use ordinary interest. How much did Abe receive?arrow_forwardCalculate the discount period for the bank to wait to receive its money: (Use Days in a year table): date of note length of note date note discounted discount period (days) july 14th 50 days august 5 ?arrow_forward

- 4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Maturity Face Interest Date of Term of Maturity Value Value Rate (%) Note Note (days) Date (in $) 11- $250 June 5 135 -Select--- $ Date of Discount Discount Proceeds Discount Period (days) Rate (%) (in $) Sept. 7 12.5 $arrow_forwardUse the journals provided in the assignment file to journalize the notes receivable transactions below. Nov. 2 - Received cash for the maturity value of a notes receivable for $400.00 plus $15.00 interest. Receipt 49 Nov. 10 - Accepted a 60-day, 9% note from Paula Jones for an extension of time on her account, $2,000.00. Note NR13 Nov. 20 - Accepted a 90-day, 8% note from George Robbins for an extension of time on his account, $3,000.00. Note NR14 Nov. 27 - Received cash for the maturity value of a notes receivable for $1,000.00 plus $30.00 interest. Receipt 51arrow_forward

- Calculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forward4. Jill Hamlin borrowed $40,000 from the bank on August 16, issuing the bank a 12% note. The entry to record accrued interest on the note on August 31 (15 days later) would include: a . debit Interest Expense for $197.26 b. debit Interest Payable for $197.26 c. credit Interest Expense for $407.67 d. credit Interest Payable for $407.67 d. debit Cash for $18,000arrow_forwardThe following interest-bearing.promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.). Face Value: $1,280 Interest Rate : 7.7 Date of Note: Sept 18 Term of Note (days) : 130 Maturity Date : ? Maturity Value (in $) $? Date of Discount : Dec 11 Discount Period (days) : ? Discount Rate (%) : 11.2 Proceeds (in $): $? If you purchase $28,000 in U.S. Treasury Bills with a discount rate of 4.9% for a period of 26 weeks, what is the effective interest rate (as a %)? Round to the nearest hundredth percent.arrow_forward

- Check my wor Solve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) (Do not round intermediate calculations. Round your final answers to the nearest cent.) Face value Rate of Length of note Date note (principal) $26, 300 interest Maturity value Date of note discounted 9% 65 days Discount period Bank discount Proceeds March 17 April 20 days 24 $4 hparrow_forwardOn January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 90-day note with a face amount of \( \$ 44, 400 \). Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of \(8\% \). b. Determine the proceeds of the note, assuming the note is discounted at \(8\% \),arrow_forwardCalculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education