FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

help

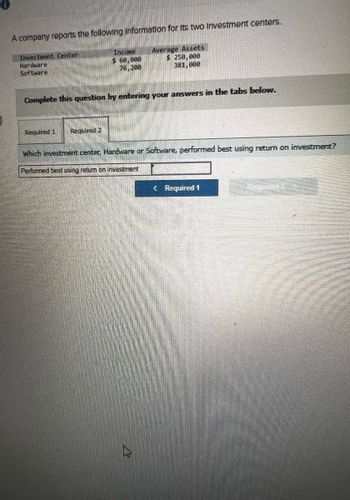

Transcribed Image Text:A company reports the following Information for its two Investment centers.

Investment Center

Hardware

Software

Income

$ 60,000

76,200

Average Assets

$ 250,000

381,000

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Which investment center, Hardware or Software, performed best using return on investment?

Performed best using return on investment

<Required 1

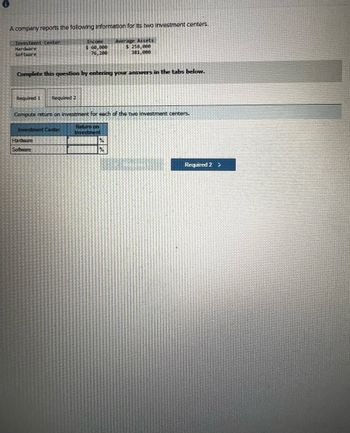

Transcribed Image Text:A company reports the following Information for its two investment centers.

Investment Center

Hardware

Software

Income

$ 60,000

76,200

Average Assets

$ 250,000

381,000

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute return on investment for each of the two investment centers.

Investment Center

Return on

Investment

Hardware

Software

%

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- pject: Company Accour X DEL. Project Guidelines and Rubric x DEL 7-1 Problem Set: Module Sev X CengageNOWv2 |Online tea x com/ilm/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator3D&inprogress=false eBook 4Show Me How Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $224,540 Interest expense 39,620 000'080 Determine the return on total assets. If required, round the answer to one decimal place. Average total assets Feedback Check My Work Divide the sum of net income and interest expense by average total assets. Check My Work ( Previous *AD dyarrow_forwardn Ltd is considerinc X O VitalSource Bookshelf: Manageria X G Marian Ltd is considering two mu X ses/1155/quizzes/6003/take - LIBIS - Sampoerna... Dashboard A VitalSource Booksh... O Spotify - Web Player MLA For Show your computation Scooby Doo Ltd is considering two mutually-exclusive projects with the following details: Project A Initial investment is $450,000 Scrap value in year 5 is $20,000 Year: 1 3 4 5 Annual cash flows 200 150 150 55 100 ($000) Project B Initial investment $100,000 Scrap value in year 5 is $10,000 Year: 1 2 3 4 Annual cash flows ($000) 20 20 30 40 40 33%arrow_forwardIt says the answer is inarrow_forward

- Nonearrow_forward7-2 Project: Company Accour x 121. Project Guidelines and Rubric x 121. 7-1 Problem Set: Module Sev X CengageNOWv2 | Online tea now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator3D&inprogress3false eBook Show Me How Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $224,540 Interest expense 39,620 Average total assets Determine the return on total assets. If required, round the answer to one decimal place. 1.8 Check My Work Divide the sum of net income and interest expense by average total assets. Previa Check My Work ADE dyarrow_forwardquestion attached in ss below thanks for da help aprpeicate it! gwhopwhkwtoph whwobp wtb owptwarrow_forward

- gageNOWv2 | Online teachir X * CengageNOWv2 | Online teachin x om/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre.. eBook Show Me How Long-Term Solvency Analysis The following information was taken from Acme Company's balance sheet: Fixed assets (net) $1,092,000 Long-term liabilities 280,000 Total liabilities 196,000 Total stockholders' equity 980,000 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity Previous Next Check My Work 11:17 A 67°F Sunny A O E O G 40) 12/3/20 delete ome prt se 84l 144 4+ 6 backscace %Darrow_forwardI need help with A&B pleasearrow_forwardKindly help me with accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education