FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

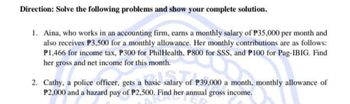

Transcribed Image Text:Direction: Solve the following problems and show your complete solution.

1. Aina, who works in an accounting firm, earns a monthly salary of P35,000 per month and

also receives P3,500 for a monthly allowance. Her monthly contributions are as follows:

P1,466 for income tax, P300 for PhilHealth, P800 for SSS, and P100 for Pag-IBIG. Find

her gross and net income for this month.

salary of

basic salary of P3

2. Cathy, a police officer, gets a basic

P39,000 a month, monthly allowance of

P2,000 and a hazard pay of P2,500. Find her annual gross income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rafaela has a gross monthly income of $3,900. She has 15 remaining payments of $189 on a used car. The taxes and insurance on a house Rafaela may purchase are $115 per month. What maximum monthly payment does the bank's loan officer feel that Rafaela can afford? The maximum monthly payment includes principal and interest for the amount of the loan as well as the taxes and insurance. Round your answer to the nearest cent.arrow_forwardLee Sutherlin is a self-employed electrical consultant. He estimates his annual net earnings at $35,300. How much Social Security and Medicare must he pay (in $) this year? Social Security $ Medicare $arrow_forwardTHIS IS FOR FINANCIAL MATHEMATICS 2, THANK YOUUUUUarrow_forward

- The expenses and income of an individual are given in table form to the right. Find the net monthly cash flow (it may be negative or positive). Assume that amounts shown for salaries and wages are after taxes and that 1 month= 4 weeks. Income Part-time job: $1100/month Student loans: $7800/year Scholarship: $7000/year The net monthly cash flow is $ (Round to the nearest dollar as needed.) ... Expenses Rent: $400/month Groceries: $40/week Tuition and fees: $6500/year Health insurance: $25/month Entertainment: $150/month Phone: $55/montharrow_forwardMelissa recently paid $760 for round trip airfare to San Francisco to attend a business conference for three days. Melissa also put the following expenses: $370 fee to register for the conference, $365 per night for three nights' lodging, $250 for meals and $300 for can fare. what amount of these costs can Melissa deduct as business expenses. Explain the answerarrow_forwardPlease helparrow_forward

- LaMont works for a company in downtown Chicago. The firm encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $270 per month. a. If LaMont receives one pass (worth $270) each month, how much of this benefit must he include in his gross income each year? b. If the company provides each employee with $270 per month in parking benefits, how much of the parking benefit must LaMont include in his gross income each year?arrow_forwardG, the Manager of ABC Co., was given a fringe benefit of a Household Expense account for the salary of his driver and other personal expenses in the amount of P20,000 per month for the current year. Compute the following: 1) Grossed Up Monetary of the Fringe Benefits 2) Fringe Benefits Tax Payable 3) If G is employed in an Offshore Banking unit, compute the fringe Benefits Tax. Upload your solutions in Spreadsheet Format.arrow_forwardTamara works for FunCorp. She makes $65,000 per year in salary. How much does she pay in FICA taxes for the year? $4,030.00 O $4,972.50 O $8,060.00 O $9,945.00arrow_forward

- 1. Ms. Evelyn is tax compliance officer at the Bureau of internal revenue earning a monthly salary P35,196.00. How much is Ms. Evelyn's take home pay? 2. Allan S. Gala is a sales representative at a private pharmacy. He is given a monthly rice subsidy of P2,000.00. Over his monthly salary of P24,300.00. How much is his monthly net pay?arrow_forwardHow is income defined by the IRC? For example, suppose you decided to hold a garage sale one fine summer weekend. The proceeds of such came out to $40. Do you report this? Why or why not?arrow_forwardNellie has paid $3358.46 in CPP this year. She makes $2800.00 per pay and is paid bi-weekly How much will she have to pay in CPP contributions this pay? O $141.34- O $107.99 $69.97 O $78.56arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education