Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

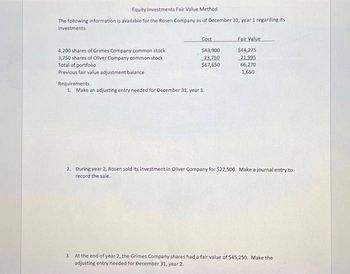

Transcribed Image Text:Equity Investments Fair Value Method

The following information is available for the Rosen Company as of December 31, year 1 regarding its

investments.

4,200 shares of Grimes Company common stock

3,750 shares of Oliver Company common stock

Total of portfolio

Previous fair value adjustment balance

Cost

$43,900

23,750

$67,650

Requirements

1. Make an adjusting entry needed for December 31, year 1.

Fair Value

$44,275

21,995

66,270

1,650

2. During year 2, Rosen sold its investment in Oliver Company for $22,500. Make a journal entry to

record the sale.

3. At the end of year 2, the Grimes Company shares had a fair value of $45,250. Make the

adjusting entry needed for December 31, year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Investments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.arrow_forwardDuring 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardRecording Entries for Equity Investment: FV-NI Adjust FVA at Year-End At December 31, 2019, the portfolio of investments in equity securities measured at FV-NI held by Athletes Inc. is as follows. Investment Security Cost Fair Value UnrealizedHoldingGain (Loss) Badger Common Stock (1,000 shares) $20,000 $19,750 $(250) Spartan Common Stock (1,600 shares) 25,000 25,500 500 Wildcat Common Stock (500 shares) 12,500 11,750 (750) Total $57,500 $57,000 $(500) On June 1, 2020, Athletes Inc. sold 200 shares of Spartan stock for $33 per share and 50 shares of Wildcat stock for $55 per share. Athletes Inc. purchased 200 shares of Gopher common stock for $35 per share on August 1, 2020. The fair value of the remaining stock held on December 31, 2020, is as follows: Badger common stock, $21,000; Spartan common stock, $18,000; Wildcat common stock, $10,400; and Gopher common stock, $7,200. a. Prepare the entry for the sale of Spartan and Wildcat common stock on June 1, 2020.b.…arrow_forward

- Adjusting AFS Debt Securities to Fair Value A portfolio of investments of available-for-sale securities held by Dow Inc. is as follows. Dec. 31, 2020 Cost Fair Value Eastern Corp. bonds $204,000 $217,600 Western Corp. bonds 340,000 348,500 Total $544,000 $566,100 Dec. 31, 2021 Cost Fair Value Eastern Corp. bonds $204,000 $238,000 Western Corp. bonds 340,000 323,000 Total $544,000 $561,000 The Fair Value Adjustment account had a $0 balance on January 1, 2020. No sales or purchases took place in the available-for-sale investment portfolio in 2020 and 2021. a. Record the adjusting entry on December 31, 2020, to adjust the debt investments to fair value. Date Account Name Dr. Cr. Dec. 31, 2020 b. Record the adjusting entry on December 31, 2021, to adjust the debt investments to fair value. . Date Account Name Dr. Cr. Dec. 31, 2021 c. Indicate how the adjustment to fair value in (b) would be…arrow_forwardUse the following information on a company’s investments in equity securities to answer questions 1- 2 below. The company’s accounting year ends December 31. Investment Date of acquisition Cost Fair value 12/31/16 Date sold Selling price Ajax Company stock 6/20/16 $40,000 $35,000 2/10/17 $32,000 Bril Corporation stock 5/1/16 20,000 N/A 11/15/16 26,000 Coy Company stock 8/2/16 16,000 16,500 1/17/17 23,000 1. If the above investments are categorized as trading securities, what amount is reported for gain or loss on securities, on the 2016 income statement? 2. If the above investments are categorized as trading securities, what amount is reported for gain or loss on securities, on the 2017 income statement?arrow_forwardTopic: Investment Prepare all necessary entries and provide all financial statementsarrow_forward

