College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 5PA

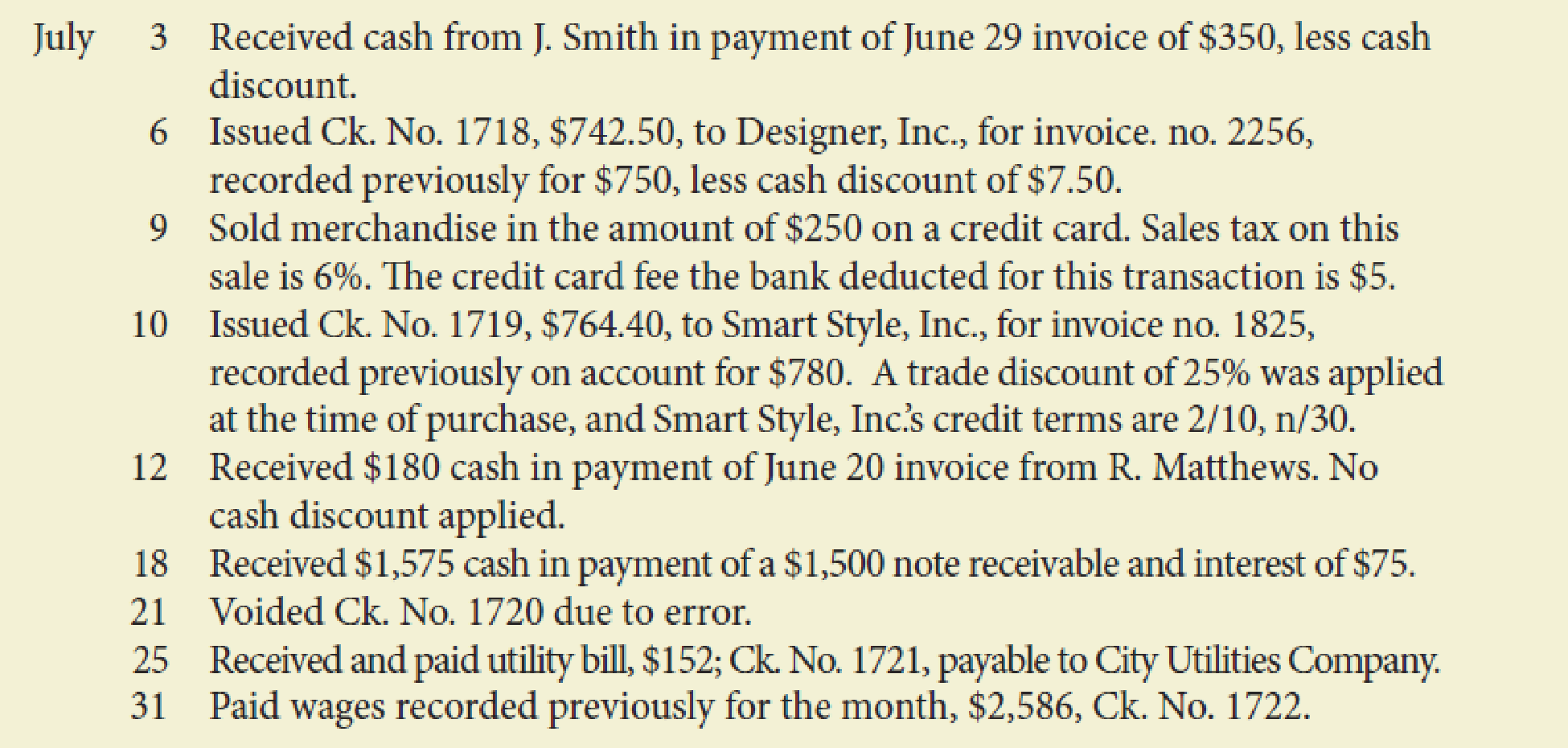

The following transactions were completed by Nelson’s Boutique, a retailer, during July. Terms on sales on account are 2/10, n/30, FOB shipping point.

Required

- 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payment journal as appropriate. Assume the periodic inventory method is used.

- 2. Total and rule the journals.

- 3. Prove the equality of debit and credit totals.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What are the equipment units of production for materials?

What would be the cost per equivalent unit for conversion costs?

Kindly help me with accounting questions

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

Ch. 10 - What do credit terms of 2/10, n/30 mean? 210 days...Ch. 10 - What is the entry to record the cash received on a...Ch. 10 - Prob. 3QYCh. 10 - Which of the following is not an advantage of the...Ch. 10 - Prob. 5QYCh. 10 - What is the normal balance for each of the...Ch. 10 - What does an X under the total of a special...Ch. 10 - Prob. 3DQCh. 10 - In a cash receipts journal, both the Accounts...Ch. 10 - If a cash payments journal is supposed to save...

Ch. 10 - Describe the posting procedure for a cash payments...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - For the following purchases of merchandise,...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Record the following transactions in general...Ch. 10 - Prob. 5ECh. 10 - Record general journal entries to correct the...Ch. 10 - Label the blanks in the column heads as either...Ch. 10 - Describe the transaction recorded.Ch. 10 - Prob. 9ECh. 10 - Indicate the journal in which each of the...Ch. 10 - The following transactions were completed by...Ch. 10 - Preston Company sells candy wholesale, primarily...Ch. 10 - MacDonald Bookshop had the following transactions...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by Yang...Ch. 10 - C. R. McIntyre Company sells candy wholesale,...Ch. 10 - Prob. 3PBCh. 10 - The following transactions were completed by Yang...Ch. 10 - Prob. 5PBCh. 10 - Prob. 1ACh. 10 - You are the manager of the Accounts Receivable...Ch. 10 - Prob. 3ACh. 10 - Suppose we collected cash from a charge customer...Ch. 10 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the cost per equipment unit of conversion for the month of Aprilarrow_forwardAcorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forwardThe equivalent units of production are?arrow_forward

- What is the variable overhead spending variance?arrow_forwardWhat is the estimated ending inventory at June 30?arrow_forwardA manufacturing company allocates overhead at a fixed rate of $50 per hour based on direct labor hours. During the month, total overhead incurred was $375,000, and the total direct labor hours worked was 5,500. Job numbers 7-19 had 600 hours of direct labor. What is the amount of overhead allocated to job 7-19? a. $33,000 b. $28,500 c. $35,000 d. $30,000 helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY