Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

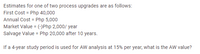

Transcribed Image Text:Estimates for one of two process upgrades are as follows:

First Cost = Php 40,000

Annual Cost = Php 5,000

Market Value = (-)Php 2,000/ year

Salvage Value = Php 20,000 after 10 years.

If a 4-year study period is used for AW analysis at 15% per year, what is the AW value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Projects A and B have first costs of $5,000 and $9,000 respectively. Project A has net annual benefits of $2,500 during each year of its 5-year useful life, after which it can be replaced identically. • Project B has net annual benefits of $3,300 during each year of its 10-year life. Use present worth analysis, an interest rate of 30% per year, and a 10-year analysis period to determine which project to select. Project A Project Barrow_forwardYou are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardThe equivalent annual worth of the process currently used in manufacturing motion controllers is AW = $-62,000 per year. A replacement process is under consideration that will have a first cost of $64,000 and an operating cost of $38,000 per year for the next 3 years. Three different engineers have given their opinion about what the salvage value of the new process will be 3 years from now as follows: $10,000, $13,000, and $18,000. Is the decision to replace the process sensitive to the salvage value estimates at the company’s MARR of 15% per year?arrow_forward

- You are evaluating two different systems: System A costs $45,000, has a three year life and costs $5,000 per year to operate. System B costs $65,000, has a five year life and costs $4,000 per year to operate. If the required rate of return is 8%, which system would you prefer? I Next Slidearrow_forwardTwo roadway design are under consideration. Design 1A will cost $3 million to build and $100,000 per year to maintain. Design 1B will cost $3.5 million to build and $40,000 per year to maintain. Both designs are assumed to be permanent. Use an AW based rate of return equation to determine (a) the breakeven ROR, and (b) which design is preferred at a MARR of 10% per yeararrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forward

- A manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardA conveyor system costs $110,000 to install. The salvage value of the conveyor system decreases by $20,000 each year until its salvage value is $0, at which point it no longer decreases. The cost to operate and maintain the conveyor system the first year is $20,000; this cost increases by 7% per year. What is the optimal replacement interval and minimum EUAC for the conveyor system, assuming a MARR of 15% is used? Click here to access the TVM Factor Table Calculator. years ORI: EUAC*: $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is ±10 for the EUAC*. eTextbook and Media Hint Assistance Used Construct an Excel® table that computes the EUAC for different values of n. This will help you to find EUAC*, from which you can deduce the optimal replacement interval.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education