FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:gener a rullu

neverve rullu

TULOA

Revenues

Property taxes

Intergovernmental

Miscellaneous

Total revenues

Expenditures

Current

Personnel services

Supplies

Capital outlay

Debt service

Principal

Interest

Total expenditures

Excess of revenues over expenditures

Other financing sources (uses):

Issuance of debt

Transfers from other funds

Transfers to other funds

Total other financing sources (uses)

Fund balance beginning of year

Excess of revenues and other sources over (under) expenditures and other uses

Fund balance end of year

Additional information:

$ 284,000

29,700

4,800

$ 20,100

318,500

20,100

$ 284,000

49,800

4,800

338,600

145,500

22,500

14,100

159,600

22,500

115,000

115,000

5,000

7,800

5,000

7,800

$ 295,800

$ 14,100

$ 309,900

22,700

6,000

28,700

38,400

38,400

7,700

7,700

(7,700)

(7,700)

30,700

7,700

38,400

53,400

13,700

67,100

24,200

8,200

32,400

$ 77,600

$ 21,900

$ 99,500

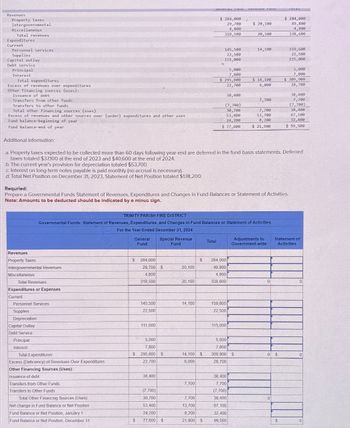

a. Property taxes expected to be collected more than 60 days following year-end are deferred in the fund-basis statements. Deferred

taxes totaled $37,100 at the end of 2023 and $40,600 at the end of 2024.

b. The current year's provision for depreciation totaled $53,700.

c. Interest on long-term notes payable is paid monthly (no accrual is necessary).

d. Total Net Position on December 31, 2023, Statement of Net Position totaled $138,200.

Requried:

Prepare a Governmental Funds Statement of Revenues, Expenditures and Changes in Fund Balances or Statement of Activities.

Note: Amounts to be deducted should be indicated by a minus sign.

Revenues

TRINITY PARISH FIRE DISTRICT

Governmental Funds: Statement of Revenues, Expenditures, and Changes in Fund Balances or Statement of Activities

For the Year Ended December 31, 2024

General

Fund

Special Revenue

Fund

Total

Adjustments to

Government-wide

Statement of

Activities

Property Taxes

Intergovernmental Revenues

Miscellaneous

Total Revenues

S

284,000

$

29,700 $

20,100

284,000

49,800

4,800

318,500

20,100

4,800

338,600

0

0

Expenditures or Expenses

Current

Personnel Services

145,500

14,100

159,600

Supplies

22,500

22,500

Depreciation

Capital Outlay

Debt Service

115,000

115,000

Principal

5,000

5,000

Interest

7,800

7,800

Total Expenditures

$ 295,800 $

Excess (Deficiency) of Revenues Over Expenditures

22,700

14,100 $

6,000

309,900 $

0 $

0

28,700

Other Financing Sources (Uses):

Issuance of debt

Transfers from Other Funds

Transfers to Other Funds

Total Other Financing Sources (Uses)

Net change in Fund Balance or Net Position

Fund Balance or Net Position, January 1

38,400

38,400

7,700

7,700

(7,700)

(7,700)

30,700

7,700

38,400

0

53,400

13,700

67,100

24,200

8,200

32,400

Fund Balance or Net Position, December 31

$ 77,600 $

21,900 $

99,500

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DO NOT GIVE SOLUTION IN IMAGEarrow_forwardWhich of the following neither increases nor decreases fund balance of the General Fund during the current period? a. Revenues. b. Other financing sources. c. Deferred revenues. d. Expenditures.arrow_forwardFor the following event, prepare journal entries under a governmental fund (using modified accrual), necessary worksheet entries, and government-wide financial statements (using accrual basis of accounting). At year end, additional general obligation bonds were issued at 102 with a face value of $1,000,000. J/E under Modified Accrual Account Debited [Select) Worksheet Entries Account Debited [Select] [Select] Account Credited [Select] [Select] Account Credited [Select [Select] Amount Debited [Select] Amount Debited 1.000.000 [Select) Amount Credited 1,000,000 [Select] Amount Credited 1.000.000 [Select]arrow_forward

- Using the Balance Sheet in the St. Johns County, Florida 2015 CAFR calculate the following ratios for each of the five (5) funds shown and for the “Total Governmental Funds:”a. Current Ratiob. Net Working Capitalc. Debt Ratio 1d. Debt Ratio 2e. Unrestricted Net Assets Ratiof. Response RatioReconciliation of the Governmental Funds Balance Sheetto the Statement of Net Position September 30, 2015Total fund balances- governmental funds $ 157,315,850Amounts reported for governmental activities in the statement of netposition are different because:Capital assets used in governmental activities are not current financialresources and therefore are not reported in the governmental funds. 1,241,213,205Net OPEB obligations are created through the estimated calculation of the county'semployer contribution toward the retiree's benefits. The amount greater or less than the 5,549,497annual required contribution is posted as an asset/(liability).Deferred outflows for bond refunding losses are…arrow_forwardHardevarrow_forwardCity of Smithville CH 4 Fiscal year 2023. Questions 8-13arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education