FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

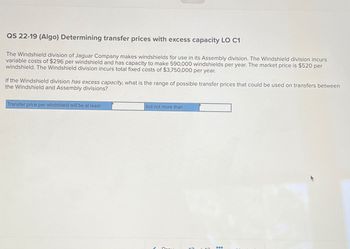

Transcribed Image Text:QS 22-19 (Algo) Determining transfer prices with excess capacity LO C1

The Windshield division of Jaguar Company makes windshields for use in its Assembly division. The Windshield division incurs

variable costs of $296 per windshield and has capacity to make 590,000 windshields per year. The market price is $520 per

windshield. The Windshield division incurs total fixed costs of $3,750,000 per year.

If the Windshield division has excess capacity, what is the range of possible transfer prices that could be used on transfers between

the Windshield and Assembly divisions?

Transfer price per windshield will be at least

but not more than

Drav

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 6-18 (Algo) Relevant Cost Analysis In a Variety of Situations [LO6-2, LO6-3, LO6-4] Andretti Company has a single product called a Dak. The company normally produces and sells 87,000 Daks each year at a selling price of $60 per unit. The company's unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 7.50 8.00 2.90 5.00 ($435,000 total) 2.70 2.50 ($217,500 total) $28.60 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 113,100 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 30% above the present 87,000 units each year if it were willing to increase the fixed selling expenses by $110,000. What is the financial…arrow_forward8.5 Special order pricing Marston Manufacturing has an annual capacity of 85,000 units per year. Currently, the company is making and selling 78,000 units a year. The normal sales price is $120 per unit, cariable costs are $90 per unit, and total fixed expenses are $2,000,000. an out of state distributor has offered to buy 12,000 units at $105 per unit. Marston's cost structure should not change as the result of this special order. REQUIRED By how much will Marstonsincome change if the company accepts this order?arrow_forwardQUESTION 7 Quiet Corp. currently makes 2000 subcomponents a year in one of its factories. The unit costs to produce are: Description Per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $4 4 2 IMI An outside supplier has offered to provide Quiet Corp. with the 2000 subcomponents at a $17 per unit price. Fixed overhead is not avoidable. If Quiet Corp. decides to buy from the outside supplier, the impact to net income will be ? If positive, enter the number, if negative, place a-sign before your numberarrow_forward

- nkt.3arrow_forwardH1. Accountarrow_forwardExercise 11-7 (Algo) Transfer Pricing from the Viewpoint of the Entire Company (LO11-3] Division A manufactures electronic circuit boards that can be sold to Division B of the same company or to outside customers. Last year, the following activity occurred in Division A: Selling price per circuit board Variable cost per circuit board Number of circuit boards: Produced during the year Sold to outside customers Sold to Division B $ 189 $ 120 20,300 14,500 5,800 Sales to Division B were at the same price as sales to outside customers. The circuit boards purchased by Division B were used in an electronic instrument manufactured by that division (one board per instrument). Division B incurred $300 in additional variable cost per instrument and then sold the instruments for $690 each. Required: 1. Calculate the net operating incomes earned by Division A, Division B, and the company as a whole. 2. Assume Division A's manufacturing capacity is 20,300 circuit boards. Next year, Division B wants…arrow_forward

- Target Costing Laser Cast Inc. manufactures color laser printers. Model J20 presently sells for $150 and has a product cost of $120, as follows: Direct materials $90 Direct labor 20 Factory overhead 10 Total $120 It is estimated that the competitive selling price for color laser printers of this type will drop to $140 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit. 2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $3 per unit. 3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 42% of the factory overhead are related to running injection molding machines. The…arrow_forwardExercise 20.3 (Algo) Computing Required Sales Volume (LO20-4, LO20-5) The following is information concerning a product manufactured by Ames Brothers. Sales price per unit Variable cost per unit Total fixed manufacturing and operating costs (per month) 78 43 430,000 ces a. Determine the unit contribution margin. b. Determine the number of units that must be sold each month to break even. (Round your answer to the nearest whole number.) c. Determine the number of units that must be sold to earn an operating income of $234,000 per month. (Round your answer to the nearest whole number.) a. Unit contribution margin b. Break-even units C. Target sales in units 23 NOV 11 itv li 1 W %24 ...arrow_forward7. Division X produces a single product for both Division Y and an external market. It has spare capacity to produce another 20,000 items. Additional details for Division X are as follows: Information for Division X Price of product sold to outside market Current transfer price Variable cost per item made in division Fixed costs per item (based on budget) Division Y has requested a further 5,000 items. £25 £20 £12 £6 What is the minimum price that Division X should ask per item? (a) £12 (b) £18 (c) £20 (d) £25arrow_forward

- Please do not give solution in image format thankuarrow_forwardExercise A-2 Absorption Costing Approach to Setting a Selling Price [LOA-2] Martin Company is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year 15,500 Unit product cost $ 50 Projected annual selling and administrative expenses $ 66,000 Estimated investment required by the company $ 450,000 Desired return on investment (ROI) 18 % The company uses the absorption costing approach to cost-plus pricing. Required: 1. Compute the markup required to achieve the desired ROI. ((Round your final answer to 2 decimal places (i.e., 0.1234 should be entered as 12.34).) 2. Compute the selling price per unit. (Round your intermediate and final answers to 2 decimal places. )arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education