FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need the answer as soon as possible

Transcribed Image Text:Company XYZ manufactures a tangible product and sells the product at wholesale. In its first year of operations, XYZ

manufactured 1,900 units of product and incurred $351,500 direct material cost and $194,750 direct labor costs. For financial

statement purposes, XYZ capitalized $149,750 indirect costs to inventory. For tax purposes, it had to capitalize $180,750

indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 190 units in inventory. In its second year

of operations, XYZ manufactured 3,800 units of product and incurred $722,000 direct material cost and $418,000 direct labor

costs. For financial statement purposes, XYZ capitalized $282,000 indirect costs to inventory. For tax purposes, it had to

capitalize $336,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 380 items in

inventory.

Required:

a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

FIFO costing convention.

b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

LIFO costing convention.

Complete this question by entering your answers in the tabs below.

Required A

Required B

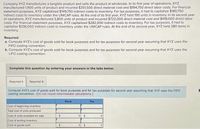

Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO

costing convention. (Do not round intermediate calculations.)

Book

Тах

Cost of beginning inventory

Total cost of units produced

Cost of units available for sale

Cost of ending inventory

Cost of goods sold

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain Future Advances?arrow_forwardWhat is political risk with practical example?arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education