Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

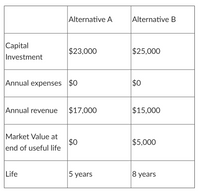

Two mutually exclusive design alternatives are shown below. The MARR is 12% per year. Use the repeatability assumption.

What is the PW of Alternative A and B?

Which alternative should be recommended?

please solve normally, not excel.

Transcribed Image Text:Alternative A

Alternative B

Сapital

$23,000

$25,000

Investment

Annual expenses $0

$0

Annual revenue

$17,000

$15,000

Market Value at

$0

end of useful life

$5,000

Life

5 years

8 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your Question : Please introduction and correct and incorrect option explain!arrow_forwardHarry is trying to evaluate a two year project using NPV. There is uncertainty as to the level of sales (in units) in each of the two years: Year 1 Sales units Probability Year 2 Sales units Probability 10,000 0.3 8,000 0.2 10,000 0.8 15,000 0.7 20,000 0.6 10,000 0.4 Required: (a) On what expected level of sales in Year 1 and 2 should Harry base his NPV calculation? (b) Imagine that the project outlay is £230,000 and each unit sold has a contribution of £10. If Harry’s cost of capital is 10%, what is the project’s…arrow_forwardFor the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback period (b) which one do you select if you use the PW analysis. (c) is your selection different in (a) and (b)? Why? (d) use Spreadsheet to solve a and b. Alternative A: initial cost = $300,000 Revenue = $60,000 Alternative B: initial costs = $300,000 Revenue starts from n=1 at $10,000 and increases by $15,000 per year The expected life is 10 years for each alternative.arrow_forward

- The following information is available on two mutually exclusive projects. All numbers are in ‘000s. Project Year 0 Year 1 Year 2 Year 3 Year 4 A $700 $300 $300 $400 $400 B $700 $600 $300 $200 $100 a: If the minimum acceptable rate of return is 10%, which project should be selected using the Net Present Value (NPV) method? Which project should be selected if the Internal Rate of Return (IRR) method is used? b: At what cross‐over rate would the firm be indifferent between the two projects? What is the NPV for both projects at the crossover rate? c: How much should cash flow in year 3 for project B increase or decrease in order for NPV(B) to be equal to NPV(A)?arrow_forwardGiven the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (∆RoR) analysis. MARR =10%.arrow_forward5. QuizCo would like to use the IRR method to choose between projects A and B below. QuizCo's MARR is 10%. Each project lasts 5 years. (a) Calculate the IRR for each project. Check with Excel using the IRR function, the rate function, and Goal Seek. Include the Excel output in your Assignment. (b) Calculate the incremental IRR. (c) Which project should be selected based on incremental IRR? Project First Cost Annual Savings 12,000 13,000 A 3450 3700arrow_forward

- Answer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote.arrow_forwardi need the answer quicklyarrow_forwardConsider these mutually exclusive alternatives. MARR = 8% per year, so all the alternatives are acceptable. Solve, a. At the end of their useful lives, alternatives A and C will be replaced with identical replacements (the repeatability assumption) so that a 20-year service requirement (study period) is met. Which alternative should be chosen and why? b. Now suppose that at the end of their useful lives, alternatives A and C will be replaced with replacement alternatives having an 8% internal rate of return. Which alternative should be chosen and why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education