FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

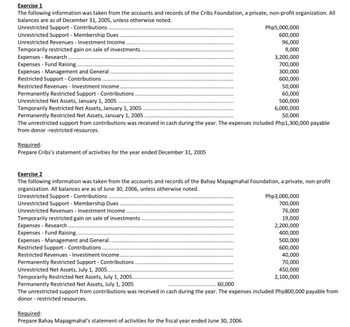

Transcribed Image Text:Exercise 1

The following information was taken from the accounts and records of the Cribs Foundation, a private, non-profit organization. All

balances are as of December 31, 2005, unless otherwise noted.

Unrestricted Support - Contributions.

Unrestricted Support - Membership Dues.

Unrestricted Revenues - Investment Income.

Temporarily restricted gain on sale of investments

Expenses - Research.

Expenses - Fund Raising....

Expenses - Management and General

Restricted Support - Contributions

Restricted Revenues - Investment Income.

Permanently Restricted Support - Contributions

Unrestricted Net Assets, January 1, 2005

Temporarily Restricted Net Assets, January 1, 2005.

Php5,000,000

600,000

96,000

9,000

3,200,000

700,000

300,000

600,000

50,000

60,000

500,000

6,000,000

Permanently Restricted Net Assets, January 1, 2005.

50,000

The unrestricted support from contributions was received in cash during the year. The expenses included Php1,300,000 payable

from donor-restricted resources.

Required:

Prepare Cribs's statement of activities for the year ended December 31, 2005

Exercise 2

The following information was taken from the accounts and records of the Bahay Mapagmahal Foundation, a private, non-profit

organization. All balances are as of June 30, 2006, unless otherwise noted.

Unrestricted Support - Contributions

Unrestricted Support - Membership Dues

Unrestricted Revenues - Investment Income

Temporarily restricted gain on sale of investments

Expenses - Research

Expenses - Fund Raising.....

Expenses Management and General

Restricted Support - Contributions

Restricted Revenues - Investment Income.

Unrestricted Net Assets, July 1, 2005....

Permanently Restricted Support - Contributions

Temporarily Restricted Net Assets, July 1, 2005..

Permanently Restricted Net Assets, July 1, 2005

60,000

Php3,000,000

700,000

76,000

19,000

2,200,000

400,000

500,000

600,000

40,000

70,000

450,000

2,100,000

The unrestricted support from contributions was received in cash during the year. The expenses included Php800,000 payable from

donor restricted resources.

Required:

Prepare Bahay Mapagmahal's statement of activities for the fiscal year ended June 30, 2006.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Exercise 2 (LO 4, 6) Contributions, statement of activities. Early in 2018, a not-for- profit organization received a $4,000,000 gift from a wealthy benefactor. This benefactor speci- fied that the gift be invested in perpetuity with income restricted to provide speaker fees for a lecture series named for the benefactor. The not-for-profit is permitted to choose suitable investments and is responsible for all other costs associated with initiating and administering this series. Neither the donor's stipulation nor the law addresses gains and losses on this permanent endowment. In 2018, the investments purchased with the gift earned $100,000 in dividend income. The fair value of the investments increased by $300,000. The not-for-profiť's accounting policy is to record increases in net assets, for which a donor-imposed restriction is met in the same accounting period as gains and investment income are recognized, as increases in unrestricted net assets. Five presentations in the lecture…arrow_forwardP. 12-6 The distinction between contributed services that warrant financial statement recognition and those that do not is not always clear. For each of the following situations, indicate whether the organization should recognize the described contributed services as revenue (offset by a corresponding expense). Briefly justify your response or identify key issues. Nellie Wilson, the noted country-and-western singer, performs a benefit concert for the Save Our Farms Association, a political advocacy group. Wilson, who would normally charge $60,000 per concert, did not accept a fee. Camp Chi-Wan-Da, a summer camp for disadvantaged youth, benefits from the services of four physicians, each of whom spends two weeks at the camp providing medical services to the campers. The doctors receive free room and board but no salary. Camp association standards require that a camp of Chi-Wan-Da’s size either have a physician on premises or have a physician on call. The Taconic Music Festival, a…arrow_forwardExercise 10-8 (Algo) Presented below is a partially completed Statement of Activities for a homeless shelter. Complete the Statement of Activities by filling in any missing amounts as needed. Revenues Contribution revenues Net assets released from restrictions Total revenues CENTERVILLE AREA HOMELESS SHELTER Statement of Activities For the Year Ended December 31, 2020 Expenses Temporary shelter program Self-sufficiency program Fund raising Administration Total expenses Increase in net assets Net assets January 1 Net assets December 31 Net Assets without Donor Restrictions $ 0 0 90,000 21,000 111,000 Net Assets with Donor Restrictions $ (30,000) (30,000) 0 28.150 14,650 42,800 Total $ 1,595,530 $ 0 1,595,530 1,037,400 372,200 8,200 59,580 1,477,380 118,150 35,650 153,800arrow_forward

- Assume the financial statements of a non-profit organization had the following financial data at 12-31-22: Change in net assets yr/yr $550,000 Revenue & Gains $10,550,000 Beginning year net assets $4,830,000 1)How much were the expenses for the year? 2) Assume that there were $2,100,000 of fund-raising expenses. Which of the three below areas would those expenses usually fall under: a. Unrestricted b. Temporarily restricted c. Permanently restrictedarrow_forwardgener a rullu neverve rullu TULOA Revenues Property taxes Intergovernmental Miscellaneous Total revenues Expenditures Current Personnel services Supplies Capital outlay Debt service Principal Interest Total expenditures Excess of revenues over expenditures Other financing sources (uses): Issuance of debt Transfers from other funds Transfers to other funds Total other financing sources (uses) Fund balance beginning of year Excess of revenues and other sources over (under) expenditures and other uses Fund balance end of year Additional information: $ 284,000 29,700 4,800 $ 20,100 318,500 20,100 $ 284,000 49,800 4,800 338,600 145,500 22,500 14,100 159,600 22,500 115,000 115,000 5,000 7,800 5,000 7,800 $ 295,800 $ 14,100 $ 309,900 22,700 6,000 28,700 38,400 38,400 7,700 7,700 (7,700) (7,700) 30,700 7,700 38,400 53,400 13,700 67,100 24,200 8,200 32,400 $ 77,600 $ 21,900 $ 99,500 a. Property taxes expected to be collected more than 60 days following year-end are deferred in the fund-basis…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education