FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide correct solution and accounting question

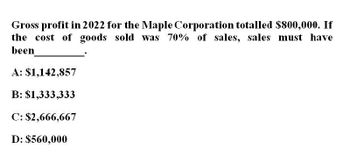

Transcribed Image Text:Gross profit in 2022 for the Maple Corporation totalled $800,000. If

the cost of goods sold was 70% of sales, sales must have

been

A: $1,142,857

B: $1,333,333

C: $2,666,667

D: $560,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Burrow Corporation had the following information for the year ended December 31, 2020: Sales Revenue $70,000 Cost of Goods Sold 30,000 Operating Expenses 15,000 Net Income 25,000 What is Burrow Corporation's gross profit ratio (rounded) for the year 2020?arrow_forwardThe following comparative information is available for Blossom Company for 2025. LIFO FIFO Sales revenue $89,000 $89,000 Cost of goods sold 37,000 29,000 Operating expenses (including depreciation) 27,000 27,000 Depreciation 10,000 10,000 Cash paid for inventory purchases 20,750 20,750 (a) Determine net income under each approach. Assume a 30% tax rate. LIFO Net income $ FIFOarrow_forwardCalculate gross profitarrow_forward

- What is the gross profit that Brighton electronics would report?arrow_forwardDuring 2020, Bramble Co. generated revenues of $102000. The company’s expenses were as follows: cost of goods sold of $41000, operating expenses of $16000 and a loss on the sale of equipment of $2700.Bramble’s gross profit is $42300. $45000. $102000. $61000.arrow_forwardABC Company has the following information for the year ended December 31, 2022: Sales revenue: $1,500,000 Cost of goods sold: $800,000 Operating expenses: $300,000 Interest expense: $50,000 Income tax rate: 30% Calculate the net income for ABC Company for the year ended December 31, 2022.arrow_forward

- Milton, Inc. provides the following income statement for 2025: Net Sales $240,000 Cost of Goods Sold 110,000 Gross Profit $130,000 Operating Expenses: Selling Expenses 45,000 Administrative Expenses 12,000 Total Operating Expenses 57,000 Operating Income $73,000 Other Income and (Expenses): Loss on Sale of Capital Assets (26,000) Interest Expense (1,000) Total Other Income and (Expenses) (27,000) Income Before Income Taxes $46,000 Income Tax Expense 5,000 Net Income $41,000 Calculate the times−interest−earned ratio. (Round your answer to two decimal places.)arrow_forwardThe following information was taken from the financial statements of Sunland Company: 2021 2020 Gross profit on sales $678,600 $760,000 Income before income taxes 205,400 225,000 Net income 260,000 225,000 Net income as a percentage of net sales 10% 9% Please show steps to finding answer Compute the cost of goods sold in dollars and as a percentage of net sales for each year. (Round percentages to 1 decimal place, e.g. 15.2%) 2021 2020 Cost of goods sold in dollars $enter a dollar amount $enter a dollar amount Cost of goods sold as a percentage of net sales nter percentages rounded to 1 decimal place % nter percentages rounded to 1 decimal place %arrow_forwardCrane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Variable Fixed $416,000 $234.000 34,320 46,800 72,800 Administrative expenses 36,320 Prepare a detailed CVP income statement for the year ended December 31, 2022. Crane Manufacturing Ltd. CVP Income Statementarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education