FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

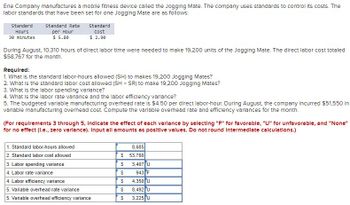

Transcribed Image Text:Erle Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The

labor standards that have been set for one Jogging Mate are as follows:

standard

Hours

30 minutes

Standard Rate

per Hour

$ 5.80

standard

Cost

$ 2.90

During August, 10,310 hours of direct labor time were needed to make 19,200 units of the Jogging Mate. The direct labor cost totaled

$58,767 for the month.

Required:

1. What is the standard labor-hours allowed (SH) to makes 19,200 Jogging Mates?

2. What is the standard labor cost allowed (SH x SR) to make 19,200 Jogging Mates?

3. What is the labor spending variance?

4. What is the labor rate variance and the labor efficiency variance?

5. The budgeted variable manufacturing overhead rate is $4.50 per direct labor-hour. During August, the company Incurred $51,550 In

variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month.

(For requirements 3 through 5, Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None"

for no effect (l.e., zero varlance). Input all amounts as positive values. Do not round Intermediate calculations.)

1. Standard labor-hours allowed

2. Standard labor cost allowed

3. Labor spending variance

4. Labor rate variance

4. Labor efficiency variance

5. Variable overhead rate variance

5. Variable overhead efficiency variance

$

$

$

$

$

69

8,685

53,780

3,407 U

943 F

4,350 U

8,492 U

3,225 U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Summer company manufactures beach chairs. $ 4.00 of direct materials are needed for each chair. Labor is $ 15 an hour. The company manufactures 3 chairs per hour. Indirect costs are $ 9.00 per hour. Commissions to sellers are $ 2.00 per unit sold. The cost of a chair will be:arrow_forwardErie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Hours Standard Rate per Hour Standard Cost 24 minutes $ 6.00 $ 2.40 During August, 8,380 hours of direct labor time were needed to make 19,500 units of the Jogging Mate. The direct labor cost totaled $48,604 for the month. Required: 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is $4.50 per direct labor-hour. During August, the company incurred $40,224 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month.arrow_forwardMarvel Parts, Incorporated, manufactures auto accessories including a set of seat covers that can be adjusted to fit most cars. According to its standards, the factory should work 1,075 hours each month to produce 2,150 sets of seat covers. The standard costs associated with this level of production are: Total Direct materials $ 54,825 Direct labor $ 10,750 Per Set of Covers $ 25.50 5.00 Variable manufacturing overhead (based on direct labor-hours) $ 5,375 2.50 $ 33.00 During August, the factory worked 800 direct labor-hours and produced 2,500 sets of covers. The following actual costs were recorded during the month: Total Direct materials (12,500 yards) Direct labor $ 58,750 $ 13,000 Variable manufacturing overhead $ 7,000 Per Set of Covers $ 23.50 5.20 2.80 $ 31.50 At standard, each set of covers should require 3.0 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2.…arrow_forward

- Required information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,600 units, and monthly production costs for the production of 1,300 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($270 fixed) Depreciation Total Cost $ 2,500 8,100 650 3,000 510 750 Suppose it sells each birdbath for $24. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units.arrow_forwardC-Cubed uses standards to control its costs. The direct materials and direct labor standards for one Fit-Right-Bike, which is made out of chromoly steel, are given below: Quantity Standard 60 inches Price Standard $3.50 per inch $20 per hour Direct Materials Direct Labor 3 hours During the month of September, C-Cubed planned on making 300 bikes, but it actually produced 275 bikes. C-Cubed incurred the following costs: A. 19,000 inches of chromoly steel were purchased at a cost of $3.25 per inch. C-Cubed used only 17,500 inches of chromoly steel in making the 275 bikes. B. Direct laborers worked 825 hours at an average rate of $22 per hour. Compute the labor price variance for September. Multiple Choice $1,710U $1.650U $1.710F $1,650Farrow_forwardMo Furniture manufactures a frame for use in its production of sofas. When 10,000 frames are produced, the costs per unit are: Direct materials $ 12 Direct manufacturing labor 60 Variable manufacturing overhead 24 Fixed manufacturing overhead 32 Total $128 A company has offered to sell Mo Furniture 10,000 sofa frames for $120 per unit. Fixed manufacturing overhead of $20 per unit used to make the frame could be eliminated if the frames were purchased instead of made. What is the relevant cost per unit to make the frame in this make or buy decision?arrow_forward

- sarrow_forwardMarvel Parts, Incorporated, manufactures auto accessories.One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 2, 850 hours each month to produce 1,900 sets of covers. The standard costs associated with this level of production are: Total Per Set of Covers Direct materials $ 42, 560 $ 22.40 Direct labor $ 51,300 27.00 Variable manufacturing overhead (Training Training hing based on direct labor-hours) $ 6,840 3.60 $ 53.00 During August, the factory worked only 2, 800 direct labor-hours and produced 2,000 sets of covers. The following actual costs were recorded during the month: Total Per Set of Covers Direct materials (12, 000 yards) $ $ 45,600 $ 22.80 Direct labor $ 49,000 24.50 Variable manufacturing overhead $ 7,000 3.50 $ 50.80 At standard, each set of covers should require 5.6…arrow_forwardVermont Instruments manufactures two models of calculators. The fiancé model is the Fin-X and the scientific model is the Sc-X. Both models are assembled in the same plant and require the same assembling operations. The difference between the models is in the cost of the parts. The following data are available for June: Fin-X Sci-X Total Number of units 12,000 40,000 52,000 Parts cost per unit $25 $23 Other costs: Direct labor $53,000 Indirect materials 18,000 Overhead…arrow_forward

- Subject: Acountingarrow_forwardA firm makes a range of running shoes. There are three models – Short; Middle; and Long distance. The products are aimed at different segments of the market. Product costs are computed using an overhead rate based on the labour hour method. Selling prices are set on full cost plus 20%. A unit refers to a pair of running shoes. The following information is available: Short distance Middle distance Long distance Direct material cost per unit $25 $35 $40 Labour hours per unit 2 hrs 2 hrs 2 hrs Labour rate per hour $12 $12 $12 Total labour hours used 120,000 hrs 24,000 hrs 16,000 hrs Total number of units 60,000 units 12,000 units 8,000 units Cost driver information: Short distance Middle distance Long distance No. of machine hours 60,000 48,000 48,000 No. of material orders 30 100 200 No. of sales orders 12 48 63 The total overhead costs for the business amount to $1.2…arrow_forwardMunabhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education