FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using the given information, create a pro forma

Transcribed Image Text:Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.6 million. It wishes to analyze expected performance and financing needs for 2021-2 years ahead. Given the following information, respond to parts a. and b.

(1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 12.3%, Inventory: 17.6%, Accounts payable, 13.9%; Net profit margin, 2.7%.

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of $478,000 is desired.

(4) A new machine costing $651,000 will be acquired in 2020, and equipment costing $854,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $295,000, and in 2021 $394,000 of depreciation will be taken.

(5) Accruals are expected to rise to $499,000 by the end of 2021.

(6) No sale or retirement of long-term debt is expected.

(7) No sale or repurchase of common stock is expected.

(8) The dividend payout of 50% of net profits is expected to continue.

(9) Sales are expected to be $11.8 million in 2020 and $11.8 million in 2021.

(10) The December 31, 2019, balance sheet is here

a. Prepare a pro forma balance sheet dated December 31, 2021.

b. Discuss the financing changes suggested by the statement prepared in part (a)

a. Prepare a pro forma balance sheet dated December 31, 2021.

Complete the assets part of the pro forma balance sheet for Peabody & Peabody for December 31, 2021 below. (Round to the nearest dollar)

Pro Forma Balance Sheet

Data Table

Peabody & Peabody

December 31, 2021

Assets

(Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet

Current assets

Leonard Industries Balance Sheet December 31, 2019

Liabilities and Stockholders' Equity

Accounts payable

Cash

%24

Assets

Cash

Marketable securities

Accounts receivable

$399,000

199,000

$1,397,000

Marketable securities

Accruals

395,000

Accounts receivable

%24

1,203,000

Other current liabilities

Total current liabilities

Long-term debt

Common stock

Total liabilities and

stockholders' equity

80,300

$1,872,300

2,016,700

3,716,000

Inventories

Total current assets

Net fxed assets

1.805,000

$3,606,000

3,999.000

Inventories

Total current assets

Net foxed assets

Total assets

$7,605.000

$7,605,000

Total assets

%24

Print

Done

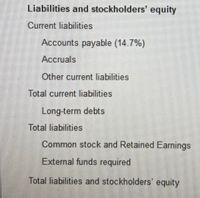

Transcribed Image Text:Liabilities and stockholders' equity

Current liabilities

Accounts payable (14.7%)

Accruals

Other current liabilities

Total current liabilities

Long-term debts

Total liabilities

Common stock and Retained Earnings

External funds required

Total liabilities and stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The three parts of your balance sheet are Group of answer choices assets, liabilities, net worth. income, liabilities, balance. assets, liabilities, balance. assets, expenditures, balance.arrow_forwardFirst picture is the instructionarrow_forwardIdentify the items or data that appear on multiple financial statements (income statement, statement of owners equity, balance sheet, statement of cash flow)arrow_forward

- I need a balance sheet for this information as well.arrow_forwardDescribe the purpose of the balance sheet.arrow_forwardCClassify each of the following items as an Asset (A), Liability (L), or part of Owner’s Equity (OE). a. Computer Tabletb. Accounts Payablec. Accounts Receivabled. Cashe. A. Jones, Capitalarrow_forward

- analyze the use of the assets of Facebook please. Please include two ratios, Asset Turnover and Return on Assets. These ratios need to incorporate all assets on the balance sheet.arrow_forwardThe income statement section of the worksheet includes ________arrow_forwardHow do REA and ER diagrams support financial statements?arrow_forward

- please do the balance sheet and sshow work the first partarrow_forwarda. List the four types of financial statements b.Describe the interrelationshipbetween balance sheet and the income statementarrow_forward1) Where is the Standard Balance Sheet located in QuickBooks? 2) What is the purpose of a comparative balance sheet? 3) How is a balance sheet modified?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education