FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

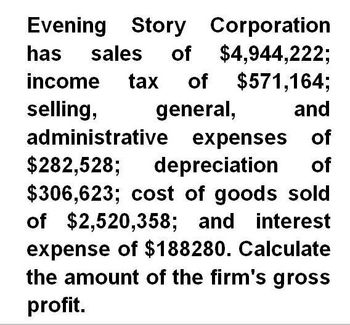

Transcribed Image Text:Evening Story Corporation

has sales of $4,944,222;

income tax of $571,164;

selling,

general,

and

administrative expenses of

$282,528; depreciation of

$306,623; cost of goods sold

of $2,520,358; and interest

expense of $188280. Calculate

the amount of the firm's gross

profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Net incomearrow_forwardPlease help me. Thankyou.arrow_forwardXYZ Company reported the following information for the year: Net Sales $1,000,000, Cost of goods sold $500,000, Selling expenses $200,000, General and administrative expenses $100,000, and Interest expense $50,000. Calculate the company's Earnings Before Interest and Taxes (EBIT) and Net Income.arrow_forward

- The web Corp has sales of $143489, cost of goods sold and other expenses (excluding depreciation) of $55491, depreciation of $16870, and a debt of $8000 on which it has to pay 4% interest. It's tax rate is 35%. Calculate its net incomearrow_forwardGarden Pro Corporation has sales of $4,953,171; income tax of $343,835; the selling, general and administrative expenses of $203,842; depreciation of $382,438; cost of goods sold of $2,453,450; and interest expense of $155,731. Calculate the firm’s net income?arrow_forwardHammett, Inc., has sales of $90,509, costs of $33,530, depreciation expense of $10,890, and interest expense of $3,410. If the tax rate is 37 percent, what is the operating cash flow, or OCF?arrow_forward

- Moby Dick Corporation has sales of $4,920,229; income tax of $574,192; the selling, general and administrative expenses of $265,391; depreciation of $374,888; cost of goods sold of $2,777,705; and interest expense of $195,023. Calculate the amount of the firm’s after-tax cash flow from operations?arrow_forwardQuartz Corporation had the following account balances: Sales, $875,000; Sales Returns and Allowances, $73,000; Cost of Goods Sold, $580,000; and Selling, General & Administrative Expenses, $120,000. How much was Quartz’s gross profit? $802,000 $222,000 $875,000 $248,000 $102,000arrow_forwardGarden Pro Corporation has sales of $4,374,312; income tax of $562,963; the selling, general and administrative expenses of $291,061; depreciation of $399,602; cost of goods sold of $2,863,521; and interest expense of $105,428. Calculate the firm's net income?arrow_forward

- Grandy productions reported the following items for the current year sales 15,250,000; cost of goods 8750,000; depreciation expense 335,000; taxes925,000 administrative expenses; 275,000 interest, expenses; 97,500 and marketing expenses 385,000. What is grandes operating income?arrow_forwardHolly Farms has sales of S509,600, costs of $448,150, depreciation expense of $36,100, and interest paid of SI2,400. The tax rate is 28 percent. How much net income did the firm carn for the period?arrow_forwardpm.6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education