FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Help & Save is a private not-for-profit entity that operates in Kansas. Swim For Safety is a private not-for-

profit entity that operates in Missouri. The leaders of these two organizations have decided to combine

forces on January 1, 2020, in order to have a bigger impact from their work. They are currently discussing

ways by which this combination can be created. The following are statements of financial position for both

charities at that date.

HELP & SAVE

Statement of Financial Position

January 1, 2020

Assets

Cash

$1,800,000

110,000

400,000

800,000

$3,110,000

Contributions receivable (net)

Investments

Buildings & equipment (net)

Total assets

Liabilities

Accounts payable and accrued liabilities

Notes payable

Total liabilities

$210,000

1,200,000

$1,410,000

Net Assets

$1,300,000

400,000

$1,700,000

$3,110,000

Net assets without donor restrictions

Net assets with donor restrictions

Total net assets

Total liabilities and net assets

SWIM FOR SAFETY

Statement of Financial Position

January 1, 2020

Assets

Cash

$700,000

250,000

270,000

690,000

$1,910,000

Contributions receivable (net)

Investments

Buildings & equipment (net)

Total assets

Liabilities

Accounts payable and accrued liabilities

Notes payable

$270,000

720,000

$990,000

Total liabilities

Net Assets

Net assets without donor restrictions

$520,000

400,000

$920,000

$1,910,000

Net assets with donor restrictions

Total net assets

Total liabilities and net assets

The buildings and equipment reported by Help & Save have a fair value of $1,020,000. The buildings and

equipment reported by Swim For Safety have a fair value of $810,000.

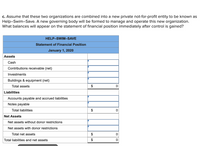

Transcribed Image Text:c. Assume that these two organizations are combined into a new private not-for-profit entity to be known as

Help-Swim-Save. A new governing body will be formed to manage and operate this new organization.

What balances will appear on the statement of financial position immediately after control is gained?

HELP-SWIM-SAVE

Statement of Financial Position

January 1, 2020

Assets

Cash

Contributions receivable (net)

Investments

Buildings & equipment (net)

Total assets

$

Liabilities

Accounts payable and accrued liabilities

Notes payable

Total liabilities

$

Net Assets

Net assets without donor restrictions

Net assets with donor restrictions

Total net assets

$

Total liabilities and net assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardJournal entries for a nonprofit Fruits & Veggies, a nonprofit, conducts two types of programs: education and research. It does not use fund accounting. During 2018, the following transactions and events took place. Prepare journal entries for these transactions, identifying increases and decreases by net asset classification as appropriate. 1. Pledges amounting to $200,000 were received, to be used for any purpose designated by the trustees. Fruits & Veggies normally collects 90 percent of the amount pledged. 2. Fruits & Veggies collected $190,000 in cash on the amount pledged in the previous transaction. It wrote off the balance as uncollectible. 3. Ed Victor donated $5,000 cash in 2018, stipulating that it could be used for any purpose, but only during 2019. 4. Howard Gore donated $675,000, stipulating that the donation must be used solely to purchase a building that Fruits & Veggies could use for research. 5. Fruits & Veggies invested $20,000 of…arrow_forwardRakesharrow_forward

- Seniors Moving, a non-profit, had the following: contributions of $200,000; stamps and paper to send to donors to request more money, $20,000; salaries for case works that help senior citizens (for Seniors Moving's mission), $150,000; various gifts to donors, $30,000. What amount would be program expenses? Would Senior Movers have to show information in a separate statement of functional expenses (yes), or could show program/support in another report (No)? 1. 200,000, Yes 2. 150,000, No 3. 200,000, No 4. 150,000, Yesarrow_forwardA donor gave $75,000 to a nongovernmental, not-for-profit charity with instructions that s be transferred to Sam Smith, an individual who lost his home in a fire. The not-for-profit w A) A. Record the $75,000 cash and credit revenue with donor restrictions. B) B. Record the $75,000 cash and credit a liability. C) C. Not record the transaction, because the money is going directly to the intended D) D. Do either of the choice A or B, depending upon the policy of the not-for-profit.arrow_forwardThe board of directors of Orange Corporation, a calendar year taxpayer, is holding its year-end meeting on December 28, 2022. One topic on the board’s agenda is the approval of a $25,000 gift to a qualified charitable organization. Orange has a $20,000 charitable contribution carryover to 2022 from a prior year. Identify the tax issues the board should consider regarding the proposed contribution.arrow_forward

