Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Statement Exercise #2 - Protected View Saved V

erences Mailings Review

View Help

entain viruses. Unless you need to edit, it's safer to stay in Protected View,

4

DI

R

96

5

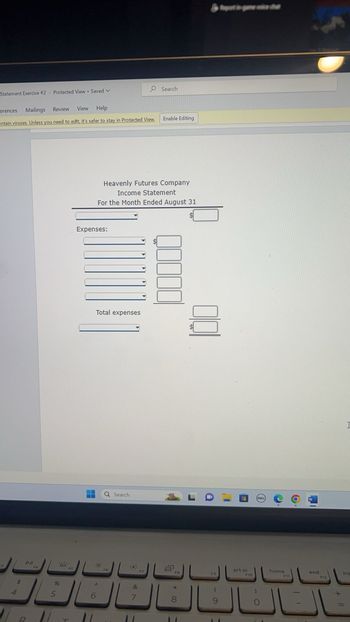

Expenses:

Total expenses

Heavenly Futures Company

Income Statement

For the Month Ended August 31

Do

6

Q Search

F6

&

7

Search

11

Enable Editing

8

FB

8

11

F9

(

9

Repost in game voice du

prt sc

F10

DELL

0

home

F11

end

F12

I

Ins

Transcribed Image Text:Exercise #2 Protected View Saved V

Mailings Review View Help

es. Unless you need to edit, it's safer to stay in Protected View.

PII

2

B

%

5

FS

T

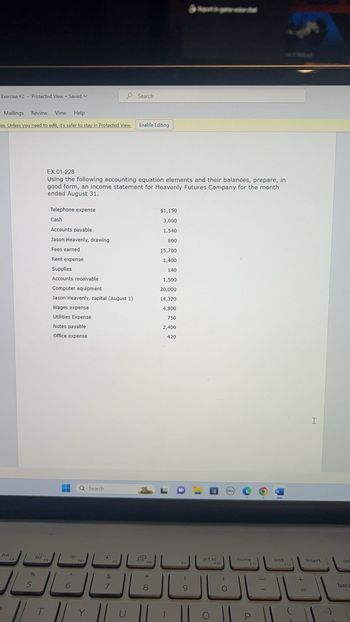

Telephone expense

Cash

Accounts payable

Jason Heavenly, drawing

Fees earned

Rent expense

Supplies

Accounts receivable

Computer equipment

EX.01-228

Using the following accounting equation elements and their balances, prepare, in

good form, an income statement for Heavenly Futures Company for the month

ended August 31.

Jason Heavenly, capital (August 1)

Wages expense

Utilities Expense

Notes payable

Office expense

H Q Search

50%16

F6

A

6

Y

&

7

Search

U

Enable Editing

2

FB

*

8

$1,150

3,000

1,540

800

15,700

1,400

140

1,500

20,000

14,320

4,800

750

2,400

420

F9

Report in game volte a

(

9

prt sc

F10

)

0

home

F11

end

OP

F12

P || !

+

I

insert

}

del

back

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following account balances of Evan McGruder, Incorporated, as of December 31, Year 3: Accounts Payable $ 113,420 Retained Earnings $ 56,000 Equipment 422,900 Notes Payable, due Year 5 344,500 Common Stock 206,500 Accounts Receivable 203,800 Income Tax Payable 4,030 Cash 97,750 Required:Prepare a classified balance sheet at December 31, Year 3.arrow_forward2arrow_forwardThe following items are reported on a company's balance sheet: Cash $283,200 Marketable securities 83,400 Accounts receivable 251,600 Inventory 185,700 Accounts payable 315,200 Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forward

- On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forwardDirections: Given the account balances below, calculate the indicated amounts for the current year's financial statements. Hint: Build a balance sheet and income statement in columns to the right of the given numbers and copy each provided item into the appropriate section for the balance sheet or income statement. Retained Earnings prior year 7,050 PP&E, net 4,440 Wages Expense 190 Administration Expense 150 Cash 1,550 Tax Expense 205 Common Stock 300 Inventory 3,700 Accounts Payable 1,800 Accounts Receivable 2,700 Notes Payable 2,200 Depreciation Expense 220 Cost of Goods Sold 6,700 Dividends 200 Interest Expense 85 Revenue 8,400 Tax Liability…arrow_forwardThe following information is taken from the 2022 general ledger of Swifty Company. Rent Salaries Sales Rent expense Prepaid rent, January 1 Prepaid rent, December 31 Salaries and wages expense Salaries and wages payable, January 1 Salaries and wages payable, December 31 Sales revenue Accounts receivable, January 1 Accounts receivable, December 31 $30,500 5,800 7,400 $65,100 2,500 7,700 $160,900 20,000 7,400 In each case, compute the amount that should be reported in the operating activities section of the statement of cash flows under the direct method.arrow_forward

- Below are the accounts of King's Landing Trading for the year ended June 30, 2020 Prepare the Statement of Financial Position. (The accounts are not in order) Include the additional information when making the Balance sheet Cash on hand P150,000 20,000 20,000 Trade securities Accounts Receivable Prepaid rent Merchandise Inventory Prepaid Utilities Cash on bank 12,000 38,000 15,000 100,000 42,000 Advance to employees Land 120,000 220,000 65,000 Building Furniture and Fixture Accounts Payable Notes Payable Unearned Revenue 120,000 50,000 30,000 20,000 11,000 Taxes Payable Warranty payable Loan(lyear) Mortgage Bonds Payable Goodwill Trademark 35,000 200,000 150,000 25,000 10,000 The beginning capital of King's Landing Trading is 120,000. During the year the owner made an additional investment of P50,000 and withdrew P30,000 for personal use. Net income during the year amounted to 56,500. The business assessed their Assets and incurred a depreciation on Building for P20,000 and Furniture…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardRequired information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable. Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 30,800 88,100 111,000 10,900 280,000 $ 520,800 $ 128,400 98,000 163,500 130,900 $ 520,800 Current Year 1 Year Ago $ 35,000 61,500 82,400 9,300 250,500 $ 438,700 $ 478,850 243,350 12,100 9,550 $73,750 101,750 163,500 99,700 $438,700 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $785,000 Interest expense Income tax expense Total costs and expenses Net income Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: 743,850 $ 41,150 $ 2.52 2…arrow_forward

- The bookkeeper for Geronimo Company has prepared the following balance sheet at 31/12/2007 Balance sheet for (Geronimo Company) at 31/12/2007 liabilities and owner equity Assets ID ID Current assets: Short-term liabilities: Bills payable 40625 Account payable (A/P) 28000 Long-Term Liabilities: bonds payable 82350 Long-term notes payable. Owners' Equity: Cash 22000 22000 Account receivable(A/R) Ending inventory Fixed assets: 35000 Machinery and equipment Intangible assets: Patents 40000 54900 Capital 155500 Total Total 274500 If you know Current assets 50% from total assets, fixed assets 30% from total assets, Intangible assets 20% from total assets, Cash 50% from Current assets R/ Complete the balance sheetarrow_forwardPlease SHOw your workarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education