- Fair value adjustment for trading investments During the year ended December 31, 20Y3, trading securities were purchased for $346,000. On December 31, 20Y3, the securities had a fair value of $309,000. Journalize the December 31, 20Y3, adjusting entry to record the unrealized gain or loss on trading investments purchased in 20Y3. If an amount box does not require an entry, leave it blank. 20Y3 Dec. 31arrow_forwardoptions for a: Available-for-sale Investments, at cost cash Retained Earnings Unrealized gain(loss) on available-for-sale Investments Valuation Allowance for available-for-sale Investments options for b first slot is yes or no Second slot is as other revenue/expense or in the stockholder equity sectionarrow_forwardJournal entries for trading investments The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $216,000. The fair value of the securities on December 31, 20Y7, is $288,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 Accounting numeric field 20Y7 Dec. 31 Feedback Check My Work a. Increase the investment and reduce Cash for number of shares times the per share price. The unrealized gain (credit) or unrealized loss (debit) is the difference between the acquired per share price and the market price per share at 20Y7 taken times the number of shares acquired. The offset account for the gain or loss entry is the valuation allowance account. b. How is a unrealized gain or loss for trading investments reported on the financial statements? 00arrow_forward

- Fair Value Journal Entries, Available-for-Sale Investments The investments of Steelers Inc. include a single investment: 8,100 shares of Bengals Inc. common stock purchased on September 12, Year 1, for $13 per share including brokerage commission. These shares were classified as available-for-sale securities. As of the December 31, Year 1, balance sheet date, the share price declined to $10 per share. CashCash DividendsInterest ReceivableInvestments-Bengals Inc. StockRetained EarningsUnrealized Gain (Loss) on Available-for-Sale InvestmentsValuation Allowance for Available-for-Sale Investme a. Journalize the entries to acquire the investment on September 12 and record the adjustment to fair value on December 31, Year 1. Year 1 Sept. 12 fill in the blank fb2219094fa204f_2fill in the blank fb2219094fa204f_4Year 1 Dec. 31 fill in the blank fb2219094fa204f_6fill in the blank fb2219094fa204f_8b. How is the unrealized gain or loss for available-for-sale investments disclosed on the financial…arrow_forwardBalance Sheet Presentation of Available-for-Sale Investments During Year 1, its first year of operations, Galileo Company purchased two available-for-sale investments as follows: Security Shares Purchased Cost Hawking Inc. 860 $43,602 Pavlov Co. 2,330 61,512 Assume that as of December 31, Year 1, the Hawking Inc. stock had a market value of $60 per share and the Pavlov Co. stock had a market value of $48 per share. Galileo Company had net income of $337,400 and paid no dividends for the year ending December 31, Year 1. All of the available-for-sale investments are classified as current assets. a. Prepare the Current Assets section of the balance sheet presentation for the available-for-sale investments. Galileo Company Balance Sheet (selected items) December 31, Year 1 Assets Current Assets: $fill in the blank 6f30cb02405dfbc_2 Plus Unrealized Gain (Loss) on Available-for-Sale Investments fill in the blank 6f30cb02405dfbc_4 $fill…arrow_forwardBalance Sheet Presentation of Available-for-Sale Investments During Year 1, its first year of operations, Galileo Company purchased two available-for-sale investments as follows: Security Shares Purchased Cost Hawking Inc. 860 $43,602 Pavlov Co. 2,330 61,512 Assume that as of December 31, Year 1, the Hawking Inc. stock had a market value of $60 per share and the Pavlov Co. stock had a market value of $48 per share. Galileo Company had net income of $337,400 and paid no dividends for the year ending December 31, Year 1. All of the available-for-sale investments are classified as current assets. available for sale investments at cost/available for sale investments at fair value/common stock/retained earning/unrealized gain (loss) on available for sale investments/less retained earning/less unrealized gain (loss) on available for sale /plus retained earnings/plus unrealized gain (loss) on available/plus valuation allowance for available for sale/less unrealized gain…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning