FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

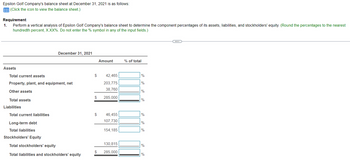

Transcribed Image Text:Epsilon Golf Company's balance sheet at December 31, 2021 is as follows:

(Click the icon to view the balance sheet.)

Requirement

1. Perform a vertical analysis of Epsilon Golf Company's balance sheet to determine the component percentages of its assets, liabilities, and stockholders' equity. (Round the percentages to the nearest

hundredth percent, X.XX%. Do not enter the % symbol in any of the input fields.)

Assets

Total current assets

Property, plant, and equipment, net

Other assets

Total assets

Liabilities

Total current liabilities

December 31, 2021

Long-term debt

Total liabilities

Stockholders' Equity

Total stockholders' equity

Total liabilities and stockholders' equity

$

$

$

$

Amount

42,465

203,775

38,760

285,000

46,455

107,730

154,185

130,815

285,000

% of total

%

%

%

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected information is for H55 Corporation: Total assets Total shareholders' equity Sales Cost of goods sold Net income. H55 had no preferred shares. ype here to search 2021 $357,000 $285,000 136.000 503.000 378.759 2020 32.695 97,500 394,000 276.982 29.944 2019 $267,000 48,500 297.000 181,000 20,400arrow_forwardCalculate the following ratios from the income statement and balance sheet all are required 1-Payables Turnover 2-Debt-Equity Ratio 3-Debt Ratio 4-Total Asset Turnover 5-Fixed Asset Turnover Statement of financial positionas at 31 December 2018 2018 2017 Note RO RO ASSETS Non-current assets Property, plant and equipment 14 8,407,572 9,300,442 Deferred tax assets 12 40,977 18,550 8,448,549 9,318,992 Current assets Inventories 15 430,885 422,421 Trade and other receivables 16 1,129,440 1,235,724 Due from related parties 24 70,300 73,050 Cash and bank balances 17 6,856,734 6,439,709 Total current assets 8,487,359 8,170,904 Total assets 16,935,908 17,489,896 EQUITY…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Balance Sheet Prepare a horizontal analysis of the balance sheet for Year 4 and Year 3. Note: Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (1.e., .234 should be entered as 23.4). Assets Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Total long-term assets Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Terlam Notes payable Accounts payable Salaries payable Total current liabilites Noncurrent liabilities Bonds payable Other Total noncurrent liabilities Total abilities Stockholders' equity FRANKLIN COMPANY Horizontal Analysis of Balance Sheets Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,300 shares authorized and issued) EMAIA Common stock (no par; 50,000 shares authorized, 10,000 shares issued) Retained earnings Total stockholders' equity Total habilities & stockholders equity…arrow_forwardPlease do not give solution in image format thankuarrow_forwardAnalysis above two financial statement, what you can observe without using financial ratio.arrow_forward

- Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other RUNDLE COMPANY Vertical Analysis of Balance Sheets Year 4 Total noncurrent liabilities Total liabilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating; 6,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities & stockholders' equity Amount $ 16,900 21,000 55,100…arrow_forwardUsing the following Balance Sheet summary information, calculate for the two companies presented:working capitalcurrent ratio Company L and Company M, respectively: Current assets $124,680, $180,550. Current liabilities 63,250, 153,250.arrow_forward(a) Calculate the asset tumover ratio, Asset tumover ratio________ 1) eTextbook 2) and Media List of Accountsarrow_forward

- Angela Corporation has the following selected assets and liabilities: Given the said data, determine the company’s net working capital. (check the photo) Choose the letter of correct answer a. P35,000.00b. P39,000.00c. P33,000.00d. P72,000.00e. P52,000.00arrow_forward5. Prepare a classified balance sheet as of January 31, 2024. (Enter the asset accounts in order of liquidity. Amounts to be deducted should be indicated with a minus sign.) Current Assets: Assets Less: Allowance for Uncollectible Accounts Total Current Assets Property, Plant and Equipment: Total Assets ACME FIREWORKS Classified Balance Sheet January 31, 2024 Current Liabilities: Total Current Liabilities Long-term Liabilities: Liabilities Total Liabilities Stockholders' Equity Total Stockholders' Equity Total Liabilities and Stockholders' Equity Required information Exercise 8-19 (Algo) Complete the accounting cycle (LO8-1, 8-2, 8-4, 8-6) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: Accounts Cash Debit $25,600 Credit Accounts Receivable 47,200 Allowance for Uncollectible Accounts $4,700 Inventory 20,500 Land 51,000 Equipment 17,500 Accumulated Depreciation 2,000…arrow_forwardFollowing are the current asset and current liability sections of the balance sheets for Freedom Incorporated at January 31, 2023 and 2022 (in millions): Current Assets Cash Accounts receivable Inventories Total current assets Current Liabilities Note payable Accounts payable Other accrued liabilities Total current liabilities Req A January 31, 2023 $12 8 7 $ 27 Req B and C Working capital Current ratio 4 3 $ 11 January 31, 2022 Required: a. Calculate the working capital and current ratio at each balance sheet date. b. Evaluate the firm's liquidity at each balance sheet date. c. Assume that the firm operated at a loss during the year ended January 31, 2023. How could cash have increased during the year? $ 9 11 11 $ 31 Complete this question by entering your answers in the tabs below. 1 3 01/31/2023 01/31/2022 $8 Calculate the working capital and current ratio at each balance sheet date. Note: Enter "Working capital" in millions of dollars (i.e., 10,000,000 should be entered as 10).…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education