ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

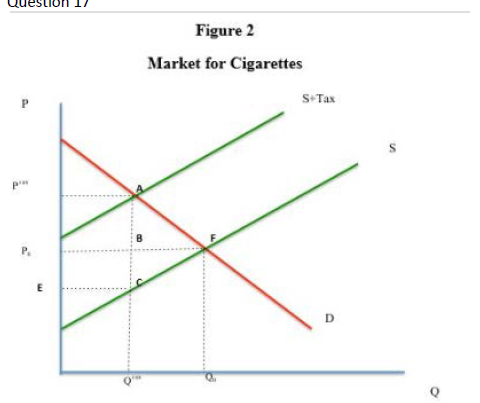

Refer to Figure 2. It shows the imposition of a per-unit tax on the market for cigarettes. S = Market Supply Curve; D = Market Demand Curve; S+Tax = Market Supply Curve with per-unit tax imposed. The total tax collected can be represented by:

A) Triangle ABF

B) Rectangle PTax

C) Rectangle PTaxECA

D) Rectangle P0 ECB

Transcribed Image Text:estion 1/

Figure 2

Market for Cigarettes

S Tax

P

P

E

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the state government would like to increase tax revenue, please give three examples of products/commodities that the government should impose tax on so that they can collect the highest amount of tax revenue. Please explain your reasons clearly.arrow_forwardGraph B.5. shows the economics offects of a per-unit tax Refer to Graph B 5. to answer (38 following questions Graph B.5 P S P₁ D₂ D₁ Q Q₁ Q₂ Qs (a) is the tax levied on buyers or on sellers? (b) What is the price buyers pay after the tax is imposed? (c) What is the price the sellers receive after the tax is imposed? (d) What area represents government tax revenue after the tax is imposed? Ps ܘ ܘ ܘ ܘ ܘ P₂ B C F 11 J К H L Marrow_forward(Figure: Determining Tax Burdens) Based on the graph, the original market price is $4. The graph depicts a tax of with a corresponding deadweight loss of Price ($) 98765432 T X D 0 50 100 150 200 250 300 350 400 450 500 550 600 Quantity $6; $3 $3; $150 $6; 50 units $3; $75arrow_forward

- Consider the market described by the graph below where the vertical distance between points A and B represents a tax in the market. 22 20 10 16 14 12 10 Price Demand 100 200 300 400 500 600 700 800 900 1000 Supply Quantity The per-unit burden of the tax on buyers is $16 and the tax results in a loss of $2700 in consumer surplus. $6 and the tax results in a loss of $900 in consumer surplus $6 and the tax results in a loss of $2700 in consumer surplus. $16 and the tax results in a loss of $900 in consumer surplus. 2.5 poarrow_forwarda. Suppese a $0.50 tax, collected by the government from sellers, is levied on each bottle of sugary beverages. Adjust the graph to reflect this change. b. Following the tax, consumers pay a price of and the new equilibrium quantity is while sellers end up with Out of the $0.50 tax, consumers pay The disproportionate burdens of the tax reflect the fact that of the market. The deadweight loss associated with the tax is on each bottle sold, while sellers pay are the less price sensitive sidearrow_forwardHow much would the excess burden of this $12 tax be if the equation of the original supply curve had been: Supply: P = 40 +0.2Q? A) $80 B) $120 C) $140 D) $360arrow_forward

- of a given activity. c) Economists refer to the revenue collected as a result of a tax as the burden of taxation. Economists refer to other costs imposed on society because of the tax as the burden of taxation.arrow_forwardThe vertical distance between points A and B represents the original tax. 12+ 11+ 10 9 8 7. 6 Price 2 1 D 05 1 15 2 25 3 35 4 45 5 Quantity Refer to Figure 8-19. If the government changed the per-unit tax from $5.00 to $7.50, then the price paid by buyers would be $10.50, the price received by sellers would be $3, and the quantity sold in the market would be 0.5 units. Deadweight loss would now be a. $1.50 O b. $0.50 c. $4.0 Od. $0.625arrow_forwardWhen an excise tax is levied on sellers and they are responsible for paying the tax to the government, this will have no effect on buyers since they don’t have to directly pay the tax. Select one: True Falsearrow_forward

- Do a comparative analysis of taxation in Kenya, Uganda and Tanzania showing how these countries have addressed the following tax matters: Income tax Customs tax Excise tax Value added taxarrow_forwardIf a $6 per unit excise (sales) tax is imposed, who will suffer the greater burden of this tax, the suppliers or demanders? a) Demanders b) Suppliers c) Both share the burden equally d) Can't tell from the available informationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education