FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

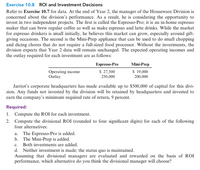

Transcribed Image Text:Exercise 10.8 ROl and Investment Decisions

Refer to Exercise 10.7 for data. At the end of Year 2, the manager of the Houseware Division is

concerned about the division's performance. As a result, he is considering the opportunity to

invest in two independent projects. The first is called the Espresso-Pro; it is an in-home espresso

maker that can brew regular coffee as well as make espresso and latte drinks. While the market

for espresso drinkers is small initially, he believes this market can grow, especially around gift-

giving occasions. The second is the Mini-Prep appliance that can be used to do small chopping

and dicing chores that do not require a full-sized food processor. Without the investments, the

division expects that Year 2 data will remain unchanged. The expected operating incomes and

the outlay required for each investment are as follows:

Espresso-Pro

Mini-Prep

Operating income

Outlay

S 27,500

250,000

S 19,000

200,000

Jarriot's corporate headquarters has made available up to $500,000 of capital for this divi-

sion. Any funds not invested by the division will be retained by headquarters and invested to

earn the company's minimum required rate of return, 9 percent.

Required:

1. Compute the ROI for each investment.

2. Compute the divisional ROI (rounded to four significant digits) for each of the following

four alternatives:

a. The Espresso-Pro is added.

b. The Mini-Prep is added.

c. Both investments are added.

d. Neither investment is made; the status quo is maintained.

Assuming that divisional managers are evaluated and rewarded on the basis of ROI

performance, which alternative do you think the divisional manager will choose?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Sandhill Fiber Company is the creator of Y-Go, a technology that weaves silver into its fabrics to kill bacteria and odor on clothing while managing heat. Y-Go has become very popular in undergarments for sports activities. Operating at capacity, the company can produce 1,065,000 Y-Go undergarments a year. The per unit and the total costs for an individual garment when the company operates at full capacity are as follows. Per Undergarment Total Direct materials $1.92 $2,44,800 Direct labor 0.43 457,950 Variable manufacturing overhead 1.02 1,086,300 Fixed manufacturing overhead Variable selling expenses 1.53 1,629,450 0.37 394,050 Totals $5.27 $5,612,550 The U.S.Army has approached Sandhill Fiber and expressed an interest in purchasing 249,000 Y-Go undergarments for soldiers in extremely warm climates. The Army would pay the unit cost for direct materials, direct labor, and variable manufacturing overhead costs. In addition, the Army has agreed to pay an…arrow_forwardSubmit test Test Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and inline skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-snow Sports. The following divisional information is available for the past year: (Click the icon to view the information.) Test's management has specified a 13% target rate of return. Compute each division's RI. Interpret your results. Are your results consistent with each division's ROI? First, select the formula to calculate residual income (RI). 1) = RI The RI for the Snow Sports division is The RI for the Non-snow Sports division is Both divisions have residual income. This means that the divisions are earning income at a rate that management's minimum expectations. Are your results consistent with each division's ROI? This result is with the ROI calculations. 4 12 144arrow_forward1. Compute the unit contribution margin for both models.arrow_forward

- D1. Accountarrow_forwardI have been given the wrong answer several times.arrow_forwardPart A A software company is considering launching a new product in the market. To record consumer behavior, the company participated in two domestic software fairs in Athens and Thessaloniki that costed €7,000. The results showed that there are two Scenarios (A and B) whose probabilities of occurrence are 60% and 40% respectively, based on consumers’ willingness to buy the new product. To start production, €100,000 is required for new machinery, plus another €2,000 for transport costs and €1,000 for installation costs. This is a state-of-the-art technology machinery, thus, its economic life is only two years. The new machinery will be fully depreciated at the end of its economic life and the company applies the straight-line depreciation method. Table 1 shows the estimated figures on sales, variable costs, selling price, management and distribution costs and working capital needs. At the end of the second year the working capital will be recovered. Table 1: Estimated financial data…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education