EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

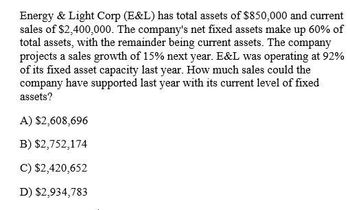

Transcribed Image Text:Energy & Light Corp (E&L) has total assets of $850,000 and current

sales of $2,400,000. The company's net fixed assets make up 60% of

total assets, with the remainder being current assets. The company

projects a sales growth of 15% next year. E&L was operating at 92%

of its fixed asset capacity last year. How much sales could the

company have supported last year with its current level of fixed

assets?

A) $2,608,696

B) $2,752,174

C) $2,420,652

D) $2,934,783

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Water and Power Co. (W&P) currently has $575,000 in total assets and sales of $1,400,000. Half of W&P’s total assets come from net fixed assets, and the rest are current assets. The firm expects sales to grow by 22% in the next year. According to the AFN equation, the amount of additional assets required to support this level of sales is . (Note: Round your answer to the nearest whole number.) W&P was using its fixed assets at only 95% of capacity last year. How much sales could the firm have supported last year with its current level of fixed assets? (Note: Round your answer to the nearest whole number.) $1,547,368 $1,768,421 $1,473,684 $1,694,737 When you consider that W&P’s fixed assets were being underused, its target fixed assets to sales ratio should be %. (Note: Round your answer to two decimal places.) When you consider that W&P’s fixed assets were being underused, how much fixed assets must W&P raise to…arrow_forwardNewtown Propane currently has $645,000 in total assets and sales of $1,720,000. Half of Newtown’s total assets come from net fixed assets, and the rest are current assets. The firm expects sales to grow by 22% in the next year. According to the AFN equation, the amount of additional assets required to support this level of sales is $ Newtown was using its fixed assets at only 95% of capacity last year. How much sales could the firm have supported last year with its current level of fixed assets? $1,720,000 $1,629,473 $1,448,421 $1,810,526 When you consider that Newtown’s fixed assets were being underused, its target fixed assets to sales ratio should be %. When you consider that Newtown’s fixed assets were being underused, how much fixed assets must Newtown raise to support its expected sales for next year? $41,022 $46,150 $48,714 $51,278arrow_forwardGiven answer Accounting questionarrow_forward

- Walter Industries has $5 billion in sales and $1.7 billion in fixed assets. Currently, the company’s fixed assets are operating at 90% of capacity. What level of sales could Walter Industries have obtained if it had been operating at full capacity? b.What is Walter’s Target fixed assets/Sales ratio? c.If Walter’s sales increase 12%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio?arrow_forwardWilliamson Industries has $7 billion in sales and $1.944 billion in fixedassets. Currently, the company’s fixed assets are operating at 90% of capacity.a. What level of sales could Williamson Industries have obtained if it had been operatingat full capacity?b. What is Williamson’s target fixed assets/sales ratio?c. If Williamson’s sales increase 15%, how large of an increase in fixed assets will thecompany need to meet its target fixed assets/sales ratio?arrow_forwardwhen answering the question please type out all of your workarrow_forward

- Earleton Manufacturing Company has $3 billion in sales and$787,500,000 in fixed assets. Currently, the company’s fixed assets are operating at 80% ofcapacity.a. What level of sales could Earleton have obtained if it had been operating at fullcapacity?b. What is Earleton’s target fixed assets/sales ratio?c. If Earleton’s sales increase 30%, how large of an increase in fixed assets will thecompany need to meet its target fixed assets/sales ratio?arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $90 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 90 Variable costs (70% of revenue) 1,260 Depreciation 160 Interest (6% of beginning-of-year debt) 18 Taxable income 272 Taxes (at 35%) 95 Net income $ 177 Dividends $ 89 Addition to retained…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $350,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $86 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,160 Fixed costs 86 Variable costs (70% of revenue) 1,512 Depreciation 280 Interest (6% of beginning-of-year debt) 18 Taxable income 264 Taxes (at 35%) 92 Net income $ 172 Dividends $ 86 Addition to retained…arrow_forward

- CCC currently has sales of $28,000,000 and projects sales of $39,200,000 for next year. The firm's current assets equal $9,000,000 while its fixed assets are $8,000,000. The best estimate is that current assets will rise directly with sales while fixed assets will rise by $500,000. The firm presently has $3,600,000 in accounts payable, $1,800,000 in long-term debt, and $11,600,000 in common equity. All current liabilities are expected to change directly with sales. CCC plans to pay $1,000,000 in dividends next year and has a 5.0% net profit margin. Assuming the increase in fixed assets will occur, what is the most sales could equal next year without using discretionary sources of funds? (Round your answer to the nearest dollar.) $30,330,300 $27,300,000 $33,619,950 $24,103,170 $25,721,514arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 60 Variable costs (80% of revenue) 1,440 Depreciation 80 Interest (8% of beginning-of-year debt) 24 Taxable income 196 Taxes (at 40%) 78 Net income $ 118 Dividends $ 79 Addition to…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company's policy is to pay out two- thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019 (Figures in $ thousands) Revenue $1,800 Fixed costs Variable costs (80% of revenue) Depreciation Interest (8% of beginning-of-year debt) Taxable income Taxes (at 40%) 60 1,440 80 24 196 78 Net income 118 Dividends Addition to retained earnings $ 79 $ 39 BALANCE SHEET, YEAR-END (Figures in $ thousands) 2019 Assets Net working capital Fixed assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT