FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

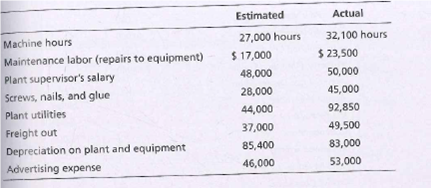

Accounting for manufacturing

Prestige Woods manufactures jewelry boxes. The primary materials (wood, brass, and glass) and direct labor are assigned directly to the products.

Requirements

- Compute the predetermined overhead allocation rate. Round to two decimal places.

- Post actual and allocated manufacturing overhead to the Manufacturing Overhead T-account.

- Prepare the

journal entry to adjust for underallocated or overallocated overhead. - The predetermined overhead allocation rate usually turns out to be inaccurate. Why don’t accountants just use the actual manufacturing overhead rate?

Transcribed Image Text:Estimated

Actual

27,000 hours

Machine hours

Maintenance labor (repairs to equipment)

Plant supervisor's salary

Screws, nails, and glue

Plant utilities

32,100 hours

$ 17,000

$ 23,500

48,000

50,000

28,000

45,000

44,000

92,850

49,500

Freight out

Depreciation on plant and equipment

Advertising expense

37,000

85,400

83,000

46,000

53,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardThe following information is available for Lock Company, which produces custom security systems and uses a job order cost accounting system. Inventories Chapter 15 Flows of Manufacturing Worksheet Raw Materials Work in Process Finished Goods Activities and information for March Raw Materials purchases (paid in cash) Factory payroll (paid in cash) Factory overhead Indirect materials Indirect labor Other overhead costs (paid in cash) November 30 Sales (received in cash) Predetermined overhead rate based on direct labor costs 1. Cost of direct materials used 2. Cost of direct labor used 43,000 10,200 63,000 1. Raw materials purchases 2. Direct materials usage 3. Indirect materials usage 4. Direct labor usage December 31 3. Cost of goods manufactured 4. Cost of goods sold (ignore under or over applied overhead at this stage) 5. Gross profit 6. Overapplied or underapplied overhead 52,000 21,300 35,600 15,000 80,000 120,000 1,400,000 Part A: Compute the following amounts for the month of…arrow_forward

- Required Information [The following information applies to the questions displayed below.] The following Information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Inventories Raw materials Work in process Finished goods Beginning of period Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used Indirect labor used Other overhead costs End of Period $ 35,000 $ 39,000 9,980 56,000 Required 134 Required 2 and 5 20,900 33,500 Cost of direct labor used $ 183,000 200,000 1. In the Raw Materials Inventory T-account, Insert amounts for beginning and ending balances along with purchases and indirect materials used. Solve for direct materials used in the period. 2. Compute the cost of direct labor used for the period. 3. In the Work in Process Inventory T-account, Insert amounts for…arrow_forwardAll information includedarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Manufacturing cost data for Cullumber Company, which uses a job - order cost system, are presented below. Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labour cost and the rate is the same.arrow_forward1. How much overhead would have been charged to the company’s Work-in-Process account during the year? 2. Comment on the appropriateness of the company’s cost drivers (i.e., the use of machine hours in Machining and direct-labor cost in Assembly).arrow_forwardQuestion: In a job order cost accounting system, which journal entry would be made when raw materials are transferred into production during the month? a. Debit Goods in Process Inventory and Credit Materials Expense. b. Debit Factory Overhead and Credit Raw Materials Inventory. c. Debit Goods in Process Inventory and Credit Raw Materials Inventory. d. Debit Raw Materials Inventory and Credit Goods in Process Inventory. e. Debit Finished Goods Inventory and Credit Goods in Process Inventory.arrow_forward

- Dakota Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Dakota allocates manufacturing overhead costs using direct manufacturing labor costs. Dakota provides the following information: E (Click the icon to view the information.) Read the requirements. Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2017. (Enter your answer as a number (not as a percentage) rounded to two decimal places, X.XX.) Actual manufacturing overhead rate Budgeted manufacturing overhead rate = Data table Budget for 2017 Actual Results for 2017 Direct material costs 2,250,000 $ 2,150,000 Direct manufacturing labor costs 1,700,000 1,650,000 Manufacturing overhead costs 3,060,000 3,217,500 Print Donearrow_forwardFactory Overhead Rates and Account Balances Prostheses Industries operates two factories. The manufacturing operations of Factory 1 are m e intensive, while the manufacturing operations of Factory 2 are labor intensive. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Estimated factory overhead cost for fiscal year beginning August 1 Estimated direct labor hours for year Estimated machine hours for year Actual factory overhead costs for August Actual direct labor hours for August Actual machine hours for August 1,730 a. Determine the factory overhead rate for Factory 1. Round your answer to the nearest cent. per machine hour $887,200 Factory 2 22,180 $70,930 $1,049,400 15,900 $90,600 1,430 b. Determine the factory overhead rate for Factory 2. Round your answer to the nearest cent. per direct labor…arrow_forwardPredetermined Overhead Rate; Disposing of Underapplied or Overapplied Overhead Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $900,000 of total manufacturing overhead for an estimated activity level of 75,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company’s warehouse. The company’s cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education