FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Company XYZ manufactures a tangible product and sells the product at wholesale. In its first year of operations, XYZ

manufactured 1,900 units of product and incurred $351,500 direct material cost and $194,750 direct labor costs. For financial

statement purposes, XYZ capitalized $149,750 indirect costs to inventory. For tax purposes, it had to capitalize $180,750

indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 190 units in inventory. In its second year

of operations, XYZ manufactured 3,800 units of product and incurred $722,000 direct material cost and $418,000 direct labor

costs. For financial statement purposes, XYZ capitalized $282,000 indirect costs to inventory. For tax purposes, it had to

capitalize $336,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 380 items in

inventory.

Required:

a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

FIFO costing convention.

b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

LIFO costing convention.

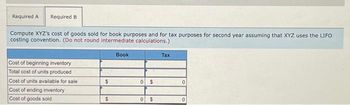

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO

costing convention. (Do not round intermediate calculations.)

Cost of beginning inventory

Total cost of units produced

Cost of units available for sale

Cost of ending inventory

Cost of goods sold

$

$

Book

0 $

0 $

Tax

0

0

Transcribed Image Text:Company XYZ manufactures a tangible product and sells the product at wholesale. In its first year of operations, XYZ

manufactured 1,900 units of product and incurred $351,500 direct material cost and $194,750 direct labor costs. For financial

statement purposes, XYZ capitalized $149,750 indirect costs to inventory. For tax purposes, it had to capitalize $180,750

indirect costs to inventory under the UNICAP rules. At the end of its first year, XYZ held 190 units in inventory. In its second year

of operations, XYZ manufactured 3,800 units of product and incurred $722,000 direct material cost and $418,000 direct labor

costs. For financial statement purposes, XYZ capitalized $282,000 indirect costs to inventory. For tax purposes, it had to

capitalize $336,000 indirect costs to inventory under the UNICAP rules. At the end of its second year, XYZ held 380 items in

inventory.

Required:

a. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

FIFO costing convention.

b. Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the

LIFO costing convention.

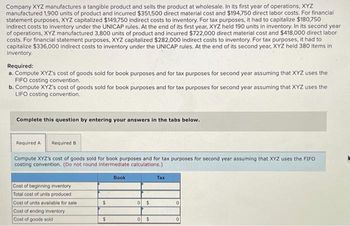

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute XYZ's cost of goods sold for book purposes and for tax purposes for second year assuming that XYZ uses the FIFO

costing convention. (Do not round intermediate calculations.)

Cost of beginning inventory

Total cost of units produced

Cost of units available for sale

Cost of ending inventory

Cost of goods sold

$

$

Book

0 $

0 $

Tax

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 34 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dry Valley Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2026: Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component Dry Valley is subject to a 20% tax rate. Instructions $120,000 28,000 (60,000) Prepare the December 31, 2026, income statement for Dry Valley Corporation, starting with income from continuing operations before income taxes.arrow_forwardVen Company is a retailer. In 2021, its before-tax net income for financial reporting purposes was $600,000. This included a $150,000 gain from the sale of land held for several years as a possible plant site. The cost of the land was $100,000, the contract price for the sale was $250,000, and the company collected $120,000 in the year of sale. The income per books also included $90,000 from a 24-month service contract entered into in July 2020 (the customer paid $180,000 in advance for this contract). The addition to the allowance for uncollectible accounts for the year was $70,000, and the actual accounts written off totaled $40,000. Answer the following regarding any necessary adjustments to the before-tax net income per books to compute Ven's taxable income for the year. What is the gross profit percentage for the installment sale? What is amount of the installment gain installment sale for 2021? What is the amount of service contract revenue recognized in 2021? What is the amount…arrow_forwardThe semiconductor business of the California Microtech Corporation qualifies as a component of the entity according to GAAP. The book value of the assets of the segment was $19 million. The loss from operations of the segment during 2021 was $3.3 million. Pretax income from continuing operations for the year totaled $6.1 million. The income tax rate is 25%. Assume that the semiconductor segment was not sold during 2021 but was held for sale at year-end. The estimated fair value of the segment’s assets, less costs to sell, on December 31 was $20 million. Prepare the lower portion of the 2021 income statement beginning with income from continuing operations before income taxes. Ignore EPS disclosures. (Amounts to be deducted and negative amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions.)arrow_forward

