FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

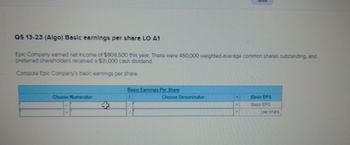

Transcribed Image Text:QS 13-23 (Algo) Basic earnings per share LO A1

Epic Company earned net income of $908,500 this year. There were 450,000 weighted-average common shares outstanding, and

preferred shareholders received a $31,000 cash dividend.

Compute Epic Company's basic earnings per share.

Choose Numerator:

Basic Earnings Per Share

1

Saved

Choose Denominator:

Basic EPS

Basic EPS

per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need the answer as soon as possiblearrow_forwardLake Incorporated and River Incorporated reported net incomes of $275,000 and $231,000, respectively, for the most recent fiscal year. Both companies had 55,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $58, while River's sold for $62 per share. Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Determine the P/E ratio for each company. Note: Do not round intermediate calculations. Round your answers to the nearest whole number. Company Lake, Incorporated River, Incorporated P/E Ratioarrow_forwardMurray Company reports net income of $855,500 for the year. It has no preferred stock, and its weighted-average common shares outstanding is 290,000 shares. Compute its basic earnings per share. Choose Numerator: 1 Basic Earnings Per Share Choose Denominator: Basic EPS Basic EPS 0 per sharearrow_forward

- Need help with this questionarrow_forwardEarnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,715,000 $2,437,000 Preferred dividends $50,000 $50,000 Average number of common shares outstanding 90,000 shares 110,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Y6 Earnings per Share $fill in the blank 1 $fill in the blank 2 b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable?arrow_forwardXYZ Corporation had the following balance sheet information: Total assets: $500,000Total liabilities: $200,000Shareholders' equity: $300,000If XYZ Corporation has 50,000 shares outstanding, what is the book value per share?arrow_forward

- Urmilabenarrow_forwardharrow_forwardEarnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,761,000 $2,555,500 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 90,000 shares 115,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Υ6 Earnings per Share $ b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable?arrow_forward

- naruarrow_forwardCan anyone please help me with this? Question in picture.arrow_forwardMayan Company had net income of $132,000. The weighted-average common shares outstanding were 80,000. The company has preferred stock. The company's basic earnings per share is: Multiple Choice $44.00. $26.67 $1.59. $1.71. $1.65.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education