FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

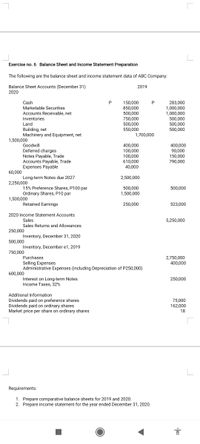

Transcribed Image Text:Exercise no. 6 Balance Sheet and Income Statement Preparation

The following are the balance sheet and income statement data of ABC Company:

Balance Sheet Accounts (December 31)

2019

2020

150,000

850,000

500,000

750,000

500,000

550,000

283,000

1,000,000

1,000,000

500,000

500,000

500,000

Cash

P

Marketable Securities

Accounts Receivable, net

Inventories

Land

Building, net

Machinery and Equipment, net

1,700,000

1,500,000

Goodwill

Deferred charges

Notes Payable, Trade

Accounts Pay

Expenses Payable

400,000

100,000

100,000

610,000

40,000

400,000

90,000

150,000

790,000

Trade

60,000

Long-term Notes due 2027

2,500,000

2,250,000

15% Preference Shares, P100 par

Ordinary Shares, P10 par

500,000

1,500,000

500,000

1,500,000

Retained Earnings

250,000

523,000

2020 Income Statement Accounts

Sales

5,250,000

Sales Returns and Allowances

250,000

Inventory, December 31, 2020

500,000

Inventory, December e1, 2019

750,000

Purchases

2,750,000

400,000

Selling Expenses

Administrative Expenses (including Depreciation of P250,000)

600,000

Interest on Long-term Notes

Income Taxes, 32%

250,000

Additional Information

Dividends paid on preference shares

Dividends paid on ordinary shares

Market price per share on ordinary shares

75,000

162,000

18

Requirements:

1. Prepare comparative balance sheets for 2019 and 2020.

2. Prepare income statement for the year ended December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- KIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 81,500 $ 54,000 Accounts receivable, net 80,000 61,000 Inventory 73,800 101,500 Prepaid expenses 5,400 7,400 Total current assets 240,700 223,900 Equipment 134,000 125,000 Accumulated depreciation—Equipment (32,000) (14,000) Total assets $ 342,700 $ 334,900 Liabilities and Equity Accounts payable $ 35,000 $ 45,000 Wages payable 7,000 17,000 Income taxes payable 4,400 5,800 Total current liabilities 46,400 67,800 Notes payable (long term) 32,000 70,000 Total liabilities 78,400 137,800 Equity Common stock, $5 par value 240,000 170,000 Retained earnings 24,300 27,100 Total liabilities and equity $ 342,700 $ 334,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 728,000 Cost of goods sold 421,000 Gross profit 307,000 Operating expenses (excluding depreciation) 77,000 Depreciation expense 68,600 161,400…arrow_forwardFind earnings per share 2019arrow_forwardHeerarrow_forward

- Condensed financial data of Concord Inc. follow. CONCORD INC.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $80,500 $48,700 Accounts receivable 87,900 38,600 Inventory 111,900 102,100 Prepaid expenses 29,400 27,900 Long-term investments 139,800 113,700 Plant assets 284,200 241,900 Accumulated depreciation (47,700) (49,100) Total $686,000 $523,800 Liabilities and Stockholders’ Equity Accounts payable $106,000 $63,700 Accrued expenses payable 16,500 21,200 Bonds payable 117,100 149,500 Common stock 219,000 175,100 Retained earnings 227,400 114,300 Total $686,000 $523,800 CONCORD INC.Income StatementFor the Year Ended December 31, 2022 Sales revenue $382,500 Less: Cost of goods sold…arrow_forwardcarrow_forwardPLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 155,100 74,800 87,000 2,400 171,800 88,000 72,800 1,200 Accounts receivable Inventory Prepaid rent Long-term assets: Land 440,000 732,00ө (406, ө00) $1,085,300 440, ө0ө 630,000 252,000) $1,151,800 Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: 91,000 6,900 6,400 $ 77,800 13,800 4, 200 115,000 230,000 Common stock 660,000 206,000 $1,085,300 660,000 166,000 $1,151,800 Retained earnings Total liabilities and stockholders' equity Additional Information for 2021: 1. Net income is $61,000. 2. The company purchases $102,000 in equipment. 3. Depreciation expense is $154,000. 4. The company repays $115,000 in notes payable. 5. The company declares and pays a cash dividend of $21,000. %24 %24 %24arrow_forward

- The most recent financial statements for Crosby, Incorporated, appear below. Sales for 2022 are projected to grow by 20 percent. Interest expense will remain constant, the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (24%) CROSBY, INCORPORATED 2021 Income Statement Net income Dividends Addition to retained earnings Current assets Cash Accounts receivable Inventory $31,335 69,745 $ 20,640 43,580 91,960 $747,000 582,000 18,000 FA $147,000 14,000 $ 133,000 31,920 $ 101,080 CROSBY, INCORPORATED Balance Sheet as of December 31, 2021 Assets Seved Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total $ 54,800 14,000 $ 68,800 MA000arrow_forwardAssets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2021: 1. Net income is $167,040. 2. Sales on account are $1,813,900. 3. Cost of goods sold is $1,346,550. 2021 $ 215,040 $ 128,000 94,000 100,000 103,000 88,000 4,800 2,800 560,000 560,000 870,000 750,000 (508,000) (348,000) $1,338,840 $1,280,800 $ 106,600 7,000 9,000 120,000 2020 780,000 316,240 $1,338,840 $ 93,000 12,800 5,800 240,000 780,000 149,200 $1,280,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education