- Truson Company paid a 4% SUTA tax on the taxable wages of $108500. The taxable wages under FUTA were $89400. What was the net FUTA tax of Truson Company? Round to the nearest centarrow_forward(Two Differences, One Rate, Beginning Deferred Balance, Compute Pretax Financial Income) Andy McDowell Co. establishes a $100 million liability at the end of 2017 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2018. Also, at the end of 2017, the company has $50 million of temporary differences due to excess depreciation for tax purposes, $7 million of which will reverse in 2018. The enacted tax rate for all years is 40%, and the company pays taxes of $64 million on $160 million of taxable income in 2017. McDowell expects to have taxable income in 2018.Instructions(a) Determine the deferred taxes to be reported at the end of 2017.(b) Indicate how the deferred taxes computed in (a) are to be reported on the balance sheet.(c) Assuming that the only deferred tax account at the beginning of 2017 was a deferred tax liability of $10,000,000, draft the income tax expense portion of the income…arrow_forwardBlack Company, organized on January 2, 20X1, had pre-tax accounting income of $500,000 and taxable income of $800,000 for the year ended December 31, 20X1. The only temporary difference is accrued product warranty costs, which are expected to be paid as follows: 20X2 20X3 20X4 20X5 $100,000 50,000 50,000 100,000 Circumstances indicate that it is highly likely that Black will have taxable income in the future. It had no temporary differences in prior years. The enacted income tax rate is 21%. Required: 1. In Black's December 31, 20X1, balance sheet, how much should the deferred tax asset be? 2. Suppose that as of December 31, 20X1, a newly enacted law called for the tax rate to change to 25%, effective January 1, 20X3. Then what would be the amount of the deferred tax asset at December 31, 20X1?arrow_forward

- TyroneCo, an S corporation with a positive E & P balance, reports gross receipts for the year totaling $533,000 (of which $266,500 is passive investment income). Expenditures directly connected to the production of the passive investment income total $106,600. Compute Tyrone's passive investment income tax. If required, round your final answer to the nearest dollar.arrow_forwardLewes Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes. Pertinent data at December 31, 2016, the close of the first year of operations, are as follows: Revenue Recognized Revenue Recognized Customer for Accounting Purposes for Tax Purposes Lowe's Builders $200,000 $100,000 Top Down Plumbing 500,000 350,000 Glass Plus Windows 600,000 350,000 Lewes's tax rate is 30%. What amount should be included in the deferred tax account at December 31, 2016 for these installment sales?arrow_forwardANNA Company purchased inventories from abroad for resale incurring the following costs: Determine the cost to be capitalized as part of inventory. 2. ROSALINDA Company accepted a special manufacturing order from RIZZA Company. The Company incurred P250,000 for materials and P170,000 for conversion costs. Since this is a special order, the Company also incurred P100,000 for designing the product and P50,000 for modifying the current production process. In addition, excessive wastage of materials amounting to P80,000 was incurred because of the highly-specialized nature of the order. Lastly, the Company also incurred storage cost of P70,000 when the inventory was in work-in-process stage and P40,000 when it was already a finished product. What amount should be capitalized as part of inventory?arrow_forward

- At the beginning of 2016, Norris Company had a deferred tax liability of $6,600, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial reporting. The income tax rate is 30% for 2015 and 2016, but in 2015 Congress enacted a 39% tax rate for 2017 and future years. Norris’s accounting records show the following pretax items of financial income for 2016: income from continuing operations, $120,300 (revenues of $351,500 and expenses of $231,200); gain on disposal of Division F, $24,000; loss from operations of discontinued Division F, $11,500; and prior period adjustment, $14,100, due to an error that understated revenue in 2015. All of these items are taxable; however, financial depreciation for 2016 on assets related to continuing operations exceeds tax depreciation by $4,600. Norris had a retained earnings balance of $161,300 on January 1, 2016, and declared and paid cash dividends of $32,800 during 2016. Required: 1.…arrow_forwardBEE company report TOTAL net income of $902 milllion before tax. During the year, BEE committed to dispose of its retail repair shops. The retail repair shops are a component of its business and the disposal represents a strategic shift in the company's operations. The retail repair shops reported $55 million in pretax profit for the year. The carrying value of the retail repair shops is $198 million with a fair (net realizable) value of $110 million. BEE is subject to a 25% income tax rate. Prepare a partial income statement begining with income from continuing operations.arrow_forwardOn June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating income was $270,000 before taxes. On September 1, Pronghorn disposed of the Mexico facility at a pretax loss of $670,000. The applicable tax rate is 30%. Show the discontinued operations section of Pronghorn’s income statement. PRONGHORN CORPPartial Income Statement select an opening section name enter an income statement item $enter a dollar amount enter an income statement item $enter a dollar amount $enter a total dollar amountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education