FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

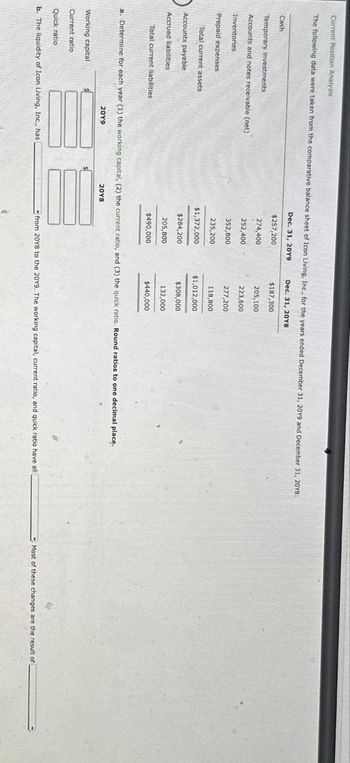

Transcribed Image Text:Current Position Analysis

The following data were taken from the comparative balance sheet of Icon Living, Inc., for the years ended December 31, 20Y9 and December 31, 20Y8:

Dec. 31, 20Y9

Dec. 31, 20YS

Cash

$257,200

$187,300

Temporary investments

274,400

205,100

Accounts and notes receivable (net)

252,400

223,600

Inventories

352,800

277,200

Prepaid expenses

235,200

118,800

Total current assets

$1,372,000

$1,012,000

Accounts payable

$284,200

$308,000

Accrued liabilities

205,800

132,000

Total current liabilities

$490,000

$440,000

a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place.

Working capital

Current ratio

Quick ratio

2019

20Y8

b. The liquidity of Icon Living, Inc., has

from 20Y8 to the 20Y9. The working capital, current ratio, and quick ratio have all

Most of these changes are the result of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question Content Area The following information pertains to Tanzi Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-term investments $41,912 Accounts receivable (net) 29,707 Inventory 28,654 Property, plant and equipment 293,074 Total Assets $393,347 Liabilities and Stockholders' Equity Current liabilities $58,253 Long-term liabilities 97,633 Stockholders' equity-common 237,461 Total Liabilities and stockholders' equity $393,347 Income Statement Sales $80,900 Cost of goods sold 36,405 Gross margin $44,495 Operating expenses 25,209 Net income $19,286 Number of shares of common stock 6,546 Market price of common stock $35 What is the current ratio for this company? Round your answer to two decimal places. Select the correct answer. 1.23 2.22 0.72 1.72arrow_forwardPerform a vertical analysis for the balance sheet entry "Accounts Receivable" given below. (Round to the nearest tenth) Assets Current Assets Cash $ 23,000 Accounts Receivables 16,000 Merchandise Inventory 50,000 Supplies 2,500 Total Current Assets 91,500 Property, Plant, and Equipment Machinery and Equipment 23,000 Total Assets $114,500arrow_forwardSolar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forward

- Subject: acountingarrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities 1. Working capital 2. Current ratio Current Year Previous Year 3. Quick ratio $391,000 515,000 634,000 368,000 182,000 $2,090,000 $725,000 275,000 $1,000,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year $300,000 354,000 426,000 222,000 138,000 $1,440,000 $600,000 300,000 $900,000 LA Previous Yeararrow_forwardCalculate Ratios. For 201B and 201A income statements and balance sheets, what percentage is each category (rounded to one decimal place)?arrow_forward

- Privett Company Accounts payable $26,195 Accounts receivable 62,336 Accrued liabilities 6,328 Cash 23,939 Intangible assets 37,985 Inventory 74,958 Long-term investments 107,215 Long-term liabilities 74,188 Marketable securities 32,601 Notes payable (short-term) 26,240 Property, plant, and equipment 660,621 Prepaid expenses 1,525 Based on the data for Privett Company, what is the quick ratio, rounded to one decimal point? Oa. 2 Оb. 17 Ос. 1 Od. 3.3arrow_forwardUsing the financial information of ABC Co. below, compute its current ratio for the period. in millions Current assets Current liabilities Long-term liabilities $ 250 O 1.38 Ⓒ 2.08arrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 70 on December 31, 2012. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 Retained earnings, January 1 Net income Dividends: On preferred stock On common stock Retained earnings, December 31 20Y2 $3,329,700 790,400 20Y1 $2,805,000 574,500 (9,800) (40,000) $4,070,300 (9,800) (40,000) $3,329,700 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 Sales Cost of merchandise sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue and expense: 20Y2 20Y1 $5,340,680 $4,920,640 1,737,400 1,598,410 $3,603,280 $1,292,110 1,100,680 $3,322,230 $1,583,590 930,050 $2,392,790 $2,513,640 $1,210,490 $808,590 Other revenue 63,710 51,610 Other expense (interest) (376,000) (207,200)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education