- Topic: Membership Dues Better Community, a new local not-for-profit entity, has been recently formed. The organizers of the entity have formalized operations in such a way that they will charge membership dues, but will not provide any specific services in exchange for the dues. In discussion with a local accountant, who is also a new member of the not-for-profit entity, the conclusion is reached that the dues will be recognized as contributions and recorded as revenue in the year received rather than over the period of membership. In a review of the entity's operations, you find that additional services, such as seminars and group insurance, are provided by the entity. However, members are charged an additional cost for the aforementioned services. Because of this new information, you decide to investigate whether Better Community's recording of membership dues is appropriate. Required: Utilize the FASB's Codification to determine the appropriate accounting treatment for membership…arrow_forwardThree not-for-profit organizations operate separately in Central City. The most established entity, Central Support, has been around for over 100 years and generates by far the largest amount of dona-tions. Central Kidz. Zone was founded 30 years ago and generates less than half of what Central Support brings in. Central Emergency Aid was founded just 20 years ago and provides relief to those in the most urgent of cir-cumstances. Central Emergency Aid is building its donation network and is already close to the level of Central Kidz Zone in terms of fundraising dollars.Until last year, all three entities operated separately —separate staff, separate spaces, and separate work plans. Then last year, discussions began to coordinate some of their administrative efforts for efficiency pur-poses, recognizing that each could benefit if they were willing to give up a bit of comfort.Each entity is paying the following amount annually to rent administrative space and cover the cost of…arrow_forward3. Charity Navigator (https://www.charitynavigator.org) is a website dedicated to providing information regarding not-for-profit charitable organizations. After reviewing the website, explain how not-for-profit organizations are rated. Explain why there is a need for the type of information provided by Charity Navigator. Choose one to two charities listed in the website. Explain the information provided about the charity (financial and nonfinancial), the rating of the charity, and any other relevant factors.arrow_forward

- The Shannon Community Kitchen provides hot meals to homeless and low-income individuals and families; it is the organization's only program. It is the policy of the kitchen to use restricted resources for which the purpose has been met before resources without donor restrictions. The Kitchen had the following revenue and expense transactions during the 2023 fiscal year. 1. Cash donations without donor restrictions of $26,200 were received. A philanthropist also contributed $4,200, which was to be used for the purchase of Thanksgiving dinner foodstuffs. 2. A local grocery store provided fresh produce with a fair value of $1,300. The produce was immediately used. 3. Volunteers from the local university contributed 160 hours to preparation and serving of meals. The estimated fair value of their labor was $1,950. 4. The Kitchen received a $6,200 federal grant for the purchase of institutional kitchen appliances. 5. A local foundation gave the Kitchen $7,200 to support serving hot meals…arrow_forwardPlease answer the all questions.arrow_forwardThe Ombudsman Foundation is a private nonprofit organization providing dispute resolution and conflict management training. The Foundation had the following preclosing trial balance at December 31, 2024, the end of its fiscal year: Account: Accounts payable Accounts receivable (net) Accrued interest receivable Accumulated depreciation Cash Contributed services Contributions-no restrictions Contributions-purpose restrictions Contributions-endowment Current pledges receivable Education program expenses Fund-raising expenses Investment revenue-purpose restrictions Training seminars expenses Debits Credits $25,500 $48,100 16,700 3,522,200 119,400 27,200 2,492,000 82,300 1,550,100 126,600 4,586,400 802,000 2,114,100 94,200 Land, buildings, and equipment Long-term investments Management and general expenses Net assets without donor restrictions Net assets with donor restrictions 5,659,500 2,765,400 409,600 496,400 2,048,000 Net gains on endowments-no restrictions Noncurrent pledges…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education