FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

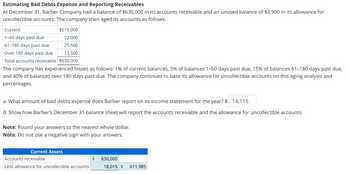

Transcribed Image Text:Estimating Bad Debts Expense and Reporting Receivables

At December 31, Barber Company had a balance of $630,000 in its accounts receivable and an unused balance of $3,900 in its allowance for

uncollectible accounts. The company then aged its accounts as follows.

Current

$519,000

1-60 days past due

72,000

61-180 days past due

25,500

Over 180 days past due

13,500

Total accounts receivable $630,000

The company has experienced losses as follows: 1% of current balances, 5% of balances 1-60 days past due, 15% of balances 61-180 days past due,

and 40% of balances over 180 days past due. The company continues to base its allowance for uncollectible accounts on this aging analysis and

percentages.

a. What amount of bad debts expense does Barber report on its income statement for the year? $ 14,115

b. Show how Barber's December 31 balance sheet will report the accounts receivable and the allowance for uncollectible accounts.

Note: Round your answers to the nearest whole dollar.

Note: Do not use a negative sign with your answers.

Current Assets

Accounts receivable

Less allowance for uncollectible accounts

$ 630,000

18,015 $ 611,985

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Simons Industries reported net income of $69,000 for the current year. The balances and activity in its accounts receivable accounts follow. In addition, the company recorded $3,400 of bad debt expense and wrote off $2,500 of uncollectible accounts. E (Click the icon to view the balances and activity in accounts receivable accounts.) Prepare the operating section of the cash flow statement under the indirect method. (Use a minus sign or parentheses for any amounts to be subtracted. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.) Simons Industries Partial Statement of Cash Flows (Indirect Method) Operating Activities: Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided (Used) by Operating Activitiesarrow_forwardRecording Entries to Estimate Bad Debt Expense Including the Write-Off and Subsequent Collection of an Account Following are accounts of Long Company at its December 31 year-end for the current year. $25,500 Accounts receivable balance, December 31, prior year Allowance for doubtful accounts balance, December 31, prior year Total sales revenue during the current year (1/6 are on credit) Uncollectible account written off during the current year (A. Smith) Cash collected on accounts receivable during the current year 1,500 480,000 500 85,000 Required Recording Write-off b. Prepare the entry to record bad debt expense for each of the following three cases. • Note: Treat each case separately. 1. Bad debt losses assume 1% of credit sales. Date Dec. 31 Bad Debt Expense Allowance for Doubtful Accounts To record bad debt Recording Bad Debt Expense Account Name Date Dec. 31 Bad Debt Expense Age Less than 30 days 31-90 days Account Name Allowance for Doubtful Accounts To record bad debt 91-120…arrow_forwardNonearrow_forward

- Estimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forwardVishalarrow_forwardSipacore Ltd. has an Accounts Receivable amount of $363,700 and an unadjusted credit balance in Allowance for Expected Credit Losses of $8,600 at March 31. The company's accounts receivable and percentage estimates of uncollectible accounts are as follows: Number of Days Outstanding 0-30 (a) 31-60 61-90 Over 90 Total Your answer is correct. Age of Accounts 0-30 days 31-60 days Accounts Receivable $258,000 45,800 32,600 27,300 $363,700 61-90 days Over 90 days Prepare an aging schedule to determine the total estimated uncollectibles at March 31. Amount % $258,000 2% 45,800 10% 32,600 30% Estimated Percentage Uncollectible 27,300 50% 2% 10% 30% 50% Estimated Uncollectible 5160 4580 9780 13650 33170arrow_forward

- Account answerarrow_forward6 Mario Company's Accounts Receivable balance atDecember 31 was $300,000 and there was a credit balance of $1,400 in the Alowance for Doubtful Accounts, The year's sales were $1,800,000. Mario estimates credit losses for the year at 1.5% of sales. After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year- end? A) $300,000 B) $271,600 C) $325,400 D) $277,400arrow_forwardThe accounts of Long Company provided the following 20X5 information at 31 December 20X5 (end of the annual period): Accounts receivable balance, 1 January 20X5 $51,000 Allowance for doubtful accounts balance, 1 January 20X5 3,000 Uncollectible account to be written off during 20X5 (ex-customer Slo) 1,000 Cash collected on accounts receivable during 20X5 170,000 Estimates for bad debt losses: Based on ending balance of accounts receivable, 8%. Based on aging schedule (excludes Slo’s account): Age Accounts Receivable Probability of Noncollection Less than 30 days $28,000 2% 31–90 days 7,000 10 91–120 days 3,000 30 More than 120 days 2,000 60 Required: Give the entry to write off customer Slo’s long-overdue account. Give all entries related to accounts receivable and the allowance account for the following two cases: Case A—Bad debt expense is based on the ending balance of accounts receivable Case B—Bad debt expense is based on aging Show how the results of applying each case above…arrow_forward

- Wohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forwardCredit Losses Based on Accounts Receivable At December 31, the Hope Company had a balance of $1,247,200 in its Accounts Receivable account and a credit balance of $11,200 in the Allowance for Doubtful Accounts account. The accounts receivable T-account consisted of $1,270,400 in debit balances and $23,200 in credit balances. The company aged its accounts as follows: Current $1,056,000 0-60 days past due 120,000 61-180 days past due 52,800 Over 180 days past due 41,600 $1,270,400 In the past, the company has experienced credit losses as follows: 2% of current balances, 6% of balances 0-60 days past due, 15% of balances 61-180 days past due, and 30% of balances over six months past due. The company bases its allowance for doubtful accounts on an aging analysis of accounts receivable.Requireda. Prepare the adjusting entry to record the allowance for doubtful accounts for the year.b. Show how Accounts Receivable (including the credit balances) and the Allowance for…arrow_forwardDon't give answer in image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education