ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

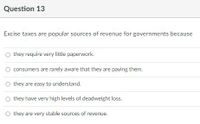

Transcribed Image Text:Question 13

Excise taxes are popular sources of revenue for governments because

O they require very little paperwork.

consumers are rarely aware that they are paying them.

O they are easy to understand.

O they have very high levels of deadweight loss.

they are very stable sources of revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve it correctly please. I will rate accordinglyarrow_forwardImagine there is a tax on cigarettes and that consumers and producers each bear some portion of the tax. Assume that when vape pens were introduced, they were not taxed. How would you expect that introduction of vape pens to affect the distribution of the tax burden associated with the cigarette tax? O It will decrease the consumer tax burden because demand for cigarettes will become more elastic. O It will increase the consumer tax burden because demand for cigarettes will become more elastic. O It will decrease the consumer tax burden because demand for cigarettes will become more inelastic. O It will increase the consumer tax burden because demand for cigarettes will become more inelastic.arrow_forwardSuppose that the demand for CDs is very price elastic and the supply is very price inelastic. A per unit tax imposed on CDs would be borne a. equally by buyers and sellers. b. more heavily by buyers. c. more heavily by sellers. d. by neither buyers or sellers.arrow_forward

- Suppose that after an excise tax was imposed on sofas, the price buyers paid for sofas increased by $5. Suppose further that the price elasticity of demand for sofas is 1.8 and the price elasticity of supply for them is 1.6. It can be concluded with certainty that the amount of the excise tax was Select one: OA less than $5. B. $5. OC. greater than $5 but less than $10. OD. $10. OE. greater than $10.arrow_forwardWith respect to the sources of state tax revenue, the corporate income tax generates approximately twice the revenue as state sales and use taxes. O True O Falsearrow_forwardIn which S is the before-tax supply curve and St is the supply curve after the imposition of an excise tax. The burden of this tax is borne: P St B A 0 C E G only by consumers. F most heavily by consumers. D S most heavily by producers. equally by consumers and producers. Qarrow_forward

- Taxes and Subsidies: End of Chapter Problem Let's see if we can formulate any real laws about the economics of taxation. Which of the following must be true? More than one may be true. If there is a tax: Must occur a. The equilibrium quantity must fall, and the price that buyers pay must rise. b. The equilibrium quantity must rise, and the price that sellers pay must rise. Will not occur c. The equilibrium quantity must fall, and the price that sellers receive must fall. Answer Bank d. The equilibrium quantity must rise, and the price that buyers receive must fall.arrow_forwardWhich of the following statement is true about tax? A. The burden shared by consumers and producers doesn’t change regardless of which party the tax is imposed onB. Market functions less efficiently, while not all suffer from a lossC. Both supply and demand curve have something to do with tax incidenceD. all of the abovearrow_forwardGovernment levied a tax on good A. The less elastic the demand is, the greater or the smaller the tax burden consumers bear? Also, is the after-tax equilibrium quantity the greater or smaller? Consumers’ tax burden: After-tax equilibrium quantity:arrow_forward

- In the diagram, consumer surpluses before and after the tax are ______ and ______, respectively. A + B; B A + B + C; A D + E + F; B B + C; A + Barrow_forwardSuppose that the demand and supply functions for a good are given as follows: Demand: Q =1080-7P --120+3P Suppose now that government iniposes S60 tax per unit of output on sellars. What is the tax revenue for the govemment at the equilibrium? 7200 7320 6840 6000arrow_forwardThe graph shows befire-tax, where the equilibrium is at 25. When the government levies the tax of 30 on X, price consumer have to pay changes to 35, and prince sellers recieve changes to 5. And at Ps:5, quantity is at 10. What is the consumers’ tax incidence and sellers’ tax incidence, when comaparing the chnage in the prices from before-tax equilibrium price 25??arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education