FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

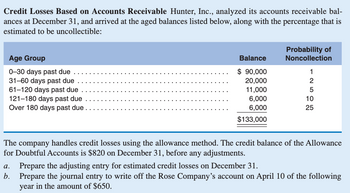

Transcribed Image Text:Credit Losses Based on Accounts Receivable Hunter, Inc., analyzed its accounts receivable bal-

ances at December 31, and arrived at the aged balances listed below, along with the percentage that is

estimated to be uncollectible:

Age Group

0-30 days past due

31-60 days past due

61-120 days past due

121-180 days past due

Over 180 days past due .

Balance

$ 90,000

20,000

11,000

6,000

6,000

$133,000

Probability of

Noncollection

1

2

5

10

25

The company handles credit losses using the allowance method. The credit balance of the Allowance

for Doubtful Accounts is $820 on December 31, before any adjustments.

a. Prepare the adjusting entry for estimated credit losses on December 31.

b.

Prepare the journal entry to write off the Rose Company's account on April 10 of the following

year in the amount of $650.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Estimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forwardCredit Losses Based on Percentage of Credit Sales Highland Company uses the allowance method of handling credit losses. It estimates losses at 29% of credit sales, which were $600,000 during the year. On December 31, the Accounts Receivable balance was $560,000, and the Allowance for Doubtful Accounts had a credit balance of $3,400 before adjustment. a. Determine the amount of the adjustment to record credit losses for the year. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Assets Liabilities Equity Revenues Expenses = Net Income 24 %24arrow_forwardVishalarrow_forward

- 6 Mario Company's Accounts Receivable balance atDecember 31 was $300,000 and there was a credit balance of $1,400 in the Alowance for Doubtful Accounts, The year's sales were $1,800,000. Mario estimates credit losses for the year at 1.5% of sales. After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year- end? A) $300,000 B) $271,600 C) $325,400 D) $277,400arrow_forwardE8-1A Credit Losses Based on Credit Sales Lewis Company uses the allowance method for recording its expected credit losses. It estimates credit losses at 2 percent of credit sales, which were $900, 000 during the year. On December 31, the Accounts receivable balance was $150, 000, and the Allowance for Doubtful Accounts had a credit balance of $12,200 before adjustment. Prepare the adjusting entry to record the credit losses for the year.arrow_forwardEstimating Bad Debts Expense and Reporting Receivables At December 31, Barber Company had a balance of $630,000 in its accounts receivable and an unused balance of $3,900 in its allowance for uncollectible accounts. The company then aged its accounts as follows. Current $519,000 1-60 days past due 72,000 61-180 days past due 25,500 Over 180 days past due 13,500 Total accounts receivable $630,000 The company has experienced losses as follows: 1% of current balances, 5% of balances 1-60 days past due, 15% of balances 61-180 days past due, and 40% of balances over 180 days past due. The company continues to base its allowance for uncollectible accounts on this aging analysis and percentages. a. What amount of bad debts expense does Barber report on its income statement for the year? $ 14,115 b. Show how Barber's December 31 balance sheet will report the accounts receivable and the allowance for uncollectible accounts. Note: Round your answers to the nearest whole dollar. Note: Do not use…arrow_forward

- The estimated loss from uncollectible accounts can be based on the net credit sales for the year or the ____________________ balance at the end of the year.arrow_forwardWohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forwardL01, 2 E6-2A. Credit Losses Based on Accounts Receivable Aging Hunter, Inc., analyzed its accounts receiv- able balances at December 31, and arrived at the aged balances listed below, along with the per- centage that is estimated to be uncollectible: MBC Probability of Noncollection Age Group Balance $ 90,000 0-30 days past due 31-60 days past due 61-120 days past due 121-180 days past due Over 180 days past due 20,000 11,000 6,000 10 4,000 25 $131,000 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $520 on December 31, before any adjustments. а. Determine the amount of the adjustment for estimated credit losses on December 31. Determine the financial statement effect of a write off of the Rose Company's account on April 10 of the following year in the amount of $425. b.arrow_forward

- S&R Company uses the aging of accounts receivable approach to estimate bad debt expense. On December 31, an analysis of accounts receivable revealed the following: Schedule of Accounts Receivable by Age December 31, 2022 Accounts Receivable Age of Accounts Receivable Expected Percentage Uncollect 130,000 50,000 18,000 3,000 9,000 210,000 Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Required: (a) Calculate the amount of allowance for doubtful accounts that should be reported on the balance sheet at December 31, 2022. (b) Calculate the amount of bad debts expense that should be reported on the 2022 income statement, assuming that the balance of Allowance for Doubtful Accounts on January 1 was $46,000 (credit balance) and accounts receivable written off during the year totaled $49,000 (c) Present the appropriate general journal entry to record bad debts expense on December 31, 2022. (d) Show how accounts receivable will appear on the balance…arrow_forwardCredit Losses Based on Accounts Receivable At December 31, the Hope Company had a balance of $1,247,200 in its Accounts Receivable account and a credit balance of $11,200 in the Allowance for Doubtful Accounts account. The accounts receivable T-account consisted of $1,270,400 in debit balances and $23,200 in credit balances. The company aged its accounts as follows: Current $1,056,000 0-60 days past due 120,000 61-180 days past due 52,800 Over 180 days past due 41,600 $1,270,400 In the past, the company has experienced credit losses as follows: 2% of current balances, 6% of balances 0-60 days past due, 15% of balances 61-180 days past due, and 30% of balances over six months past due. The company bases its allowance for doubtful accounts on an aging analysis of accounts receivable.Requireda. Prepare the adjusting entry to record the allowance for doubtful accounts for the year.b. Show how Accounts Receivable (including the credit balances) and the Allowance for…arrow_forwardReporting Uncollectible Accounts and Accounts Receivable (FSET) LaFond Company analyzes its accounts receivable at December 31 and arrives at the aged categories below along with the percentages that are estimated as uncollectible. \table [[Age Group, Accounts Receivable, \table [[Estimated], [Loss %]]], [Current (not past due), $375,000, 0.50%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education