FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

9. Esquire Comic Book Company had income before tax of $1,600,000 in 2021 before considering the following material items:

- Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting principles. The before-tax loss on disposal was $400,000. The division generated before-tax income from operations from the beginning of the year through disposal of $620,000.

- The company incurred restructuring costs of $65,000 during the year.

Required:

Prepare a 2021 income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 25%. Ignore EPS disclosures. (Amounts to be deducted should be indicated with a minus sign.)

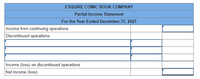

Transcribed Image Text:ESQUIRE COMIC BOOK COMPANY

Partial Income Statement

For the Year Ended December 31, 2021

Income from continuing operations

Discontinued operations:

Income (loss) on discontinued operations

Net income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one is the right answer ?arrow_forwardAfter many years of success, Kaputnik Co. recorded net operating losses for the years year 13 through year 16, totaling $250 million, resulting in the recording of large deferred tax assets based on the assumption of a rapid return to profitability. However, attempts by management to revamp its outmoded business model have so far failed. A radical final attempt to save the company will be implemented in year 18. It will entail selling off the vast majority of Kaputnik's asset groups while maintaining a small but promising segment. The projected outlook for the near term is a modest net profit of $5 million over the next three years, beyond which it is impossible to determine if Kaputnik Co. will even still be in existence. The enacted tax rate has been 35% for the last several years and is expected to be 21% in year 17 and future years. No addition to the deferred tax asset balance will be recorded for year 17, during which Kaputnik recorded a $70 million net operating loss, nor has…arrow_forwardDandy Candy Company sold its licorice division resulting in a loss of $60,000. Assuming a tax rate of 25%, the loss on this disposal will be reported on the income statement at what amount? A) $75,000 B) $15,000 C) $60,000 D) $45,000arrow_forward

- BEE company report TOTAL net income of $902 milllion before tax. During the year, BEE committed to dispose of its retail repair shops. The retail repair shops are a component of its business and the disposal represents a strategic shift in the company's operations. The retail repair shops reported $55 million in pretax profit for the year. The carrying value of the retail repair shops is $198 million with a fair (net realizable) value of $110 million. BEE is subject to a 25% income tax rate. Prepare a partial income statement begining with income from continuing operations.arrow_forwardDuring 2017, Liselotte Company reported income of$1,500,000 before income taxes and realized a gain of$450,000 on the disposal of assets related to a discontinuedoperation. The criteria for classification as a discontinued operation is appropriate for this sale. The income issubject to income taxation at the rate of 34%. The gainon the sale of the plant is taxed at 30%. Indicate anappropriate presentation of these items in the incomestatement.arrow_forwardPurple Ltd purchased a depreciable asset for $900,000 on 1 July 2014. For accounting purposes, it is estimated to have a useful life of 8 years with no residual value. For taxation purposes, the useful life is 6 years with no residual value. The asset is depreciated on a straight-line basis for both accounting and tax purposes. Tax rate is 30%. What is the adjustment required in the deferred tax liability account for the year ended 30 June 2020 and 30 June 2021 respectively in accordance with the requirements of AASB112 Income Taxes? $11,250; $11,250 $11,250; $33,750 $11,250; ($33,750) $11,250; ($11,250)arrow_forward

- On January 1, 2018, Ackerman sold equipment to Brannigan (a wholly owned subsidiary) for $150,000 in cash. The equipment had originally cost $135,000 but had a book value of only $82,500 when transferred. On that date, the equipment had a five-year remaining life. Depreciation expense is computed using the straight-line method. Ackerman reported $510,000 in net income in 2018 (not including any investment income) while Brannigan reported $167,300. Ackerman attributed any excess acquisition-date fair value to Brannigan's unpatented technology, which was amortized at a rate of $6,100 per year. a. What is consolidated net income for 2018? b. What is the parent's share of consolidated net income for 2018 if Ackerman owns only 90 percent of Brannigan? c. What is the parent's share of consolidated net income for 2018 if Ackerman owns only 90 percent of Brannigan and the equipment transfer was upstream? d. What is the consolidated net income for 2019 if Ackerman reports $530,000 (does not…arrow_forwardEsquire Comic Book Company had income before tax of $1,250,000 in 2024 before considering the following material items: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accountin principles. The before-tax loss on disposal was $365,000. The division generated before-tax income from operations from the beginning of the year through disposal of $550,000. 2. The company incurred restructuring costs of $80,000 during the year. Required: Prepare the income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 25% Ignore EPS disclosures. Note: Amounts to be deducted should be indicated with a minus sign. ESQUIRE COMIC BOOK COMPANY Partial Income Statement For the Year Ended December 31, 2024 Income from continuing operations Discontinued operations. Gain on sale of assets Income from operations of discontinued component Income tax benefit. Income tax expensearrow_forwardShannon Polymers uses straight-line depreciation for financial reporting purposes for equipment costing $780,000 and with an expected useful life of four years and no residual value. Assume that, for tax purposes, the deduction is 40%, 30%, 20%, and 10% in those years. Pretax accounting income the first year the equipment was used was $880,000, which includes interest revenue of $25,000 from municipal governmental bonds. Other than the two described, there are no differences between accounting income and taxable income. The enacted tax rate is 25%. Prepare the journal entry to record income taxes.arrow_forward

- I need the answer as soon as possiblearrow_forwardShannon Polymers uses straight-line depreciation for financial reporting purposes for equipment costing $540,000 and with an expected useful life of four years and no residual value. Assume that, for tax purposes, the deduction is 40%, 30%, 20%, and 10% in those years. Pretax accounting income the first year the equipment was used was $640,000, which includes interest revenue of $12,000 from municipal governmental bonds. Other than the two described, there are no differences between accounting income and taxable income. The enacted tax rate is 25%.arrow_forwardOn 1st July 2021, Hard Rock Pty Ltd a small construction business purchased two business assets for the purpose of producing assessable income. The aggregated turnover for the business was less than 10 million dollars. Remember that Hard Rock Ltd has chosen not to use the simplified depreciation rules in any years. You are required to analyse the two scenarios and calculate any allowable deductions arising from the decline in value of the following assets. Use all the relevant methods to show the difference in the claimable amount. Asset1: An excavator was purchased at the beginning of the year at the cost of $125,000. The estimated life of this asset is 12 years. Asset2: A luxury car on 1st July at the cost of $92,000. The estimated life of the vehicle is eight years. Required: a) How would the business decision choose a method of depreciation for the following two situations? b) What considerations a taxpayer should take in choosing a particular method of depreciation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education