FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't provide solution in an image format thank you

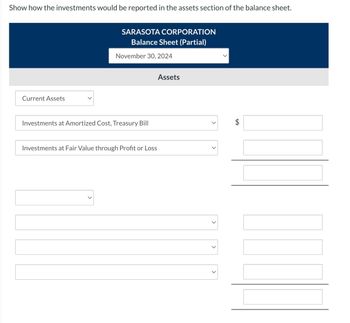

Transcribed Image Text:Show how the investments would be reported in the assets section of the balance sheet.

Current Assets

SARASOTA CORPORATION

Balance Sheet (Partial)

November 30, 2024

Investments at Amortized Cost, Treasury Bill

Investments at Fair Value through Profit or Loss

Assets

tA

Transcribed Image Text:Sarasota Corporation, a public company, has the following investments at November 30, 2024:

1.

2.

3.

4.

5.

Investments held for trading purposes: common shares of National Bank, carrying amount $22,000, fair value $22,900, and

five-year, 5% bonds of Turbo Corp., carrying amount $44,000, fair value $42,200

FVTOCI investment: 25% of the common shares of Sword Corp., carrying amount $95,000, fair value $92,400

Strategic investment: common shares of Epee Inc. (30% ownership), cost $184,800, equity method balance $220,000

Debt investment purchased to earn interest: bonds of Ghoti Ltd. maturing in four years, amortized cost $132,000, fair value

$154,000

Debt investment purchased to earn interest: Canadian government 120-day treasury bill, purchased at $22,000, $110

interest accrued to November 30, 2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is lossy compression? a MP3 is compressed music. b Reduce the size of files by taking out less important information. It drops nonessential information to decrease file size. Reduce the size of the file without losing any information and the original file can be reconstructed from a compressed version. d Joint Photographic Experts Group JPEG) is a compressed image. O O O Carrow_forwardhelp please, the answers I put are not correctarrow_forwardWhat is Contiguous data?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education