FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

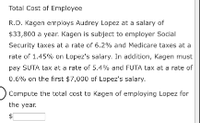

Transcribed Image Text:Total Cost of Empleyee

R.D. Kagen employs Audrey Lopez at a salary of

$33,800 a year. Kagen is subject to employer Social

Security taxes at a rate of 6.2% and Medicare taxes at a

rate of 1.45% on Lopez's salary. In addition, Kegen must

pey SUTA tax et a rate of 5.4% and FUTA tax at a rate of

0.0% on the first $7,000 uf Lopez's salary.

Compute the total cost to Kagen of emplaying Lopez for

the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- An employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 of employer earnings per calendar year and the FICA tax rate Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay?arrow_forwardMartin Jackson receives an hourly wage rate of $25, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $362; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the net amount to be paid to Jackson? Oa. $1,225.00 Ob. $1,846.13 Oc. $771.13 Od. $1,633.13arrow_forwardAn employee earned $46,800 during the year working for an employer when the maximum limit for Social Security was $128,400. The FICA tax rate for Social Security is 6.2% and the FICA tax rate for Medicare is 1.45%. The employee's annual FICA taxes amount is: Multiple Choice $2,789.20. $6,489.70. $7,160.40. $3,580.20. $670.70.arrow_forward

- Sky Company employed Tom Mills in Year 1. Tom earned $5,900 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $870 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employeearrow_forwardSupermarket Caridad offers its employees vacation benefits and contributes a 2% contribution to a 401K. The employees had total wages of $ 125,000 and vacation benefits of $ 28,460. Calculate how much the employer contributes for the 401k.Make the wage entries related to vacation pay.Make the wage entries related to the 401K contribution.arrow_forwardAn employee earns $5,500 per month working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The employee has $182 in federal income taxes withheld. The employee has voluntary deductions for health insurance of $150 and contributes $75 to a retirement plan each month. What is the amount of net pay for the employee for the month of January? (Round your intermediate calculations to two decimal places.)arrow_forward

- BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. a. b. c. Gross Pay through August 31 $ 6,400 2,700 133,300 Gross Pay for September $1,700 2,800 9,900 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answer in the tabs below. Employer Payroll taxes Payroll Taxes General Journal Expense Assuming situation (a), compute the payroll taxes expense. (Round your answers to 2 decimal places.) September earnings subject to tax Tax Ratearrow_forwardFor each circumstances, calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of $8,500. A-1 Framing employs three workers who, as of the beginning of the current pay period, have earned $8,550, $8,200, and $7,400. Calculate SUTA tax for the current pay period if these employees earn taxable pay of $1,100, $1,420, and $2,140, respectively. SUTA tax = $ What is the SUTA tax?arrow_forwardUramilabenarrow_forward

- Portia Grant is an employee who is paid monthly. for the month of Jan of the current year, she earned a total of 8,538. the FICA tax for social security is 6.2% of the first 128,400 of employee earnings each calendar year and the FICA tax for medicare is 1.45% of all earnings. the FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first 7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was 1,416.67. her net pay for the month is?arrow_forwardThomas Martin receives an hourly wage rate of $16, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $363; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? Oa. $832 Ob. $1,536 Oc. $1,152 Od. $768arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. a. b. c. Gross Pay through August 31 $ 6,400 2,700 133,300 Assuming situation (a), prepare the employer's September 30 journal entry to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $60 for this pay period. Taxes to be Withheld From Gross Pay Gross Pay for September $ 1,700 Complete this question by entering your answers in the tabs below. 2,800 9,900 General Journal Federal income tax The employee's federal income taxes withheld by the employer are $60 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee. (Round your answers to 2 decimal places.) Taxes to be Withheld From Gross Pay…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education